Mumbai, Jul 22 (PTI): Benchmark stock indices Sensex and Nifty closed almost unchanged in a volatile trade on Tuesday as gains in quick commerce and private banking shares were offset by losses in oil & gas and IT shares.

The 30-share BSE Sensex ended 13.53 points or 0.02 per cent down at 82,186.81. During the morning trade, it climbed 337.83 points or 0.41 per cent to 82,538.17 but lost momentum later.

The 50-share NSE Nifty dipped 29.80 points or 0.12 per cent to settle at 25,060.90.

Lack of clarity over the US-India trade deal ahead of the August 1 deadline and profit booking by FIIs hit the market sentiment, experts said.

Among Sensex firms, Eternal jumped the most by 10.56 per cent in a post-result rally. Food delivery and quick commerce firm Eternal, which owns the Zomato and Blinkit brands, on Monday reported a consolidated net profit of Rs 25 crore for the June quarter, as continuing investments in quick commerce and going-out businesses weighed on its bottom line.

Titan rose by over 1 per cent while HDFC Bank and ICICI Bank extended gains after their quarterly results.

Hindustan Unilever, Bharat Electronics, Maruti, ICICI Bank and Mahindra & Mahindra were also among the gainers.

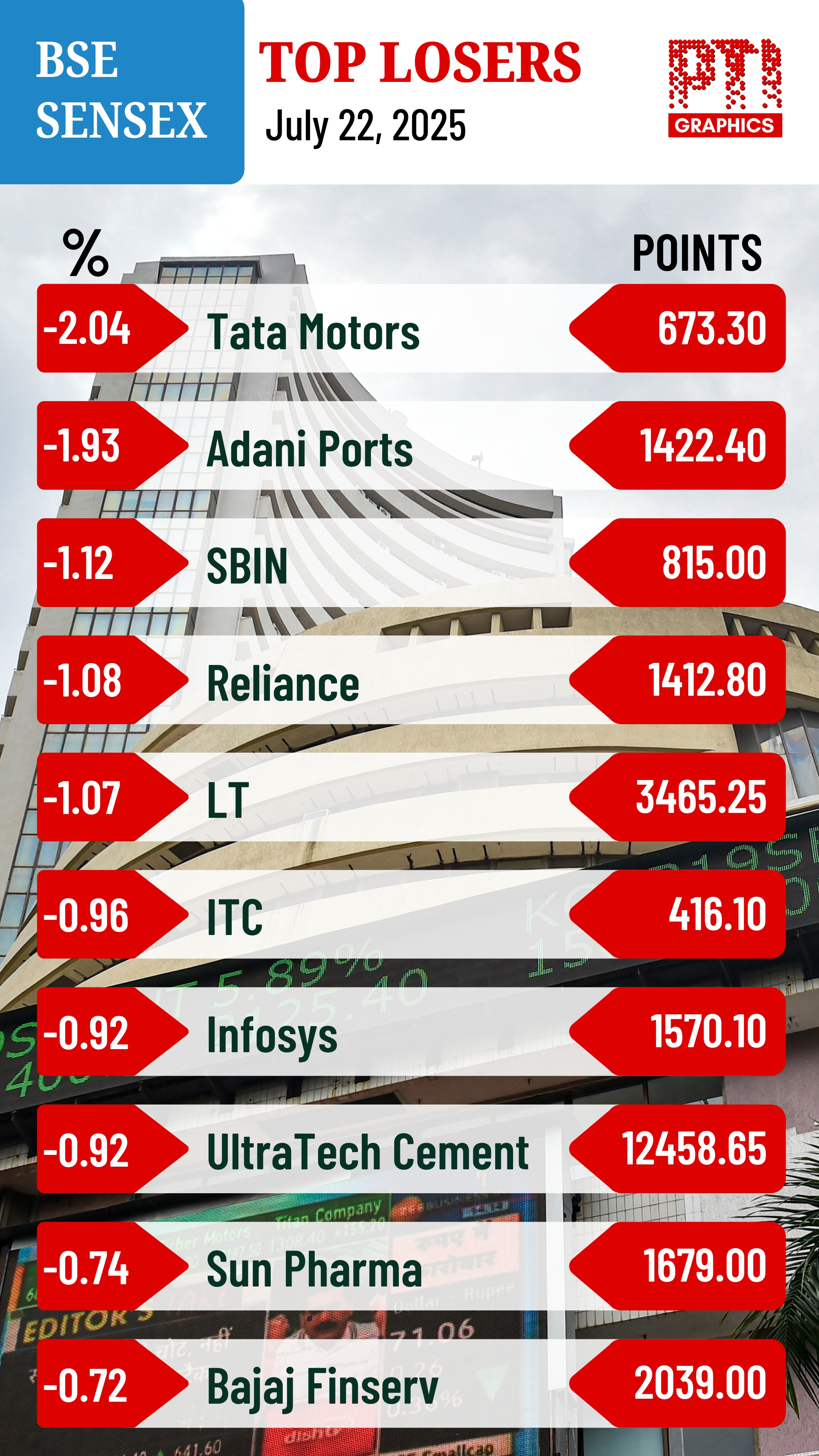

However, Tata Motors, Adani Ports, State Bank of India and Reliance Industries were among the laggards.

"The market’s attention is on quarterly earnings, which slowed lately after some traction from banking stocks. Positivity noticed on Friday and Monday tapered ahead of the critical August 1st deadline of US trade agreement.

"Upside in Q1 earnings will be the critical point to sustain the current premium valuations. Continued profit-booking by FIIs exerts downward pressure, while steady inflows from DIIs could support for a range-bound movement with a positive bias towards Q1 results and trade deal," Vinod Nair, Head of Research, Geojit Investments Limited, said.

The BSE midcap gauge declined 0.62 per cent and smallcap index dipped 0.17 per cent.

Among BSE sectoral indices, realty dropped 1.01 per cent, followed by telecommunication (0.87 per cent), auto (0.78 per cent), IT (0.53 per cent) and teck (0.53 per cent).

Consumer discretionary emerged as the only gainer.

“Markets remained range-bound and ended almost flat, indicating a pause amid mixed signals. The market continues to lack clear direction amid mixed earnings announcements and muted global cues,” Ajit Mishra – SVP, Research, Religare Broking Ltd, said.

In Asian markets, Shanghai's SSE Composite index and Hong Kong's Hang Seng settled in positive territory while South Korea's Kospi and Japan's Nikkei 225 index ended lower.

European markets were trading mostly lower. The US markets ended mostly higher on Monday.

Foreign Institutional Investors (FIIs) offloaded equities worth Rs 1,681.23 crore on Monday, while Domestic Institutional Investors (DIIs) bought stocks worth Rs 3,578.43 crore, according to exchange data.

