Mumbai, May 26 (PTI): Benchmark Sensex on Monday advanced by 455 points to close at over a week's high due to buying in auto and IT shares following positive macro factors and easing trade worries as US President Donald Trump delayed 50 per cent EU tariffs to July 9.

Rising for the second session, the 30-share BSE Sensex jumped 455.37 points or 0.56 per cent to settle at 82,176.45. During the day, it surged 771.16 points or 0.94 per cent to 82,492.24.

The NSE Nifty climbed 148 points or 0.60 per cent to settle at 25,001.15, a level not seen since May 16.

The early arrival of monsoon and the Reserve Bank announcing a record Rs 2.69 lakh crore dividend to the government for FY25 also added to the optimistic trend in the markets, experts said.

Among Sensex stocks, leading tractor and auto manufacturer Mahindra & Mahindra rose the most by 2.17 per cent. HCL Tech, Tata Motors, Nestle, ITC, Hindustan Unilever, Larsen & Toubro, and Tech Mahindra were the major gainers.

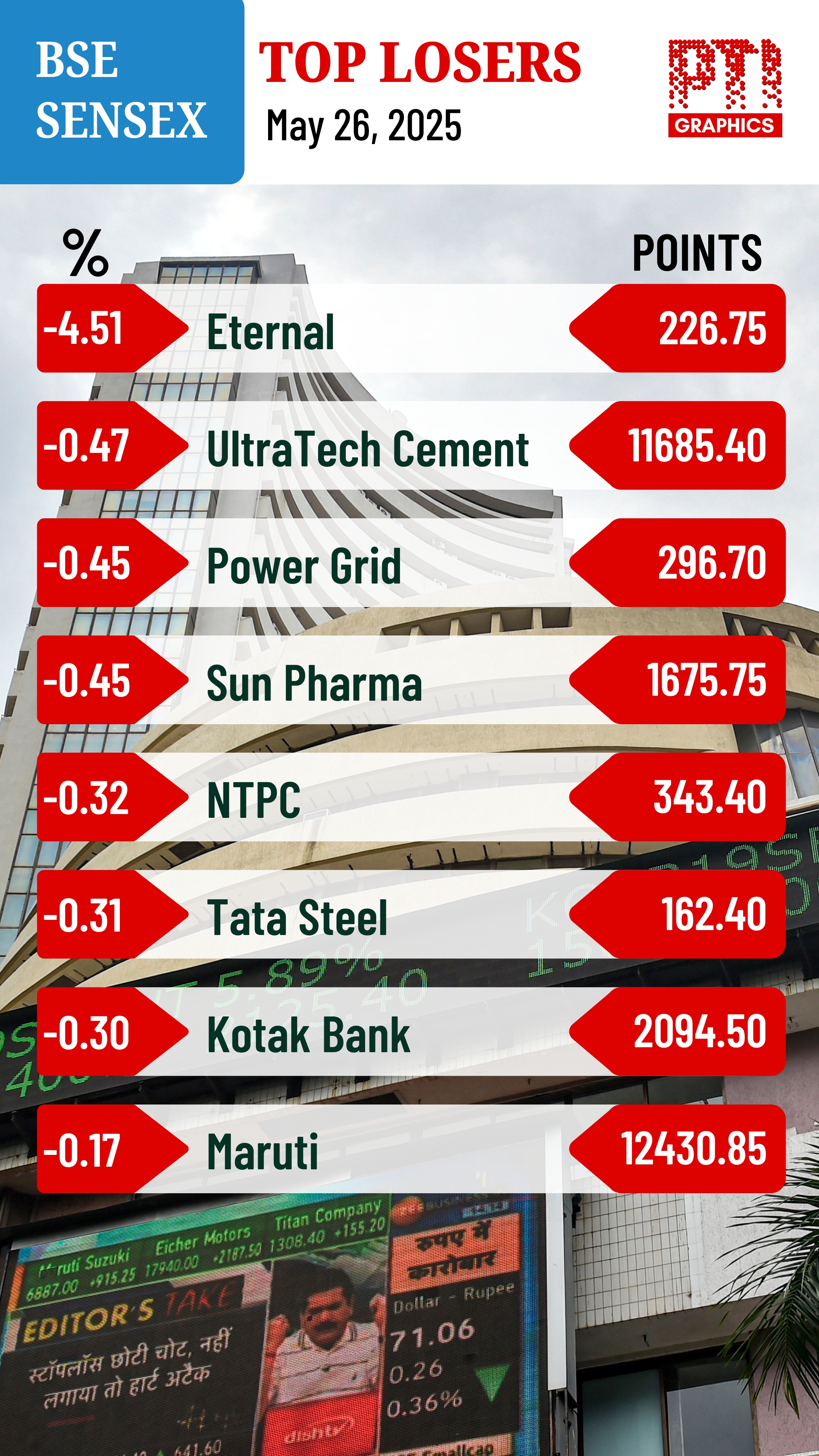

In contrast, Eternal, UltraTech Cement, Power Grid, Tata Steel and Kotak Mahindra Bank were among the laggards. Eternal dropped the most by 4.51 per cent.

