Mumbai, May 20 (PTI): Falling for the third day in a row, benchmark stock indices Sensex and Nifty tumbled 1 per cent on Tuesday dragged down by profit taking in blue-chips such as HDFC Bank, Reliance Industries and ICICI Bank.

Retreating from early highs, the 30-share BSE Sensex tanked 872.98 points or 1.06 per cent to settle at 81,186.44 as 27 of its constituents closed lower and three with gains. During the day, it dropped 905.72 points or 1.10 per cent to 81,153.70 as profit taking emerged in auto, financials and defence stocks.

The broader NSE Nifty tumbled 261.55 points or 1.05 per cent to 24,683.90.

Analysts said investors opted for profit-booking as they awaited more clarity on the India-US trade agreement.

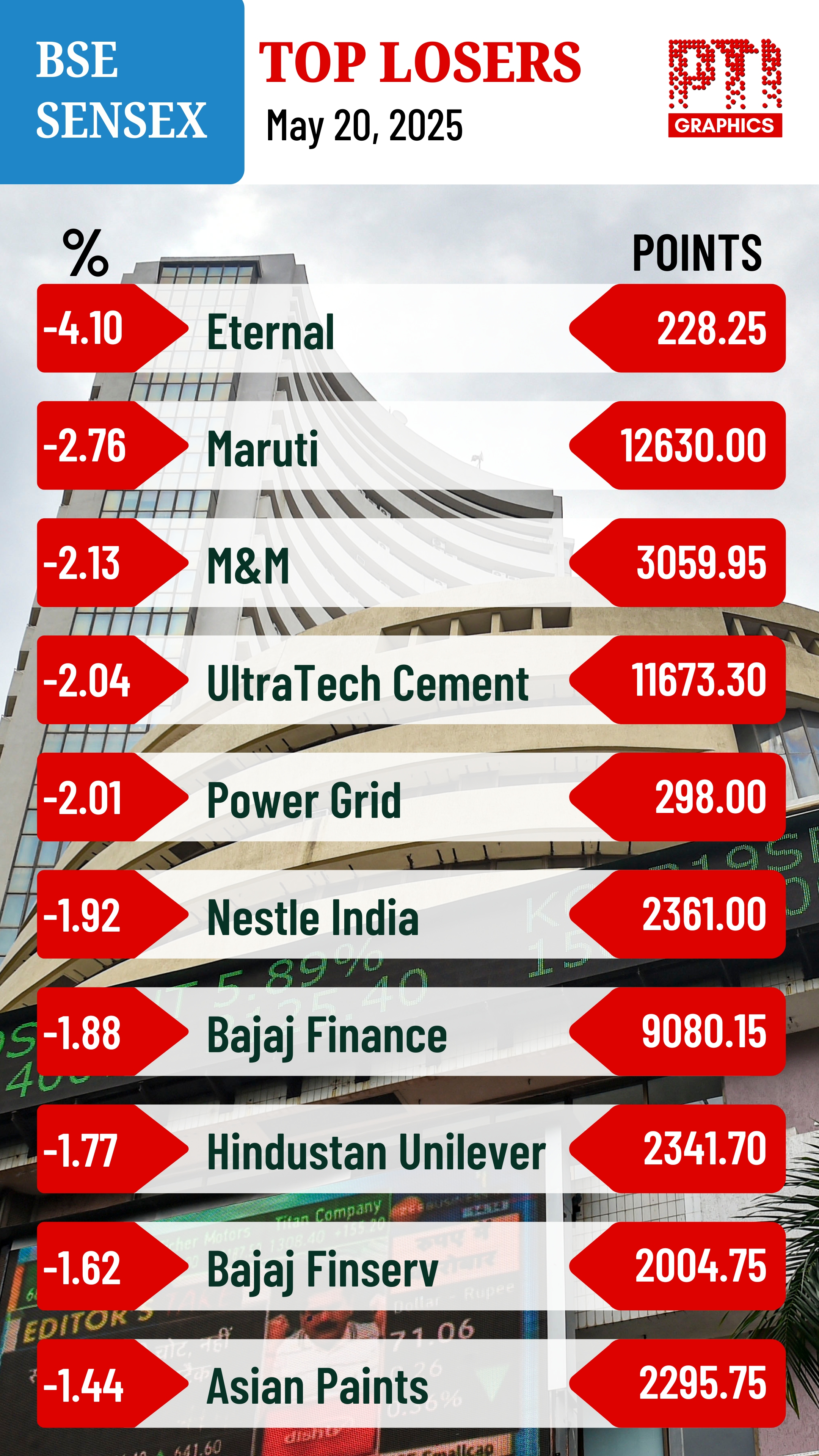

From Sensex firms, Eternal dropped the most by 4.10 per cent. Maruti, Mahindra & Mahindra, UltraTech Cement, Power Grid, Nestle, Bajaj Finance, Hindustan Unilever and Asian Paints were also among the laggards. HDFC Bank dropped by 1.26 per cent and index major Reliance Industries by 1.13 per cent.

