Mumbai, May 6 (PTI): Benchmark indices Sensex and Nifty ended lower in a range-bound trade on Tuesday due to profit booking, mainly in banking and oil shares, and investors staying on the sideline amid escalating tensions between India and Pakistan.

Snapping its two days of gains, the 30-share BSE Sensex declined 155.77 points or 0.19 per cent to settle at 80,641.07. During the day, it dropped 315.81 points or 0.39 per cent to 80,481.03.

The NSE Nifty dipped 81.55 points or 0.33 per cent to 24,379.60.

The trading activity was range bound ahead of the US Federal Reserve’s policy decision and concerns over US-China trade negotiations, analysts said.

The Union Home Ministry has directed states and UTs to hold security mock drills in light of the rising Indo-Pak tensions after the Pahalgam terror attack.

Close to 300 'civil defence districts' with sensitive installations like nuclear plants, military bases, refineries, and hydroelectric dams will be covered by mock drills on air-raid warning sirens, civilian training for a "hostile attack" and cleaning of bunkers and trenches.

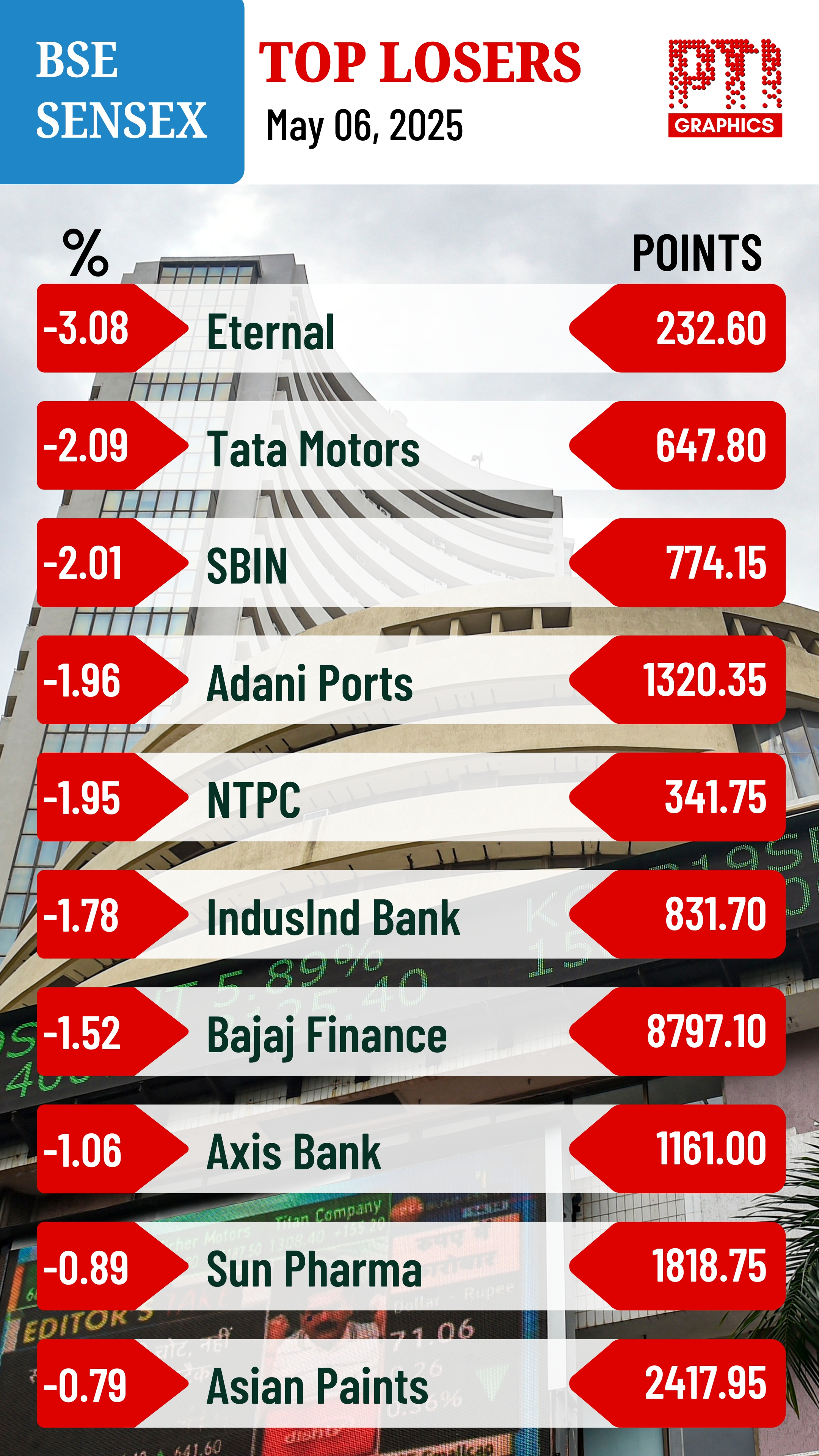

Among Sensex firms, Eternal, Tata Motors, State Bank of India, Adani Ports, NTPC, IndusInd Bank, Bajaj Finance, Asian Paints, Axis Bank and Sun Pharma were the major losers.

