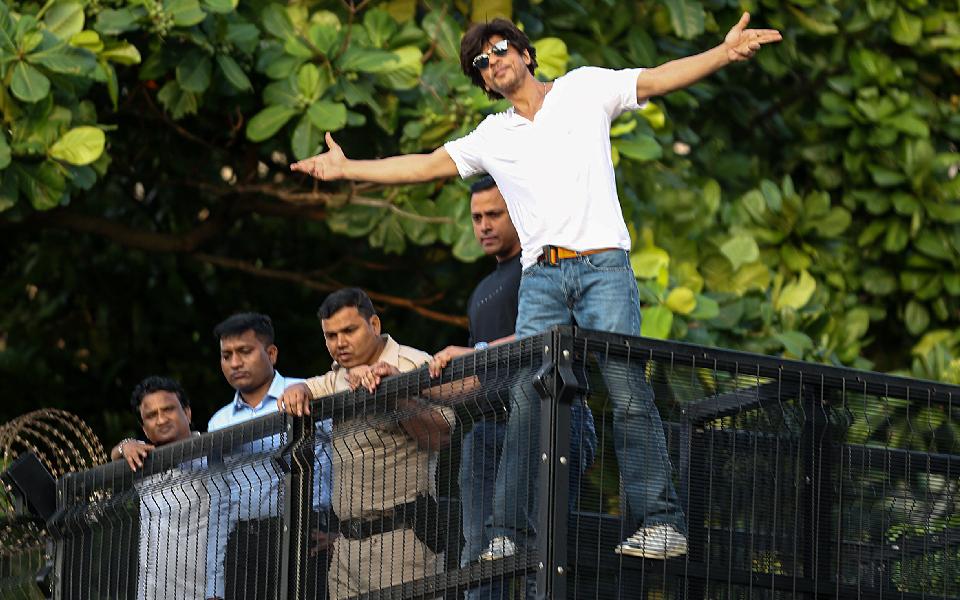

Mumbai/Raipur, Nov 7: The Mumbai police have registered an extortion case and summoned a lawyer from Chhattisgarh in connection with a death threat to Bollywood actor Shah Rukh Khan and a demand for Rs 50 lakh, officials said on Thursday.

The lawyer from Raipur has been summoned as the threat call was made from a phone number registered in his name, a senior police official from the Chhattisgarh capital said. The lawyer told the police that he lost his phone last week and had filed a police complaint, the official said.

The threat to Shah Rukh Khan follows a series of threats issued to fellow actor Salman Khan, allegedly from the Lawrence Bishnoi gang.

“The Bandra police station received a call threatening Shah Rukh Khan and asking for Rs 50 lakh. An offence has been registered. No arrest has been made yet,” a senior Mumbai police official said.

A case has been registered by the Bandra police under sections 308(4) (extortion involving threats of death or serious injury) and 351(3)(4) (criminal intimidation) of Bharatiya Nyaya Sanhita (BNS) against the caller who threatened Shah Rukh Khan, the official said.

Police teams have been dispatched to various places for further investigation, he said.

While there was no confirmation from Mumbai police on reports that the call was made from Chhattisgarh, a Raipur police official said their counterparts from the Maharashtra capital on Thursday served a notice to a man from the city in connection with it.

As part of their investigation into the threat to Shah Rukh Khan, Mumbai police visited Raipur and summoned a lawyer, identified as Faizan Khan, who lives within the limits of Pandri police station here, Raipur Senior Superintendent of Police Santosh Singh told PTI.

Police had earlier identified the man as Faiyaz Khan.

As per preliminary information, the threat call to the actor was made from a phone number registered in the name of Faizan, he said.

Faizan has been asked to appear for questioning at Bandra police station, Singh said.

A Mumbai police team arrived at Pandri police station in the morning and informed the officials about the case following which Faizan was called for questioning, City Superintendent of Police (CSP- Civil Lines) Ajay Kumar told PTI.

Faizan told the cops that he had lost his phone last week and lodged a complaint at Khamardih police station here, he said. Mumbai police have served a notice to Faizan and summoned him for further questioning, the official added.

Later, talking to reporters in Raipur, Faizan claimed that his phone was stolen and termed the threat call made from his number a conspiracy against him.

“My phone was stolen on November 2 and I lodged a complaint. I told Mumbai police about it. They interrogated me for about two hours,” he said.

He, however, said he had earlier complained to Mumbai police against Shah Rukh Khan over a dialogue in his movie ‘Anjaam’ (1994) referring to deer hunting.

“I hail from Rajasthan. The Bishnoi community (which is from Rajasthan) is my friend. It is in their religion to protect deer. So, if a Muslim says something like this about deer, it is condemnable. Therefore, I raised an objection,” he said.

Faizan added, “Whoever has made a call from my phone, it seems intentional. I think it is a conspiracy against me.”

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

Patna (PTI): Bihar was abuzz with speculation on Wednesday over rumours that JD(U) president and the state’s longest-serving Chief Minister Nitish Kumar may move to the Rajya Sabha, paving the way for the BJP to take the top post while accommodating his son Nishant as deputy CM.

However, senior BJP leader and Union minister Giriraj Singh dismissed the rumour as a "Holi prank", asserting "Nitish Kumar ji is the chief minister".

The filing of nomination papers for five Rajya Sabha seats in the state will close on Thursday.

While the BJP has named its two candidates, including national general secretary Nitin Nabin, and confirmed a second consecutive term for junior NDA ally Upendra Kushwaha, the JD(U) is yet to officially announce its nominees.

The rumours of Kumar, who turned 75 earlier this month, being one of the candidates of JD(U), surfaced a day after the party had announced that his son Nishant would be making a belated entry into politics.

Earlier, there were speculations that the reclusive Nishant, who is in his late 40s and is yet to be formally inducted into the JD(U), could be sent straight to the Rajya Sabha.

However, with less than 24 hours left for filling of nomination papers, several media outlets ran reports claiming that the chief minister, who has been at the helm since 2005, could choose the Rajya Sabha route to make an "honourable exit".

According to these unconfirmed reports, the BJP, which has been outperforming the JD(U) in elections, will have its own CM in the only Hindi heartland state where the highest seat of power has eluded it.

These reports also suggested that as a bargain, Kumar could settle for the deputy CM's post for his son.

When Giriraj Singh, who represents Begusarai Lok Sabha seat in the state, was approached with queries, he said, "Today is Holi. Such pranks are common on the occasion. Nitish Kumar ji is the chief minister".

JD(U) MLC Sanjay Kumar alias Gandhi ji, a close aide of the party supremo, reacted with bewilderment when his response was sought to the rumours.

"We have no information about who will be the Rajya Sabha candidates of the party. There is an impression that Union minister Ram Nath Thakur may retain his seat, but that is also not official. As regards the other seat, it is a decision to be taken by the chief minister, who is known to reveal his cards at the eleventh hour. We cannot say anything on the reports in the media," he said.