Mumbai, Aug 12 (PTI): Benchmark indices Sensex and Nifty ended lower in a highly volatile trade on Tuesday dragged down by blue-chip bank stocks and caution ahead of domestic and US inflation data.

The 30-share BSE Sensex dropped 368.49 points or 0.46 per cent to settle at 80,235.59. During the day, it hit a high of 80,997.67 and a low of 80,164.36, gyrating 833.31 points.

The 50-share NSE Nifty went lower by 97.65 points or 0.40 per cent to 24,487.40.

Investors are also awaiting cues from the US-Russia talks on August 15.

From the Sensex firms, Bajaj Finance, Trent, Hindustan Unilever, HDFC Bank, Eternal, Bajaj Finserv, ICICI Bank, and Bharat Electronics were among the laggards.

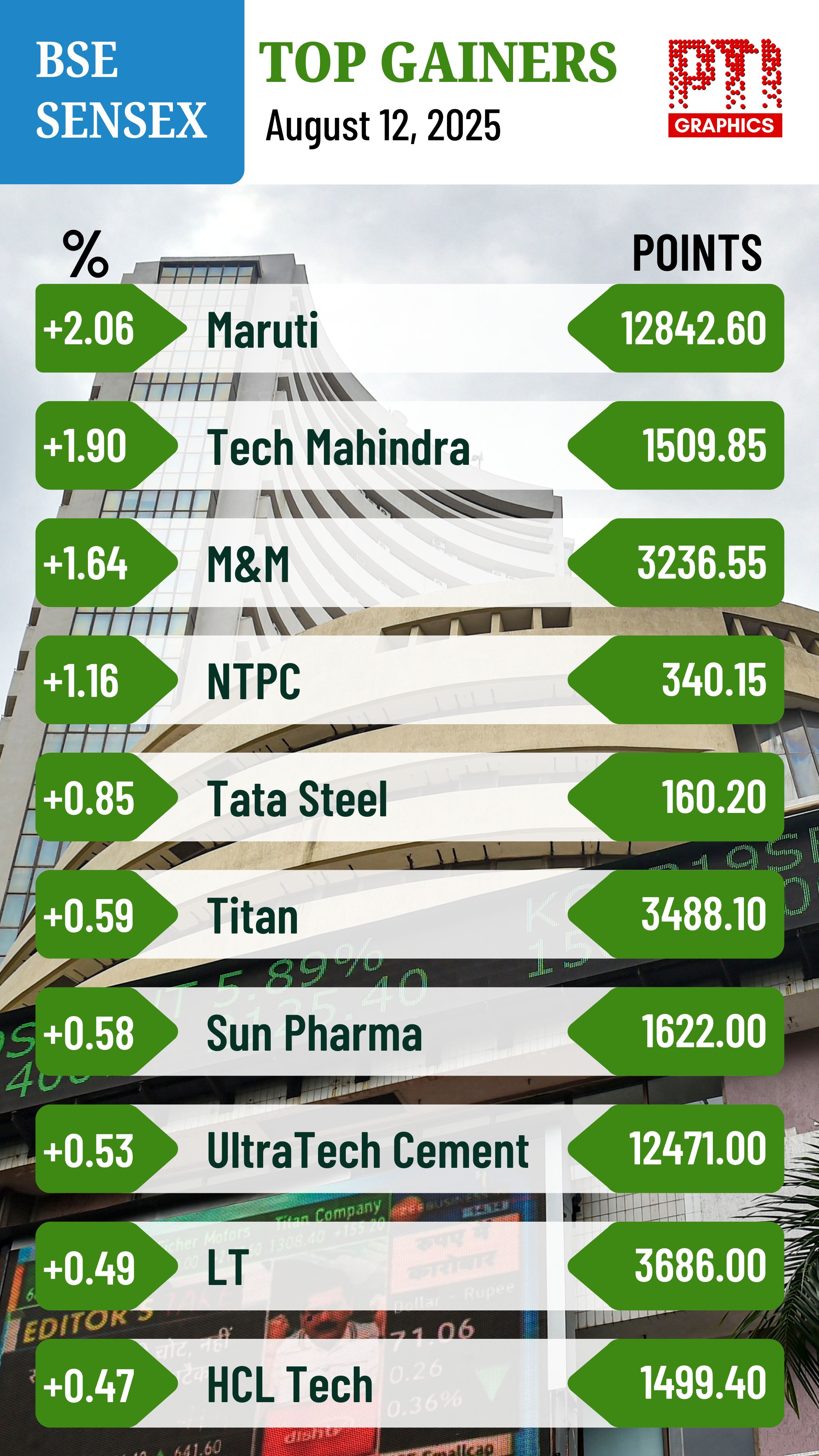

However, Maruti, Tech Mahindra, Mahindra & Mahindra and NTPC were among the major gainers.

