Bengaluru, July 1: Terming the GST a momentous reform, a wholesale retailer on Sunday said the tax regime, introduced a year ago, would lead to a unified national market while realty sector players said the key benefit for them was input tax credit though some grey areas remain.

"GST is one of the momentous reforms in the Indian taxation system as it has played a transformative role by making its structure simpler," said Metro Cash & Carry India's Chief Executive Arvind Mediratta in a statement here to mark the indirect tax regime's one year.

Merging a plethora of central and state indirect taxes, the Union government unveiled the Goods and Services Tax (GST) system across the country on July 1, 2017. The GST subsumed various taxes, including sales tax, entry tax, value added tax and other related taxes.

"The new tax regime has given an impetus to our sector through an increase in input tax credit on capital goods and services, which streamlined inter-state logistics movement, eliminated checkpoints and helped businesses reach a larger market base," said Mediratta.

Despite initial glitches and delays due to mismatch of the technology platform between the vendor and its stakeholders, he said the new regime had rationalised the tax rates to four slabs and ensured compliance at every stage of the transaction.

"We have been educating and engaging our trade partners and grocery owners to align their businesses with the policies to make them GST-complaint. We began a GST helpline and set up kiosks before its roll out," he said.

The government's interventions to ease transition challenges, introduction of the composition scheme, simplifying the complex procedure to file returns and extending return-filing deadlines benefited the traders, he said, noting a "positive sentiment" among Small and Medium Enterprises (SMEs) towards GST as compared to six months ago.

The $35-billion German self-service wholesaler, which entered India 15 years ago, operates 25 distribution centres across the country, including in Bengaluru, Hyderabad, Mumbai and Delhi.

According to House of Hiranandani Chairman Suresh Hiranandani, though GST had no impact on property prices, it helped in streamlining the tax administration by bringing transparency in the system.

"As expected with any game-changer of this magnitude, the initial few months were disruptive not only for the industry, but also for consumers and the government, as confusion marked from filing returns to providing e-way bills," said Hiranandani in a statement here.

The realty sector, however, sought clarification on the abatement of land cost to calculate service tax on under-construction projects.

"Clarity is needed because if the land cost is 10 per cent of the overall project, the final cost could remain stagnant. In cities, the land cost is a whopping 50-60 per cent of the total cost, with rising apartment costs," he said.

As stamp duty remains even after GST implementation with rates varying for different states, the additional burden on the sector averages 5-7 per cent.

"We hope state governments abolish the same or merge it with the GST rates to help reduce the cost of apartments," said Hiranandani.

PropTiger.com Chief Investment Officer Ankur Dhawan said the key benefit for the real estate sector under the GST was input tax credit, which developers could avail for taxes paid on construction material and services.

"This benefit was not available in the earlier service tax regime. Streamlining of the tax administration cleared the confusion of developers as well as customers, as the former were not sure how much benefit they can get out of input tax credit and the new raw material prices," he said.

After the clarification by the GST Council, developers have started passing 4-6 per cent discount to customers.

Demand for lower GST on the under-construction real estate or inclusion of all properties in GST will be key, as land cost is significant in overall pricing.

"In the long-run, GST reform is expected to streamline the sector to strengthen consumer sentiments rekindling hopes of a revival for the sector," added Dhawan.

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

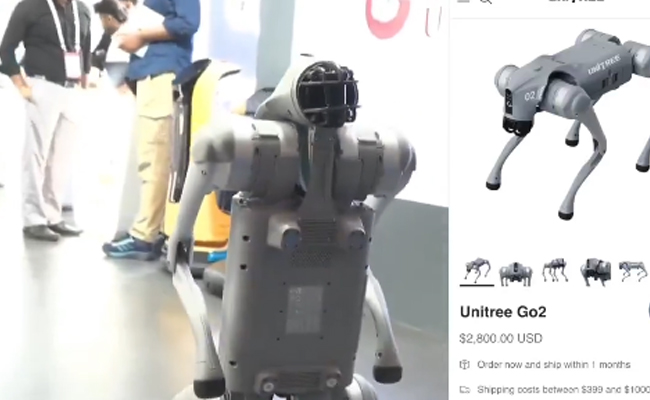

New Delhi: A Noida-based private University, Galgotias has come under severe criticism after allegedly showcasing a china-made robotic dog at the India AI Impact Summit 2026 in New Delhi.

