Mumbai, May 30 (PTI): Stock markets closed lower in a range-bound trade on Friday following losses in IT shares and sluggish trends in Asian markets due to trade uncertainty after a US appeals court temporarily reinstated reciprocal tariffs.

The 30-share BSE Sensex declined by 182.01 points or 0.22 per cent to settle at 81,451.01 as 24 of its constituents retreated and six advanced. During the day, it dropped 346.57 points or 0.42 per cent to 81,286.45.

The NSE Nifty dipped 82.90 points or 0.33 per cent to 24,750.70.

Metals, IT, and auto sector shares declined while banking shares gained.

Investors were cautious ahead of the release of domestic GDP data post-market hours, analysts said.

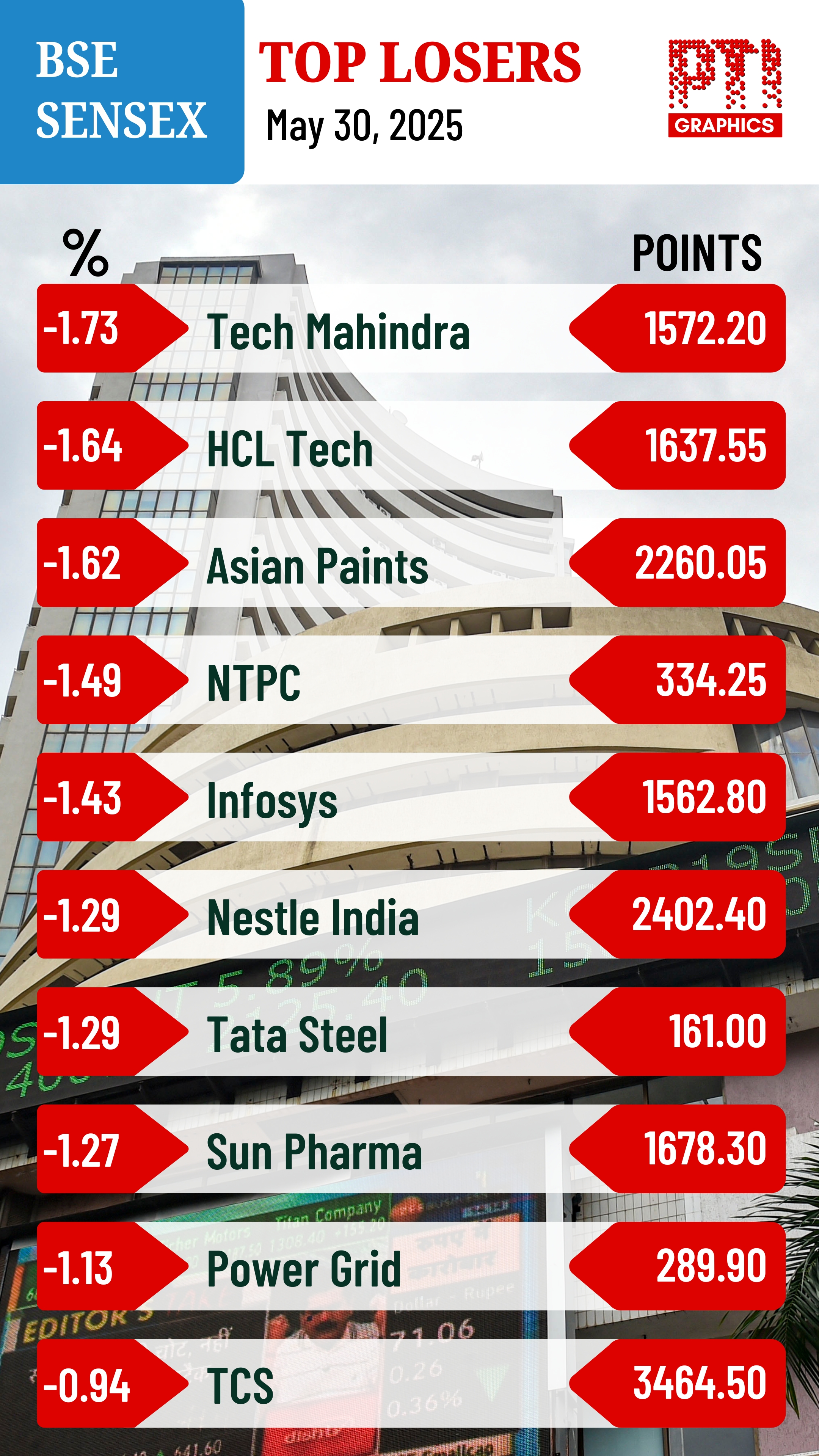

Among Sensex firms, Tech Mahindra fell the most by 1.73 per cent. HCL Tech, Asian Paints, NTPC, Infosys, Nestle, Sun Pharma, and Tata Steel also closed lower.

