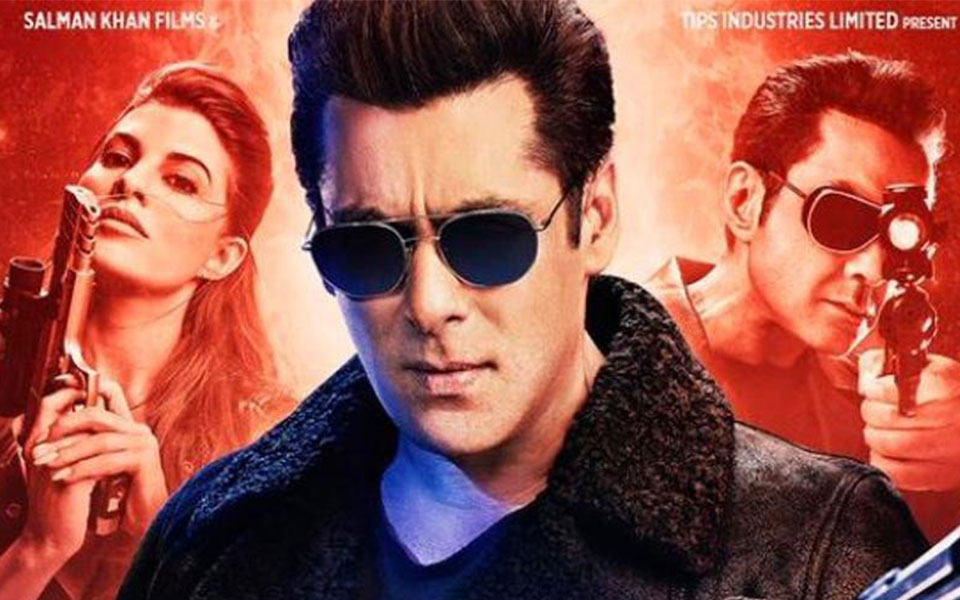

Mumbai, May 19: Filmmaker and producer Karan Johar said the makers of "Lust Stories" have no right to compete with the magnitude of Salman Khan as his forthcoming movie "Race 3" which is also releasing on June 15.

Karan Johar, who is gearing up for the release of his upcoming film "Lust Stories", said this on Friday while interacting with the media along with Bhumi Pednekar, Sanjay Kapoor, Zoya Akthar, Jaideep Ahalwat, Dibakar Banerjee, producer Ronnie Screwvala and Ashi Dua at the trailer launch of the movie.

When asked whether "Lust Stories" has the power and lust to overpower Salman Khan's "Race 3" on June 15, Karan said: "Of course not. Salman Khan is on a different platform. He is the big master of mainstream cinema."

"'Race 3' is going to be humongous film. It's a franchise film and its totally different film into totally different syntax. We are not competing with him."

"We don't have that ability to fight with Salman or 'Race 3'. We are actually very happy four filmmakers who have made a tiny little film for which we are grateful to Netflix. We don't have right to compete with the magnitude of Salman. I probably will go to watch 'Race 3' instead of 'Lust Stories' on June 15."

When asked whether Netflix gave him the platform to tell a story the way he wants, Karan said: "I definitely believe that the film is pushing some boundaries but I would be happy to do the same even in films."

"Just because this film is called 'Lust Stories', it doesn't mean that you can show overt amount of sex scenes and it has got something that is out there and in your face. All stories in this film are very emotional and deep stories."

Throwing some light on the concept of the film, he said: "We all know film is called 'Lust Stories' so the film is about love and lust. I think it's exciting that we all decided on this theme together and thought that all directors would have an individual interpretation of love and lust so invariably when you have given choice between love and lust, more sensible people will choose lust only because it's infinitely more exciting than love is."

Karan said just like men, even women have the right to seek pleasure.

My film is about seeking pleasure. It's also about the fact that it's not just the man's right to seek pleasure, it's also a woman's right."