Global oil benchmark Brent crude dropped 0.97 per cent to USD 68.54 a barrel.

On Monday, the Sensex climbed 442.61 points or 0.54 per cent to settle at 82,200.34. The Nifty jumped 122.30 points or 0.49 per cent to 25,090.70.

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

Bengaluru (PTI): Minister Shivraj Tangadagi on Wednesday told the Legislative Assembly that the Karnataka government is in favour of declaring Tulu as the state’s second additional official language.

He said the government is studying the measures adopted by West Bengal and Andhra Pradesh, both of which have additional official languages.

The minister was responding to a question by Puttur Congress MLA Ashok Kumar Rai during Question Hour.

Tulu is predominantly spoken in the coastal districts of Udupi and Dakshina Kannada, and legislators across party lines from these regions, including Speaker U T Khader, have been demanding that the government declare it as the state’s second additional official language.

At present, Kannada is the state’s only official language, while English is also used for official purposes as an additional language.

"I am continuously following it up. We have written to West Bengal and sent a committee of officials to Andhra Pradesh, where Urdu was recently declared the second official language. The committee has gathered information and returned, but is yet to submit its report," Tangadagi said.

He added that once the report is submitted, a meeting involving the Speaker, district in-charge ministers, and legislators from Tulu-speaking districts will be convened with Chief Minister Siddaramaiah. "I want to assure you that we are in favour of this," he said.

Earlier, noting that several states have two or three additional official languages, Rai demanded that Tulu be declared an official language at the earliest, stating that it would not impose any financial burden on the government.

"Tulu has a history of 3,000 years, has its own script, and is included in Google Translate. The language is being researched in Germany and France, and universities have allowed examinations in Tulu," Rai said, adding that this was a unanimous demand of 13 legislators from Tulu-speaking Dakshina Kannada and Udupi districts, with no opposition.

Saying it had been a long-standing demand, Rai added that a Cabinet meeting was likely to be held in Mangaluru in the coming days and urged that a decision be announced there.

BJP MLA Vedavyas Kamath also demanded early action to declare Tulu an official language. He even spoke in Tulu in the House with Speaker U T Khader, who hails from a Tulu-dominant region and speaks the language fluently.

Kamath said a committee headed by educationist Mohan Alva, constituted by the previous BJP government to examine the issue, had studied the matter in detail and compiled all relevant information.