Mumbai, Jul 11 (PTI): Equity benchmark indices Sensex and Nifty declined for the third session in a row on Friday, dropping nearly 1 per cent, dragged by heavy selling in IT, auto and energy stocks amid a muted start of the earnings season.

Tariff-related uncertainties and mixed global market trends also added to the pressure, analysts said.

The 30-share BSE Sensex tanked 689.81 points or 0.83 per cent to settle at 82,500.47. During the day, it fell 748.03 points or 0.89 per cent to 82,442.25.

As many as 2,450 stocks declined while 1,557 advanced and 158 remained unchanged on the BSE.

Similarly, the 50-share NSE Nifty dropped 205.40 points or 0.81 per cent to 25,149.85.

On the weekly front, the BSE benchmark dropped 932.42 points or 1.11 per cent, and the Nifty tanked 311.15 points or 1.22 per cent.

"While weak European market cues and negative US Dow Futures weighed on sentiment, the disappointing start to earnings season by software major TCS cautioned investors about the sluggish global demand scenario that led to heavy selling in IT, telecom, auto, realty and oil & gas stocks," Prashanth Tapse, Senior VP (Research), Mehta Equities Ltd, said.

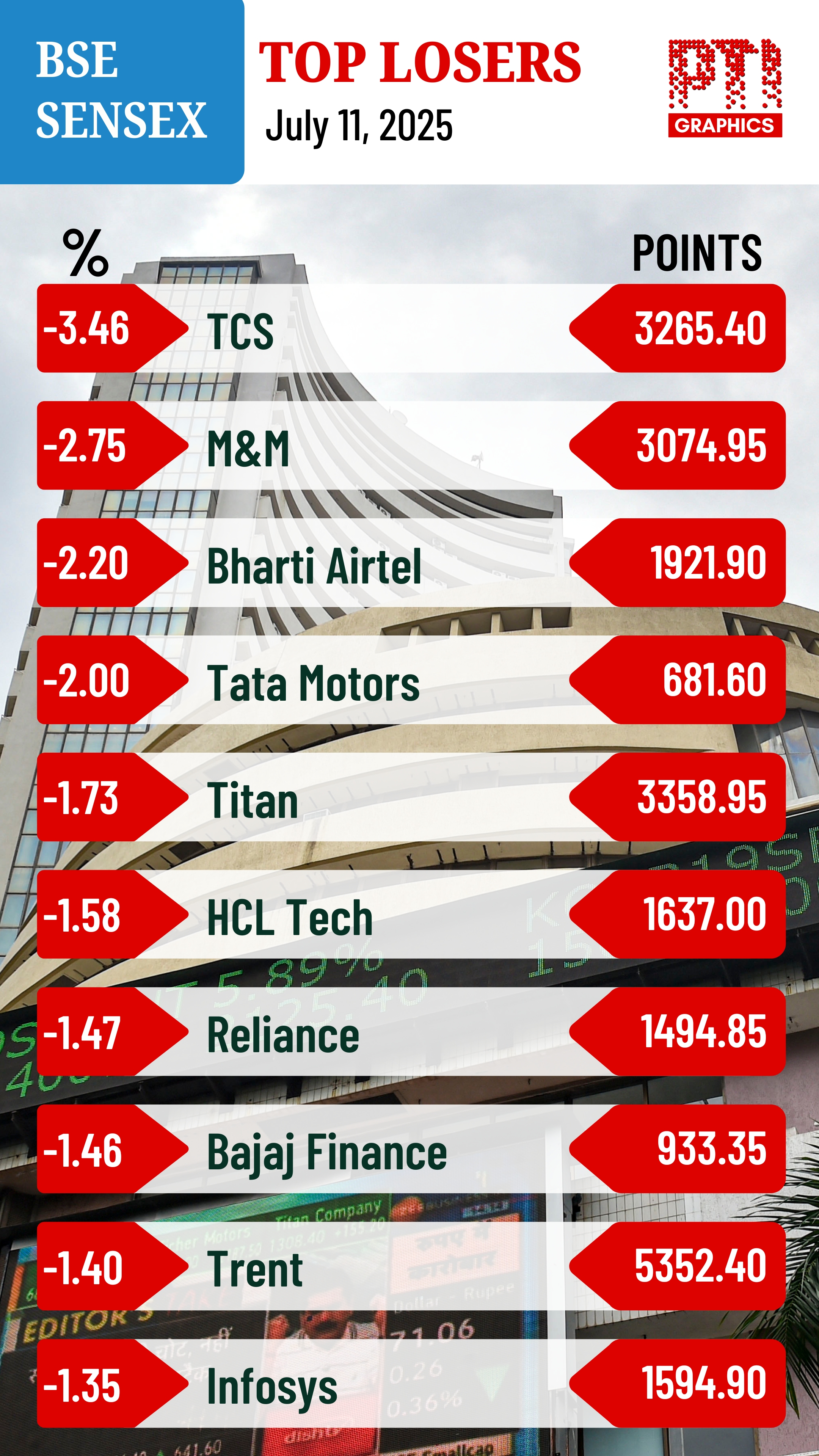

From the Sensex firms, Tata Consultancy Services declined 3.46 per cent after reporting its June quarter earnings.

The country's largest IT services company on Thursday reported a 6 per cent growth in June quarter net profit at Rs 12,760 crore, helped by a jump in non-core income even as revenues grew at a tepid pace.

The rupee revenue grew 1.3 per cent to Rs 63,437 crore during the quarter. Still, it was down by over 3 per cent on a constant currency basis, as the company faced headwinds in its major markets amid a winding down of the BSNL deal, which helped it in recent quarters.

Mahindra & Mahindra, Bharti Airtel, Tata Motors, Titan, HCL Tech, Bajaj Finance, Reliance Industries, Trent, Infosys and HDFC Bank were among the other major laggards from the pack.