Bharti Airtel, Tata Steel, Mahindra & Mahindra, Hindustan Unilever, Nestle and Maruti were among the gainers.

"The domestic market has been consolidating in recent sessions following the strong recovery, driven by cautious sentiment amid India-Pakistan border tensions. Weak earnings growth for the current quarter has further impacted the market.

"Meanwhile, investors are closely monitoring India's bilateral trade negotiations with the US. Additionally, speculation around the US Federal Reserve is drawing attention, as no rate cuts are expected in the near term, affecting global trends," Vinod Nair, Head of Research, Geojit Investments Limited, said.

India's service sector activity accelerated slightly in April largely driven by a quicker increase in new order inflows, which also underpinned a faster expansion in employment, according to a monthly survey on Tuesday.

The seasonally adjusted HSBC India Services PMI Business Activity Index reached 58.7 in April, up from 58.5 in March, indicating a sharp and stronger expansion in service sector output.

"Market volatility was further aggravated by escalating geopolitical tensions between India and Pakistan, coupled with uncertainty surrounding the US Federal Reserve’s upcoming interest rate decision," Siddhartha Khemka, Head - Research, Wealth Management, Motilal Oswal Financial Services Ltd, said.

Looking ahead, progress on the U.S. trade deal could provide near-term support to the markets, he said. However, ongoing geopolitical concerns and the earnings season are likely to keep investor sentiment cautious in the near term, Khemka added.

The BSE smallcap gauge dropped 2.33 per cent and midcap index declined 2.16 per cent.

Among sectoral indices, realty tanked 3.49 per cent, power (2.64 per cent), services (2.53 per cent), utilities (2.36 per cent), industrials (2 per cent), capital goods (1.71 per cent) and consumer durables (1.59 per cent).

Auto and teck were the only gainers.

In Asian markets, Shanghai' SSE Composite index and Hong Kong's Hang Seng settled higher. South Korean and Japanese markets were closed due to holidays.

Markets in Europe were trading lower. US markets ended in the negative territory on Monday.

Foreign Institutional Investors (FIIs) bought equities worth Rs 497.79 crore on Monday, according to exchange data.

Global oil benchmark Brent crude jumped 2.76 per cent to USD 61.85 a barrel.

The 30-share BSE benchmark climbed 294.85 points or 0.37 per cent to settle at 80,796.84 on Monday. The Nifty rose by 114.45 points or 0.47 per cent to 24,461.15.

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

Mumbai (PTI): The rupee depreciated 31 paise to settle at 91.99 against the US dollar on Wednesday, touching the lowest closing level for the second time in less than a week, amid increased month-end demand for the greenback.

Forex traders said the rupee opened higher as the US dollar index softened and a long-awaited trade breakthrough with Europe offered quiet reassurance. However, increased month-end demand for the American currency as well as the ongoing geopolitical tensions dented investors' sentiments.

At the interbank foreign exchange, the rupee opened at 91.60 and touched an early high of 91.50, but pared all the gains to touch an intra-day low of 91.99 against the greenback.

The domestic unit settled 31 paise down, revisiting its lowest-ever closing level of 91.99 against the greenback. The Indian currency previously ended at this level on January 23 when it also hit its all-time intraday low of 92 against the US dollar.

On Tuesday, the rupee rebounded from its all-time low levels and gained 22 paise to close at 91.68 against the US dollar.

Analysts said the rupee opened higher as the US dollar index softened and a long-awaited trade breakthrough with Europe bolstered investor sentiment.

India and the European Union on Tuesday announced the conclusion of negotiations for the free trade agreement (FTA), under which a number of domestic sectors such as apparel, chemicals and footwear will get duty-free entry into the 27-nation bloc, while the EU will get access to the Indian market at concessional duty for cars and wines, an official said.

The deal has been dubbed the "mother of all deals" as it will create a market of about 2 billion people.

Meanwhile, the dollar index, which gauges the greenback's strength against a basket of six currencies, was trading 0.07 per cent lower at 96.14.

Brent crude, the global oil benchmark, was trading 0.43 per cent lower at USD 67.28 per barrel in futures trade.

On the domestic equity market front, Sensex jumped 487.20 points to settle at 82,344.68, while Nifty surged 167.35 points to 25,342.75.

Foreign Institutional Investors turned net buyers and purchased equities worth Rs 480.26 crore on Wednesday, according to exchange data.