Social media users accused the university of purchasing a commercial robot from China and presenting it as its own creation at the summit.

Reports claimed that the university showcased the Unitree Go2 robotic dog, an AI-powered device available on Chinese platforms for Rs 2–3 lakh, under the name “Orion” during the event in New Delhi.

“So Galgotia university purchased a commercially available robot worth Rs 2.5 lakhs, called it their own and passed it off in the Delhi AI Summit as a part of their 350 crore AI ecosystem..I literally have no words left,” wrote ‘X’ user Roshan Rai, sharing a video in which a DD News reporter interviewed a university official about the robotic dog.

So Galgotia university purchased a commercially available robot worth ₹2.5 lakhs, called it their own and passed it off in the Delhi AI Summit as a part of their 350 crore AI ecosystem 😭😭

— Roshan Rai (@RoshanKrRaii) February 17, 2026

I literally have no words left.

pic.twitter.com/tTozvotO5m

The viral post claimed that the robot closely resembles Unitree Go2, a quadruped robotic dog developed by Chinese company Unitree Robotics.

Screenshots attached to the post compared the robot displayed at the summit with the Unitree Go2 listing, priced at roughly 2,800 dollars (around Rs 2.3–2.5 lakhs).

According Unitree Robotics, The Unitree Go2 is widely used as a programmable quadruped robot for research, education, inspection, and development purposes, and is a common learning platform in universities and robotics labs worldwide.

Several users reiterated the claim.

🚨 Galgotias University again.

— Mr Sharma (@sharma_views) February 17, 2026

Showcased a commercially available $2,800 robot as an “AI breakthrough.”

No evidence of ₹350 crore original R&D.

This is how credibility erodes.

STOP EMBARRASSING INDIA ON THE WORLD STAGE. pic.twitter.com/SyJyIntRLa

This is Unitree Go2, an AI-powered Chinese robo dog that you can buy from Chinese websites for ₹2–3 lakh.

— THE SKIN DOCTOR (@theskindoctor13) February 17, 2026

Galgotias University, Gr Noida, presented it as their multi-crore AI innovation by naming it Orion at the AI Summit. Even Ashwini Vaishnaw, the concerned minister, used… pic.twitter.com/0ZoIAJCors

Government of India funds for filing patents

Meanwhile, concerns were raised about alleged misuse of government funds.

User @sky_phd highlighted, “Galgotias University is once again in the spotlight. Under the guise of research and innovation, they are raking in plenty of money.”

The user claimed that the university took money under government funds, and wrote, “The Government of India provides incentive funding of up to five lakh rupees for filing patents.”

“To understand the patent filing process and the games being played with it, take a look at the list of top Indian institutions filing patents. All the Indian Institutes of Technology (IITs) together file only 803 patents, while institutions like Lovely Professional University, Jain Deemed-to-be University, Galgotias University, and Teerthanker Mahaveer University have filed more than a thousand patents each,” the user wrote, sharing a chart of patent filings by these universities.

“The basic international patent filing fee is $285–400. Through patent filings alone, these institutions are reportedly earning more than fifty crore rupees annually. However, while these universities file patents, they often do not pursue them further, and most patents ultimately do not get granted. This inflates filing numbers but does not reflect real innovation or recognized intellectual property,” the user added.