Eternal, State Bank of India, HDFC Bank, Larsen & Toubro, Reliance Industries and Bajaj Finserv were the gainers.

"A range-bound movement continued in the market, with the temporary reinstatement of US tariffs by the appeal court influencing investors to stay on the sideline. The global market may contend with macroeconomic concerns as the global trade landscape has yet to see stability, which may navigate a short-term consolidation.

"Meanwhile, FII inflows continued due to the volatility in the US 10-year yield and an expectation of solid domestic Q4 GDP data later today and a rate cut by RBI," Vinod Nair, Head of Research, Geojit Investments Limited, said.

"Markets languished in negative territory to end lower amid weak Asian cues as investors cut their position in IT, metal, oil & gas and auto shares," Prashanth Tapse, Senior VP (Research), Mehta Equities Ltd, said.

The BSE midcap gauge declined 0.39 per cent while smallcap index went up by 0.17 per cent.

Among sectoral indices, metal dropped the most by 1.68 per cent, followed by BSE Focused IT (1.14 per cent), commodities (1.14 per cent), utilities (1.09 per cent), teck (0.99 per cent), auto (0.91 per cent) and telecommunication (0.79 per cent).

Financial Services, bankex and capital goods were the gainers.

On the weekly front, the BSE benchmark declined 270.07 points or 0.33 per cent and the Nifty dipped 102.45 points or 0.41 per cent.

In Asian markets, South Korea's Kospi, Japan's Nikkei 225 index, Shanghai's SSE Composite index and Hong Kong's Hang Seng settled in the negative territory.

Markets in Europe were trading higher. US markets ended higher on Thursday.

Foreign Institutional Investors (FIIs) bought equities worth Rs 884.03 crore on Thursday, while Domestic Institutional Investors (DIIs) bought equities worth Rs 4,286.50 crore, according to exchange data.

Global oil benchmark Brent crude climbed 0.44 per cent to USD 64.43 a barrel.

The BSE Sensex climbed 320.70 points or 0.39 per cent to settle at 81,633.02 on Thursday. The 50-share Nifty went up by 81.15 points or 0.33 per cent to 24,833.60.

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

Bengaluru (PTI): Chartered Speed Limited and EKA Mobility on Wednesday secured a Letter of Confirmation of Quantity for the deployment of 1,750 electric buses here, officials said.

The development marks a significant milestone in strengthening sustainable public electric transport infrastructure in one of India’s major metropolitan regions.

According to Chartered Speed Limited, a leading player in passenger bus mobility services, the allocation accounts for nearly 39 per cent of Bengaluru’s planned induction of 4,500 electric buses under the PM E-Drive Scheme, underscoring the company’s role in advancing the city’s public transport electrification efforts.

Bengaluru has emerged as one of India’s leading cities in electric public transport adoption, with the Bengaluru Metropolitan Transport Corporation steadily expanding its electric bus network in line with Karnataka’s clean mobility vision and the Centre’s decarbonisation roadmap, the company said in a statement.

Emphasising that safety remains a core pillar of its EV operations, Chartered Speed Limited said it follows structured safety protocols, including preventive maintenance, battery health monitoring, and specialised driver training to ensure reliable and commuter-focused services.

The partnership combines Chartered Speed’s operational expertise with EKA Mobility’s electric vehicle manufacturing and technology capabilities to deliver accessible and dependable urban transport solutions for Bengaluru commuters, it added.

"Bengaluru is a key mobility hub in India, and electric buses are central to efforts to build a cleaner and more efficient public transport system," said Sanyam Gandhi, Whole-Time Director, Chartered Speed Limited.

"As an early adopter of e-mobility, we aim to convert around 25 per cent of our fleet to electric by fiscal 2027, supported by strong infrastructure investments to deliver commuter-centric services with lasting socio-economic impact," he added.