The prices of petrol and diesel have reached unprecedented levels, leading to massive discontent and protests organised by the opposition. Petrol in Delhi has crossed Rs 80 per litre and diesel Rs 72 per litre. In most other cities, the prices have reached higher levels, depending on the rates of VAT imposed by state governments.

Spokespersons of the Narendra Modi government are pleading helplessness over the situation, citing the hardening of global crude oil prices and the devaluation of the rupee. This is a lame excuse. The current prices of petrol and diesel in India’s neighbouring countries Asia are much lower, as can be seen from Table 1.

Table1: Retail price of petrol and diesel (1 litre) in India and neighbouring countries (in Indian rupee) on September 1, 2018

|

Petrol |

Diesel |

|

|

India (Delhi) |

78.68 |

70.42 |

|

Pakistan |

53.55 |

61.47 |

|

Bangladesh |

73.48 |

55.54 |

|

Sri Lanka |

63.96 |

52.05 |

|

Nepal (Kathmandu) |

69.94 |

59.86 |

Source: Petroleum Planning & Analysis Cell (PPAC), Ministry of Petroleum & Natural Gas

Why are the retail prices of petrol and diesel higher in India? It is because of the high incidence of Central excise and state VAT imposed on these commodities. For every litre of petrol, the Central government currently collects an excise duty of Rs 19.48; for diesel the excise duty is Rs 15.33 per litre. The state governments impose VAT over and above this. The rate of indirect taxes (central excise and VAT taken together) have crossed 100% in the case of petrol and 70% in the case of diesel. Without taxes, the retail price of a litre of petrol and diesel should have been around Rs. 40, even at the current level of international crude oil prices.

Table 2: Tax Revenues of the Union government

|

Gross Tax Revenue |

Excise Duties on Petro-Products |

Corporate Tax |

Income Tax |

|

|

2009-10 |

624528 |

64012 |

244725 |

122475 |

|

2010-11 |

793072 |

76546 |

298688 |

139069 |

|

2011-12 |

889177 |

74829 |

322816 |

164485 |

|

2012-13 |

1036235 |

84188 |

356326 |

196512 |

|

2013-14 |

1138733 |

88065 |

394678 |

237817 |

|

2014-15 |

1244886 |

106653 |

428925 |

258326 |

|

2015-16 |

1455648 |

198793 |

453228 |

287628 |

|

2016-17 |

1715822 |

276551 |

484924 |

349436 |

|

2017-18 |

1946119 |

229019* |

563745 |

439255 |

Source: Receipts Budget, 2018-19; CAG Report Nos. 42 of 2017, Department of Revenue (Indirect Taxes – Central Excise) & CAG Report No. 17 of 2013, Department of Revenue (Compliance Audit on Indirect Taxes-Central Excise and Service)

*Note: Data on excise duties on petro-products for 2017-18 is provisional and has been sourced from PPAC Ready Reckoner, June 2018, Ministry of Petroleum & Natural Gas

Table 2 provides the annual estimates of gross tax revenues of the union government under the UPA-II and the Modi regime along with the break-up of major tax-heads, namely excise duties on petro-products, corporate tax and income tax. Table 3 provides the share of these three major tax heads in gross tax revenue, calculated from Table 2.

It can be seen clearly from Table 3 that the reliance of the Union government on excise collections from petro-products have gone up considerably under the NDA. In the five years from 2009-10 to 2013-14, the share of excise collections from petro-products in gross tax revenues (GTR) averaged around 8.8%. From 2014-15 to 2017-18, the average went up to 12.5%. Simultaneously, the share of corporate tax collections in GTR fell from an average of 36.5% under UPA-II to 30.7%. The average share of income tax collections in GTR have increased from 19% under UPA-II to 21%.

