Dubai: A delegation from The Institute of Chartered Accountants of India (ICAI Dubai Chapter) recently visited the reputed NRI Businessman and founding member of the ICAI Dubai Chapter, SM Syed Khalil, at his residence in Dubai to extend their felicitations.

Led by Rajesh Kumar Somani, Chairman of the ICAI Dubai Chapter, the delegation included Secretary Rishi Chawla, Treasurer Dheeraj Ranasaria, and Executive Member Aashna Mulgaonkar.

During the visit, the delegation commended SM Syed Khalil for his dedicated service to the ICAI Dubai Chapter, where he served as Chairman for two terms between 1987 and 1994. They also acknowledged his ongoing guidance and support to the chapter's office bearers since its inception.

As a token of appreciation, the delegation presented SM Syed Khalil with a memento and expressed their gratitude for his continued support and mentorship in the future.

SM Syed Khalil, a distinguished chartered accountant, has contributed significantly to the UAE's business landscape, notably with the Galadari family for nearly three decades when he first joined as general manager of the Khaleej Times daily newspaper. His tenure includes serving as the Group Executive Director of Ilyas and Mustafa Galadari (IMG) Group from 2002 to 2011 and currently holding the position of Founding Chairman of K&K Enterprise, a general trading company based in Sharjah.

Prior to his UAE endeavors, Khalil held prominent roles with Mahindra Ugine Steel in India and served as Vice-Chairman of the Jashanmal Group of Companies. He also serves as the Chairman of Maadhyama Communications Ltd., and Chairman of news channel Sahil Online.

Additionally, he has established various media companies and charitable foundations in Dubai and India, demonstrating his commitment to philanthropy. He is also the patron and board members of various socio, cultural and charitable organisations both in India and UAE.

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

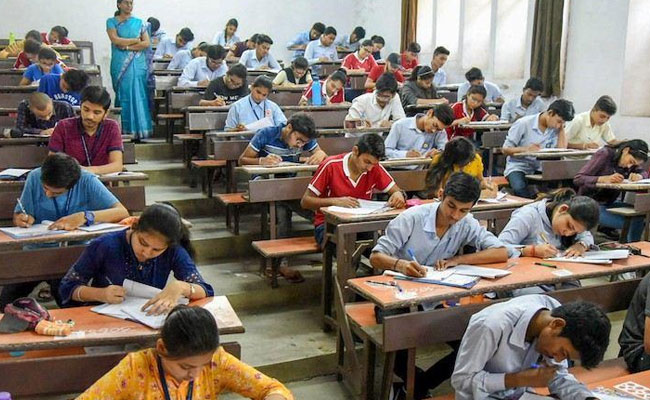

New Delhi: The Central Board of Secondary Education (CBSE) is expected to issue admit cards for the Class 10 and Class 12 board examinations by next week, ahead of the start of the 2026 board exams. Once released, students will be able to access their admit cards through the board’s official website using their login credentials.

Previous year, CBSE issued admit cards for Classes 10 and 12 on February 3. Based on this timeframe, admit cards for the 2026 exams are expected to be available by February 10. According to NDTV, the board has already released the admit cards for private candidates on January 19 of this year.

CBSE will conduct the board examinations for the academic session 2025-26 starting February 17. Both Class 10 and Class 12 exams will commence on the same day. While the examination portal has been activated, the admit cards for regular students are yet to be issued.

Once available, the admit cards, can be downloaded from the official CBSE website. Students must log in using their roll number or other credentials given by their institution. The document will carry essential information including the student’s name, roll number, school and centre details, photograph, subjects along with their codes, examination dates, date of birth and the admit card identification number.

CBSE has advised students to verify all details mentioned on the admit card carefully and retain a copy for use throughout the examination period.