Karan's short film "Ice-Cream" features Vicky Kaushal, Kiara Advani and Neha Dhupia in lead roles.

"Lust Stories" include four short stories; each of them has been directed by Karan Johar, Zoya Akthar, Dibakar Banerjee and Anurag Kashyap.

The film "Lust Stories" will release on June 15 on Netflix.

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

Srinagar (PTI): Strict restrictions remained imposed in many areas of Kashmir for the third consecutive day on Wednesday following massive protests across the valley against the killing of Iran's Supreme leader Ayatollah Ali Khamenei, officials said.

As a precautionary measure, the government shut educational institutions till Saturday, while mobile internet speed continued to remain throttled.

"Restrictions on the movement and assembly of the people continued in many parts of Kashmir on Wednesday," the officials said.

They said strict restrictions were being enforced especially in the parts having large Shia population and those areas which have witnessed massive protests over the last three days.

A large number of police and paramilitary CRPF personnel were deployed across the city to prevent gatherings of protestors, the officials said.

ALSO READ: Family of five from Bengaluru killed in road accident in Andhra

They added that concertina wires and barricades were placed at important intersections leading into the city, while asserting that these were precautionary measures imposed to maintain law and order.

The iconic Ghanta Ghar in the city centre of Lal Chowk here continued to remain a no-go zone after the authorities sealed area with barricades erected all around it on late Sunday night.

The move to seal the Ghanta Ghar came after it witnessed massive protests on Sunday after Khamenei's assassination in the joint air strikes by the US and Israel.

This is the first time since August 2019 that protests on such a large scale have taken place in Kashmir.

The government had first ordered the closure of schools, colleges and universities for two days. However, on Tuesday it decided to close the educational institutions till Saturday as a precautionary measure in view of the protests.

Mobile internet speeds continued to remain throttled while some prepaid mobile connections were also barred, the officials added.

On Tuesday, protests rocked several places in the valley, including Sumbal and Pattan areas of North Kashmir.

In Sumbal of Bandipora district, security forces had to resort to force to disperse the demonstrators.

Some media outlets and individuals, including National Conference Lok Sabha MP from Srinagar Aga Syed Ruhullah Mehdi, and former Srinagar mayor Junaid Azim Mattu, faced police heat for allegedly circulating misleading information.

A case was filed against Mehdi and Mattu under BNS sections 197(1)(d) and 353(1)(b) at Cyber Police Station, Srinagar, for allegedly circulating "false, fabricated and misleading content" on digital and social media platforms.

"The content in question, prima facie, reflects the dissemination of distorted narratives and unverified information capable of causing public unrest and societal disharmony. Such deliberate attempts to spread misinformation pose a serious threat to peace, security, and overall stability," the police said in a statement.

Both have been condemning the killing of Khameinei and the attacks by the US and Israel on Iran.

However, hours after the registration of the case, Mehdi, an influential Shia leader, said he would not be deterred from speaking the truth.

"The people of Srinagar did not elect their MP to recite government-approved condolences. They elected him to speak truth. That mandate does not expire with an FIR," he said in a post on X.

Police has issued an appeal to people to refrain from violence and provocation.

"We appeal to all sections of the society to exercise restraint and refrain from violence and provocation," it said.

Police said they will take strict legal action against instigators of violence and those involved in unlawful activities.

On Tuesday, Lieutenant Governor Manoj Sinha directed officials to be on high alert and chaired a meeting of top officials of the police and army here.

ALSO READ: Man held for molesting, extorting Rs 50,000 from schoolgirl in Thane

"Chaired a meeting of senior police & civil administration officials at the Police Control Room, Kashmir, to review the law and order situation. Directed the officers to remain on heightened alert and take all necessary measures to ensure public peace and tranquillity," Sinha said on X.

He appealed to the people and community leaders to maintain peace.

"I also appeal to the citizens and community leaders to uphold harmony and contribute to an atmosphere of calm and goodwill in society. Preserving peace and sustaining the progress of society is a shared responsibility that rests equally upon each one of us," he said.