Table 3: Share of Major Taxes in Gross Tax Revenues (GTR) of the Union government

|

Excise Duties on Petro-Products/GTR |

Corporate Tax/GTR |

Income Tax/GTR |

|

|

2009-10 |

10.2 |

39.2 |

19.6 |

|

2010-11 |

9.7 |

37.7 |

17.5 |

|

2011-12 |

8.4 |

36.3 |

18.5 |

|

2012-13 |

8.1 |

34.4 |

19.0 |

|

2013-14 |

7.7 |

34.7 |

20.9 |

|

2014-15 |

8.6 |

34.5 |

20.8 |

|

2015-16 |

13.7 |

31.1 |

19.8 |

|

2016-17 |

16.1 |

28.3 |

20.4 |

|

2017-18 |

11.8 |

29.0 |

22.6 |

Source: Same as Table 2

This exposes the class bias in the NDA’s revenue mobilisation strategy. While the tax share of large corporations have come down substantially, the tax share of fuel consumers and income tax payers has risen. The corporate class has benefitted at the cost of the poor and the middle class. This socially iniquitous and unjust revenue mobilisation strategy needs to be abandoned forthwith.

Petrol and diesel need to be brought under GST, just like kerosene and LPG. Even if the highest GST rate of 28% is applied, petrol and diesel would not cost more than Rs 55 per litre. The resulting revenue losses can be compensated through higher mobilisation of corporate taxes and doing away with corporate tax exemptions. Revenue foregone on account of corporate tax incentives have totalled over Rs 85,000 crore per year in the last two financial years, as per the receipts budget 2018-19. The pro-corporate bias in the revenue mobilisation strategy needs to be corrected.

Prasenjit Bose is an economist and political activist.

Courtesy: thewire.in

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

Ottawa (PTI): Three Indian nationals have been arrested by Canadian police on an anti-extortion patrol and charged after bullets were fired at a home.

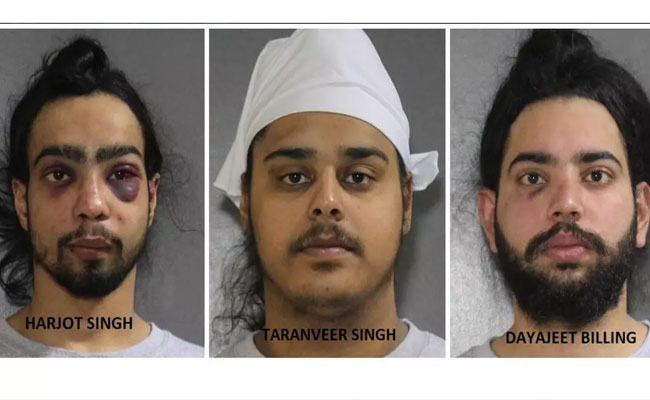

Harjot Singh (21), Taranveer Singh (19) and Dayajeet Singh Billing (21) face one count each of discharging a firearm, and all have been remanded in custody until Thursday, the Surrey Police Service (SPS) said in a statement on Monday.

The suspects were arrested by patrol officers after an early morning report of shots fired and a small fire outside a home in Surrey's Crescent Beach neighbourhood, the LakelandToday reported.

On February 1, 2026, the SPS members were patrolling in Surrey’s Crescent Beach neighbourhood when reports came in of shots being fired and a small fire outside a residence near Crescent Road and 132 Street.

The three accused were arrested by SPS officers a short time later, the statement said.

SPS’s Major Crime Section took over the investigation, and the three men have now been charged with Criminal Code offences, it said.

All three have been charged with one count each of discharging a firearm into a place contrary to section 244.2(1)(a) of the Criminal Code.

The investigation is ongoing, and additional charges may be forthcoming. All three have been remanded in custody until February 5, 2026.

The SPS has confirmed they are all foreign nationals and has engaged the Canada Border Services Agency, it said.

One of the suspects suffered injuries, including two black eyes, the media report said.

Surrey police Staff Sgt. Lindsey Houghton said on Monday that the suspect had refused to comply with instructions to get out of the ride-share vehicle and started to "actively resist."

"As we were trained, he was taken to the ground and safely handcuffed," said Houghton.

A second suspect with a black eye was also injured in the arrest after refusing to comply, Houghton said.

The arresting officers were part of Project Assurance, an initiative that patrols neighbourhoods that have been targeted by extortion violence.

Houghton said the Canada Border Services Agency (CBSA) is also involved because the men are foreign nationals, and the trio may face additional charges.

It's not clear if the men are in the country on tourist visas, a study permit, or a work permit, but Houghton said CBSA has started its own investigation into the men's status.

Surrey has seen a number of shootings at homes and businesses over the last several months, but there's been an escalation since the new year.