London, Mar 13 (PTI) The UK government announced on Monday that it has facilitated London-based banking major HSBC to buy the embattled UK arm of Silicon Valley Bank for 1 pound, securing the deposits of more than 3,000 customers worth around 6.7 billion pounds.

Santa Clara, California-based Silicon Valley Bank which specialised in lending to technology companies was shut down by US regulators on Friday in what was the largest failure of a US bank since 2008.

According to experts, although the UK arm of SVB was small with only around 3,000 business customers, its collapse would have presented a risk for the tech sector which is seen as crucial to Britain's economic growth.

HSBC said it bought SVB UK which has a balance sheet of 8.8 billion pounds for 1 pound.

"This acquisition makes excellent strategic sense for our business in the UK," HSBC said.

"It strengthens our commercial banking franchise and enhances our ability to serve innovative and fast-growing firms, including in the technology and life-science

sectors, in the UK and internationally," said Noel Quinn, HSBC group chief executive.

The deal makes use of the UK's post-crisis banking reforms, which introduced powers to safely manage the failure of banks, this sale has protected both the customers of SVB UK and taxpayers. The government said it has a dynamic start-up and scale-up ecosystem and therefore it is pleased that a private sector purchaser has been found for a bank that funds those sectors.

Customers of SVB UK will be able to access their deposits and banking services as normal as a result of the transaction, which was facilitated by the Bank of England in consultation with the UK Treasury department using powers granted by the country's Banking Act 2009.

The Treasury stressed that no taxpayer money is involved.

"The UK's tech sector is genuinely world-leading and of huge importance to the British economy, supporting hundreds of thousands of jobs. I said yesterday [Sunday] that we would look after our tech sector, and we have worked urgently to deliver on that promise and find a solution that will provide SVB UK's customers with confidence," said UK Chancellor Jeremy Hunt.

"Today the government and the Bank of England have facilitated a private sale of Silicon Valley Bank UK; this ensures customer deposits are protected and can bank as normal, with no taxpayer support. I am pleased we have reached a resolution in such short order. HSBC is Europe's largest bank, and SVB UK customers should feel reassured by the strength, safety and security that brings them," he said.

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

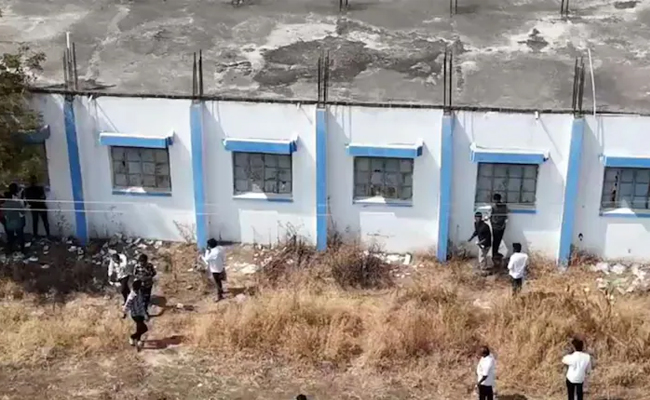

Beed (PTI): Five teachers, who were caught allegedly facilitating large-scale copying during an HSC (Class 12) examination paper at a centre in Maharashtra's Beed district, have been suspended, an official said on Tuesday.

The police had registered a first information report (FIR) against 17 teachers after a drone camera exposed large-scale copying on February 10, the first day of the Class 12 exams conducted by the Maharashtra State Board of Secondary and Higher Secondary Education, at Centre 224 in Chousala.

Drone-mounted surveillance cameras deployed by the authorities captured supervisors in 16 examination halls, not only failing to prevent copying but also allegedly helping students cheat openly.

The official said five teachers from Bhalchandra Vidyalaya in Limbaganesh have been suspended in connection with the malpractice, and 12 from three other schools and junior colleges are under investigation and may face suspension as the probe widens.

After learning about the February 10 incident, Beed Collector Vivek Johnson ordered strict action against those responsible for the lapse.

Accordingly, an FIR was registered against 17 teachers, including the chief conductor of the exam centre, at Neknoor police station and charges under the Maharashtra Universities, Boards and Other Specified Examinations (Prevention of Malpractices) Act and Bharatiya Nyaya Sanhita were invoked.

The Education Department subsequently directed the concerned institutions to suspend the implicated staff.