"Markets traded under pressure on Friday and lost over half a per cent, dragged down by weak cues. The session began on a negative note following disappointing results from IT major TCS, which further worsened due to profit-taking in heavyweight stocks across other sectors. Sentiment remained subdued due to ongoing uncertainty around tariff-related issues and a weak start to the earnings season," Ajit Mishra - SVP, Research, Religare Broking Ltd, said.

Meanwhile, shares of Hindustan Unilever Ltd (HUL) surged 4.61 per cent following the announcement that Priya Nair will become the first woman CEO and MD of the firm, effective August 1, 2025.

Axis Bank, NTPC, Eternal and State Bank of India were also among the gainers.

"The domestic market experienced a negative close due to a sober start to Q1 earnings season and a ramp-up in the tariff threat by the US to impose a 35 per cent tariff on Canada. Investors may continue to be focused on quarterly earnings for a buy-on-dips strategy. However, in the near term, the current premium valuation and the global headwinds like low spending and tariff uncertainties may restrain new inflows.

"The IT index underperformed due to deferment in orders and new investments, which may impact FY26 earnings estimates," Vinod Nair, Head of Research, Geojit Investments Limited, said.

The BSE smallcap gauge declined 0.70 per cent, and the midcap index dropped 0.65 per cent.

On BSE sectoral indicators, teck tumbled 1.85 per cent, BSE Focused IT tanked 1.77 per cent, IT (1.65 per cent), auto (1.72 per cent), oil & gas (1.28 per cent), consumer discretionary (1.23 per cent), and telecommunication (1.22 per cent).

In contrast, healthcare and FMCG were the gainers.

In Asian markets, South Korea's Kospi, Japan's Nikkei 225 index settled lower, while Shanghai's SSE Composite index and Hong Kong's Hang Seng ended higher.

European markets were trading lower in mid-session trade.

The US markets ended in positive territory on Thursday.

Global oil benchmark Brent crude climbed 0.31 per cent to USD 68.85 a barrel.

Foreign Institutional Investors (FIIs) bought equities worth Rs 221.06 crore on Thursday, according to exchange data.