Tata Steel, Infosys and ITC were the gainers.

"With the lack of major positive triggers and prevailing uncertainty over US fiscal stability, investors opted for profit-booking and adopted a cautious stance. Selling pressure was widespread as participants awaited more clarity on the India-US trade agreement,” Vinod Nair, Head of Research, Geojit Investments Limited, said.

"Given the current premium valuations and delays in the trade deal, we foresee a phase of short-term consolidation, which may lead FIIs to scale back their positions in the domestic market," he added.

The BSE midcap gauge tanked 1.65 per cent and smallcap index dropped 0.96 per cent.

All sectoral indices ended lower. Auto declined 2.13 per cent, consumer discretionary (1.81 per cent), utilities (1.64 per cent), services (1.53 per cent), industrials (1.36 per cent) and telecommunication (1.35 per cent).

As many as 2,531 stocks declined while 1,438 advanced and 135 remained unchanged on the BSE.

"While markets had witnessed a pullback rally over the past week due to Indo-Pak ceasefire, US-China heading towards a tariff understanding and strong FII fund inflows, the mood is reversing back to caution with a negative bias. The current situation shows that markets will see bouts of optimism followed by a volatile phase as global economic uncertainty remains a key challenge for investors," Prashanth Tapse, Senior VP (Research), Mehta Equities Ltd, said.

Among Asian markets, Japan's Nikkei 225 index, Shanghai's SSE Composite index and Hong Kong's Hang Seng settled in the positive territory while South Korea's Kospi ended marginally lower.

Markets in Europe were trading in the green. US markets ended higher on Monday.

Global oil benchmark Brent crude dipped 0.11 per cent to USD 65.47 a barrel.

Foreign institutional investors offloaded equities worth Rs 525.95 crore on Monday, according to exchange data.

On Monday, the 30-share BSE barometer Sensex declined 271.17 points or 0.33 per cent to settle at 82,059.42. The Nifty dipped 74.35 points or 0.30 per cent to 24,945.45.

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

Mumbai (PTI): The rupee depreciated 31 paise to settle at 91.99 against the US dollar on Wednesday, touching the lowest closing level for the second time in less than a week, amid increased month-end demand for the greenback.

Forex traders said the rupee opened higher as the US dollar index softened and a long-awaited trade breakthrough with Europe offered quiet reassurance. However, increased month-end demand for the American currency as well as the ongoing geopolitical tensions dented investors' sentiments.

At the interbank foreign exchange, the rupee opened at 91.60 and touched an early high of 91.50, but pared all the gains to touch an intra-day low of 91.99 against the greenback.

The domestic unit settled 31 paise down, revisiting its lowest-ever closing level of 91.99 against the greenback. The Indian currency previously ended at this level on January 23 when it also hit its all-time intraday low of 92 against the US dollar.

On Tuesday, the rupee rebounded from its all-time low levels and gained 22 paise to close at 91.68 against the US dollar.

Analysts said the rupee opened higher as the US dollar index softened and a long-awaited trade breakthrough with Europe bolstered investor sentiment.

India and the European Union on Tuesday announced the conclusion of negotiations for the free trade agreement (FTA), under which a number of domestic sectors such as apparel, chemicals and footwear will get duty-free entry into the 27-nation bloc, while the EU will get access to the Indian market at concessional duty for cars and wines, an official said.

The deal has been dubbed the "mother of all deals" as it will create a market of about 2 billion people.

Meanwhile, the dollar index, which gauges the greenback's strength against a basket of six currencies, was trading 0.07 per cent lower at 96.14.

Brent crude, the global oil benchmark, was trading 0.43 per cent lower at USD 67.28 per barrel in futures trade.

On the domestic equity market front, Sensex jumped 487.20 points to settle at 82,344.68, while Nifty surged 167.35 points to 25,342.75.

Foreign Institutional Investors turned net buyers and purchased equities worth Rs 480.26 crore on Wednesday, according to exchange data.