Galgotias University एक बार फिर चर्चा में है। रिसर्च और इनोवेशन के नाम पर खूब पैसा बना रहे है। भारत सरकार पेटेंट फाइल करने के लिए पाँच लाख रुपये तक की प्रोत्साहन राशि देती है।

— Santosh Yadav, Ph.D. (@sky_phd) February 17, 2026

पेटेंट फाइलिंग की प्रक्रिया और इसके खेल को समझने के लिए टॉप पेटेंट फाइल करने वाले भारतीय संस्थानों की… pic.twitter.com/6gv6HzwM1l

Another user pointed out about the selection criteria of the summit. The user questioned, “What exactly was the selection criteria for participation in this AI summit? .”

“Platforms meant to showcase India’s innovation should represent genuine research, original ideas, and credible institutions. So how did Galgotias University qualify to display a Chinese-made robot and present it as its own “innovation”? If true, this isn’t just embarrassing, it undermines the credibility of the entire summit and of India’s growing tech ecosystem. At a time when India is trying to position itself as a global AI and deep-tech leader, showcasing repackaged imports as indigenous innovation only damages trust. If we want the world to take India’s AI ambitions seriously, transparency and authenticity must come first,” the user added.

Serious question: What exactly was the selection criteria for participation in this AI summit?

— Adarsh (@OpinionKraft) February 17, 2026

Platforms meant to showcase India’s innovation should represent genuine research, original ideas, and credible institutions.

So how did Galgotias University qualify to display a… pic.twitter.com/WJRAgXTMf6

University clarifies after backlash

In response to the criticism, Galgotias University issued a clarification, stating that it “never claimed to have built the device” and that the robot was procured from a Chinese manufacturer for academic purposes.

“Let us be clear, Galgotias has not built this robodog, nor have we claimed to do so. What we are building are minds that will soon design, engineer, and manufacture such technologies in Bharat," the university said.

The university in its statement also pointed out that the Unitree Go2 is being used as a learning tool for students.

“From the US to China and Singapore, we bring advanced technologies to campus because exposure creates vision, and vision creates creators. The robodog is actively being used by students to test capabilities and explore real-world applications,” the university added.

— Galgotias University (@GalgotiasGU) February 17, 2026

University professor claims “it's developed by the Center of Excellence at the Galgotias University.”

In another video captured by DD News, a reporter showcased the Galgotias University pavilion at the India AI Impact Summit 2026.

At the pavilion, the reporter spoke with the university professor about the technology on display.

The professor introduced the robot, saying, “This is Orion. You need to meet Orion. It has been developed by the Center of Excellence at Galgotias University.”

She added, “I would also like to brief you about Galgotias University. We are the first private university investing more than Rs 350 crore in artificial intelligence and have a dedicated data science and AI lab on campus.”

“Orion has been developed by our Center of Excellence. It can take all shapes and sizes and is quite playful. It can perform small tasks such as surveillance and monitoring. It can even execute movements like moonwalks and somersaults,” she explained.

She also claimed that, “This is India’s first iOS lab in North India at a university, giving our students hands-on experience with cutting-edge technology.”

Have some shame, in this video ur Professor is clearly saying that it's developed by Galgotias University. pic.twitter.com/xt5MkL8KEN

— Aniruddh Sharma (@AniruddhINC) February 17, 2026

Reacting to the video social media users ridiculed the 350 cr rupees investment compared to the china made robo dog.

Past Controversies of the University

This is not the first time the university is in controversy. In May 2024, during the Lok Sabha elections, a video went viral showing students protesting outside the Congress headquarters in New Delhi against the party’s manifesto. The footage, captured by Aaj Tak, showed students struggling to articulate the purpose of their protest, raising questions about the demonstration’s intent.

Students of Galgotias University are holding a protest against Congress , failing to answer the reason behind it #getstrolled #GalgotiyaUniversity #protests #trolled

— the swipe (@theswipenews_) May 2, 2024

Credits - Aaj Tak pic.twitter.com/xo87HLvngL

Earlier, in 2017, students protested against the university management after being barred from appearing in exams due to low attendance, with allegations that fines were requested to allow attendance, a claim denied by the administration.