India has become the fourth largest economy in the world, overtaking Japan, NITI Aayog CEO BVR Subrahmanyam has said.

The Reserve Bank on Friday announced a record Rs 2.69 lakh crore dividend to the government for FY25, 27.4 per cent higher than 2023-24, helping the exchequer to tide over challenges posed by US tariffs and increased spending on defence due to the conflict with Pakistan.

"The US decision to consider extending the deadline for imposing aggressive tariffs on EU, coupled with a decline in the dollar index, contributed to a rebound in the domestic equity markets. These developments suggest that trade negotiations are progressing constructively, which could help moderate market volatility.

"Additionally, the early onset of the southwest monsoon and a decline in domestic bond yields have encouraged investors to maintain their focus on riskier assets," Vinod Nair, Head of Research, Geojit Investments Limited, said.

"Although the market pared most of its early gains, benchmark indices closed above their key psychological levels on steady all-round buying support due to optimism in European indices and mixed Asian cues," Prashanth Tapse, Senior VP (Research), Mehta Equities Ltd, said.

The BSE midcap gauge climbed 0.56 per cent and smallcap index went up by 0.48 per cent.

Among sectoral indices, auto jumped 1.04 per cent, BSE Focused IT (1.04 per cent), FMCG (0.93 per cent), industrials (0.98 per cent), IT (0.95 per cent), capital goods (0.91 per cent), teck (0.88 per cent) and oil & gas (0.67 per cent).

Services emerged as the only laggard.

As many as 2,301 stocks advanced while 1,772 declined and 194 remained unchanged on the BSE.

In Asian markets, South Korea's Kospi and Japan's Nikkei 225 index settled in the positive territory, while Shanghai's SSE Composite index and Hong Kong's Hang Seng ended lower.

Markets in Europe were trading higher in mid-session deals.

US markets ended lower on Friday.

Foreign Institutional Investors (FIIs) bought equities worth Rs 1,794.59 crore on Friday, according to exchange data.

The southwest monsoon hit Kerala on Saturday, marking its earliest arrival over the Indian mainland since 2009 when it reached the southern state on May 23, the India Meteorological Department (IMD) said.

Global oil benchmark Brent crude climbed 0.17 per cent to USD 64.89 a barrel.

On Friday, the 30-share BSE benchmark surged 769.09 points or 0.95 per cent to settle at 81,721.08. The Nifty rallied 243.45 points or 0.99 per cent to 24,853.15.

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

Mumbai (PTI): The rupee depreciated 31 paise to settle at 91.99 against the US dollar on Wednesday, touching the lowest closing level for the second time in less than a week, amid increased month-end demand for the greenback.

Forex traders said the rupee opened higher as the US dollar index softened and a long-awaited trade breakthrough with Europe offered quiet reassurance. However, increased month-end demand for the American currency as well as the ongoing geopolitical tensions dented investors' sentiments.

At the interbank foreign exchange, the rupee opened at 91.60 and touched an early high of 91.50, but pared all the gains to touch an intra-day low of 91.99 against the greenback.

The domestic unit settled 31 paise down, revisiting its lowest-ever closing level of 91.99 against the greenback. The Indian currency previously ended at this level on January 23 when it also hit its all-time intraday low of 92 against the US dollar.

On Tuesday, the rupee rebounded from its all-time low levels and gained 22 paise to close at 91.68 against the US dollar.

Analysts said the rupee opened higher as the US dollar index softened and a long-awaited trade breakthrough with Europe bolstered investor sentiment.

India and the European Union on Tuesday announced the conclusion of negotiations for the free trade agreement (FTA), under which a number of domestic sectors such as apparel, chemicals and footwear will get duty-free entry into the 27-nation bloc, while the EU will get access to the Indian market at concessional duty for cars and wines, an official said.

The deal has been dubbed the "mother of all deals" as it will create a market of about 2 billion people.

Meanwhile, the dollar index, which gauges the greenback's strength against a basket of six currencies, was trading 0.07 per cent lower at 96.14.

Brent crude, the global oil benchmark, was trading 0.43 per cent lower at USD 67.28 per barrel in futures trade.

On the domestic equity market front, Sensex jumped 487.20 points to settle at 82,344.68, while Nifty surged 167.35 points to 25,342.75.

Foreign Institutional Investors turned net buyers and purchased equities worth Rs 480.26 crore on Wednesday, according to exchange data.