New Delhi, May 12 (PTI): Dalal Street investors became richer by Rs 16.15 lakh crore on Monday as markets skyrocketing nearly 4 per cent, after India and Pakistan announced reaching an understanding to stop all firings and military actions on land, air and sea.

Also, a trade agreement between the US and China added to the markets' optimism.

After starting the trade on an optimistic note, the 30-share BSE benchmark gauge Sensex further jumped 2,975.43 points or 3.74 per cent to settle at 82,429.90. During the day, it rallied 3,041.5 points or 3.82 per cent to a high of 82,495.97.

The market capitalisation of BSE-listed firms jumped by Rs 16,15,275.19 crore to Rs 4,32,56,125.65 crore (USD 5.05 trillion) in a single day.

"Confluence of positive geopolitical and economic developments — the ceasefire between India and Pakistan, coupled with a breakthrough trade agreement between the US and China — sparked the strongest daily market rally in recent times," Vinod Nair, Head of Research at Geojit Investments Limited, said.

From the Sensex firms, Infosys jumped 7.91 per cent. HCL Tech, Tata Steel, Eternal, Tech Mahindra, Tata Consultancy Services, Axis Bank, ICICI Bank, Bajaj Finance, NTPC and Reliance Industries were the other major gainers.

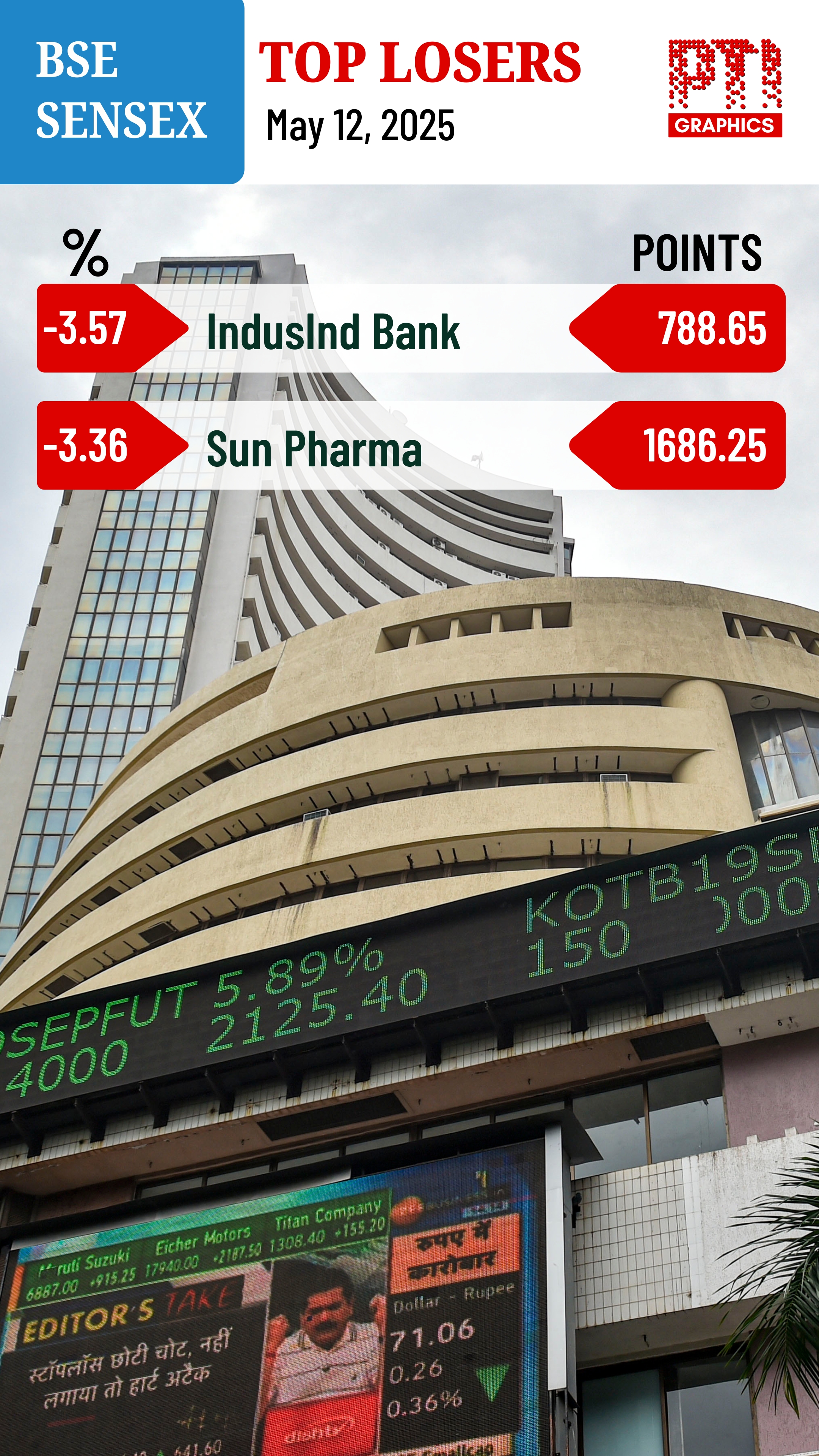

Sun Pharma and IndusInd Bank were the only laggards from the blue-chip pack.

"Markets staged a sharp rebound on Monday, buoyed by easing geopolitical tensions after the India-Pakistan ceasefire. Benchmark indices posted their strongest single-day performance in over four years," Vikram Kasat, Head - Advisory at PL Capital, said.

The BSE smallcap gauge surged 4.18 per cent and midcap index jumped 3.85 per cent.

"Markets opened the week on a strong footing, rallying nearly 4 per cent, driven by supportive global and domestic cues. The key trigger was the announcement of a ceasefire between India and Pakistan over the weekend, signalling easing geopolitical tensions. Adding to the positive sentiment were encouraging updates on the US-China trade deal, which further boosted investor confidence as the session progressed," Ajit Mishra – SVP, Research at Religare Broking Ltd, said.

All sectoral indices ended higher. IT zoomed 6.75 per cent, BSE Focused IT (6.74 per cent), realty (5.87 per cent), metal (5.24 per cent), teck (5.21 per cent), utilities (5.07 per cent), power (4.82 per cent) and industrials (4.24 per cent).

"Indian equities made spectacular gains on Monday, with the Nifty soaring by a record 917 points to close at 24,925 - a seven-month high. The de-escalation in India-Pakistan tensions over the weekend has significantly helped calm investors' nerves and improve sentiments.

