Dubai: American Specialty Foods Co has been honored with the prestigious Westford Award for Business Excellence in the Food & Beverage category. The award was presented at a grand ceremony held at Madinat Jumeirah, Mina Al Salam, Dubai, on January 24, 2025.

The award was received by the company's Founder and CEO, Hany M. Haneef, along with Co-founder and Director, Shahanaz Haneef. Expressing his gratitude, Haneef stated, "I am truly honored to receive this award. It belongs to our incredible team, partners, and supporters. Success is built on dedication, teamwork, and excellence. This is just the beginning; there is so much more ahead."

Established in 2013, American Specialty Foods Co has grown into a leading provider of premium global food solutions. Headquartered in Maryland, USA, the company also has offices in New York, Mexico, the UK, and the UAE. With a distribution network spanning over 50 countries, the company offers more than 20 specialty food categories and actively participates in major international food trade events worldwide.

The Westford Awards recognize outstanding business achievements across various industries, providing winners with greater visibility and networking opportunities. “This recognition further cements American Specialty Foods Co’s position as a leader in the specialty food and beverage sector,” a statement from the company added.

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

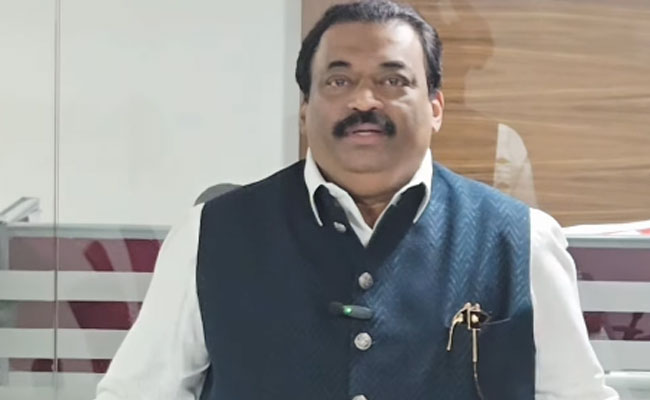

Mumbai (PTI): NCP's Rajya Sabha member Sunetra Pawar will be sworn-in as the Deputy Chief Minister of Maharashtra, replacing her deceased husband and party chief Ajit Pawar, at the Lok Bhavan here at 5 pm on Saturday.

Lok Bhavan (formerly Raj Bhavan) gave this information.

Governor Acharya Devvrat, who is currently in Mussoorie, will arrive in Mumbai at 4 pm, it said.

NCP's legislature party meeting is scheduled to take place in the city at 2 pm, where Sunetra Pawar is set to be named as its leader. After that she will take oath as the first woman deputy CM of the state.

She held talks with party leaders after arriving here from Baramati early morning on Saturday.

Ajit Pawar, who was deputy chief minister and finance minister in the Devendra Fadnavis-led Mahayuti government, was killed in a plane crash in Baramati along with four others on January 28.