On Thursday, the Sensex dropped 345.80 points or 0.41 per cent to settle at 83,190.28. On similar lines, the Nifty declined 120.85 points or 0.47 per cent to 25,355.25.

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

New Delhi: A visit by the US Ambassador to India, Sergio Gor, to Chandigarh on Monday has triggered sharp criticism from opposition leaders and social media users, raising questions about national security and foreign policy.

On X, Ambassador Gor announced his visit, writing, “Just landed in Chandigarh. Looking forward to visiting the Western Command of the Indian Army.”

Just landed in Chandigarh. Looking forward to visiting the Western Command of the Indian Army

— Ambassador Sergio Gor (@USAmbIndia) February 16, 2026

Soon after, opposition voices questioned the broader implications of the visit. Congress Kerala, in a post, commented, “Why so much panic? We’ve already seen Pakistan's ISI getting access to Pathankot Airbase with this government's blessings. Didn't they say then ‘Modi ne kiya ho to kuch soch samajh kar kiya hoga?’ Compared to that, this is very small.”

Why so much panic? We’ve already seen Pakistan's ISI getting access to Pathankot Airbase with this government's blessings.

— Congress Kerala (@INCKerala) February 16, 2026

Didn't they say then "Modi ne kiya ho to kuch soch samajh kar kiya hoga?"

Compared to that, this is very small. pic.twitter.com/gNNuAGQBPC

Shiv Sena (UBT) leader Priyanka Chaturvedi also weighed in, writing, “Since India’s national strategic interests are now tied to what US wants India to do, this visit seems to sync with that.”

She further added, “India’s history will remember the de-escalation announcement between India and Pak was announced on social media by the US President before Indians got to know from their own government. US Ambassador is doing the job for his nation, who is doing for us? The answer is blowing in the wind.”

Since India’s national strategic interests are now tied to what US wants India to do, this visit seems to sync with that. India’s history will remember the de-escalation announcement between India and Pak was announced on social media by the US President before Indians got to… pic.twitter.com/rYMq5NhJHA

— Priyanka Chaturvedi🇮🇳 (@priyankac19) February 16, 2026

The visit comes against the backdrop of the growing US-India defence partnership.

Writer and political analyst @rajuparulekar commented on ‘X’, “East India Company is back!”

“Is it allowed for an ambassador to visit any army unit in india?” asked another user.

Several X users expressed concerns over the appropriateness of the visit.

One asked, “Is it allowed for an ambassador to visit any army unit in India?” Another wrote, “Why an ambassador visiting our army places? To talk to Chandigarh lobby for F-35?”

Why an ambassador visiting our army places ? To talk to chandigarh lobby for f-35 ??

— Rohan Sagar (@RohanSagar03) February 16, 2026

“We have completely sold Indian sovereignty. Rothschild the evil Bankers will now control NSE. Modi sold Bharat Mata to Trump . And now American imperialist is visiting our army command . Scary,” wrote another user.

“The Indian Army isn’t part of geopolitics, so why is he interested in visiting there?,” opined another.

The Indian Army isn’t part of geopolitics, so why is he interested in visiting there?

— Aditya Pratap Singh (@Adi_IIMCIAN) February 16, 2026

On Sunday, Gor welcomed Admiral Samuel Paparo, Commander of the United States Indo-Pacific Command (INDOPACOM), highlighting efforts to expand the growing US-India defence partnership.

In a post on X, Gor wrote, “Delighted to have @INDOPACOM Commander Admiral Samuel Paparo in India to expand the U.S.-India defense partnership. Now is the time to strengthen vital cooperation between our two nations.”

On Monday, Admiral Samuel J. Paparo Jr visited the headquarters of India’s Western Army Command along with the American envoy Sergio Gor. The delegation was briefed on the formation’s capabilities, its past operations, and future plans.

The American delegation also visited Bengaluru, where they met three start-ups, two in the space sector and one in defence, and participated in an Indo-US conference.