"On the global front, the US announced a headway in the trade negotiations with China, as both countries agreed to drastically roll back tariffs on each other's goods for an initial 90-day period," Siddhartha Khemka, Head - Research, Wealth Management at Motilal Oswal Financial Services Ltd, said.

As many as 3,545 stocks advanced while 576 declined and 133 remained unchanged on the BSE.

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

Mumbai (PTI): The rupee depreciated 31 paise to settle at 91.99 against the US dollar on Wednesday, touching the lowest closing level for the second time in less than a week, amid increased month-end demand for the greenback.

Forex traders said the rupee opened higher as the US dollar index softened and a long-awaited trade breakthrough with Europe offered quiet reassurance. However, increased month-end demand for the American currency as well as the ongoing geopolitical tensions dented investors' sentiments.

At the interbank foreign exchange, the rupee opened at 91.60 and touched an early high of 91.50, but pared all the gains to touch an intra-day low of 91.99 against the greenback.

The domestic unit settled 31 paise down, revisiting its lowest-ever closing level of 91.99 against the greenback. The Indian currency previously ended at this level on January 23 when it also hit its all-time intraday low of 92 against the US dollar.

On Tuesday, the rupee rebounded from its all-time low levels and gained 22 paise to close at 91.68 against the US dollar.

Analysts said the rupee opened higher as the US dollar index softened and a long-awaited trade breakthrough with Europe bolstered investor sentiment.

India and the European Union on Tuesday announced the conclusion of negotiations for the free trade agreement (FTA), under which a number of domestic sectors such as apparel, chemicals and footwear will get duty-free entry into the 27-nation bloc, while the EU will get access to the Indian market at concessional duty for cars and wines, an official said.

The deal has been dubbed the "mother of all deals" as it will create a market of about 2 billion people.

Meanwhile, the dollar index, which gauges the greenback's strength against a basket of six currencies, was trading 0.07 per cent lower at 96.14.

Brent crude, the global oil benchmark, was trading 0.43 per cent lower at USD 67.28 per barrel in futures trade.

On the domestic equity market front, Sensex jumped 487.20 points to settle at 82,344.68, while Nifty surged 167.35 points to 25,342.75.

Foreign Institutional Investors turned net buyers and purchased equities worth Rs 480.26 crore on Wednesday, according to exchange data.