"The national market reacted with volatility to the ongoing developments in global trade tariffs, reflecting caution following the extension of the US-China tariff truce and ahead of key inflation data due later today. The US inflation figures with any signs of tariff-related impact could influence the Fed's policy stance," Vinod Nair, Head of Research, Geojit Investments Ltd, said.

The BSE midcap gauge dipped 0.25 per cent and smallcap index edged marginally up by 0.04 per cent.

Among BSE sectoral indices, bankex dropped 0.83 per cent, capital goods (0.76 per cent), realty (0.75 per cent), telecommunication (0.46 per cent) and FMCG (0.44 per cent).

Oil & gas, healthcare, metal, utilities, IT and BSE Focused IT were the gainers.

In Asian markets, South Korea's Kospi settled lower while Japan's Nikkei 225 index, Shanghai's SSE Composite index and Hong Kong's Hang Seng ended in positive territory.

European markets were trading on a mixed note.

The US markets ended lower on Monday.

Global oil benchmark Brent crude climbed 0.18 per cent to USD 66.75 a barrel.

Foreign Institutional Investors (FIIs) offloaded equities worth Rs 1,202.65 crore on Monday, according to exchange data.

On Monday, the Sensex jumped 746.29 points or 0.93 per cent to settle at 80,604.08. The Nifty climbed 221.75 points or 0.91 per cent to 24,585.05.

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

New Delhi: Assam Chief Minister Himanta Biswa Sarma on Tuesday said that four to five lakh “Miya voters” would be removed from the electoral rolls in the state once the Special Intensive Revision (SIR) of voter lists is carried out. He also made a series of controversial remarks openly targeting the Miya community, a term commonly used in Assam in a derogatory sense to refer to Bengali-speaking Muslims.

Speaking to reporters on the sidelines of an official programme in Digboi in Tinsukia district, Sarma said it was his responsibility to create difficulties for the Miya community and claimed that both he and the BJP were “directly against Miyas”.

“Four to five lakh Miya votes will have to be deleted in Assam when the SIR happens,” Sarma said, adding that such voters “should ideally not be allowed to vote in Assam, but in Bangladesh”. He asserted that the government was ensuring that they would not be able to vote in the state.

The chief minister was responding to questions about notices issued to thousands of Bengali-speaking Muslims during the claims and objections phase of the ongoing Special Revision (SR) of electoral rolls in Assam. While the Election Commission is conducting SIR exercises in 12 states and Union Territories, Assam is currently undergoing an SR, which is usually meant for routine updates.

Calling the current SR “preliminary”, Sarma said that a full-fledged SIR in Assam would lead to large-scale deletion of Miya voters. He said he was unconcerned about criticism from opposition parties over the issue.

“Let the Congress abuse me as much as they want. My job is to make the Miya people suffer,” Sarma said. He claimed that complaints filed against members of the community were done on his instructions and that he had encouraged BJP workers to keep filing complaints.

“I have told people wherever possible they should fill Form 7 so that they have to run around a little and are troubled,” he said, adding that such actions were meant to send a message that “the Assamese people are still living”.

In remarks that drew further outrage, Sarma urged people to trouble members of the Miya community in everyday life, claiming that “only if they face troubles will they leave Assam”. He also accused the media of sympathising with the community and warned journalists against such coverage.

“So you all should also trouble, and you should not do news that sympathise with them. There will be love jihad in your own house.” He said.

The comments triggered reactions from opposition leaders. Raijor Dal president and MLA Akhil Gogoi said the people of Assam had not elected Sarma to keep one community under constant pressure. Congress leader Aman Wadud accused the chief minister of rendering the Constitution meaningless in the state, saying his remarks showed a complete disregard for constitutional values.

According to the draft electoral rolls published on December 27, Assam currently has 2.51 crore voters. Election officials said 4.78 lakh names were marked as deceased, 5.23 lakh as having shifted, and 53,619 duplicate entries were removed during the revision process. Authorities also claimed that verification had been completed for over 61 lakh households.

On January 25, six opposition parties the Congress, Raijor Dal, Assam Jatiya Parishad, CPI, CPI(M) and CPI(M-L) submitted a memorandum to the state’s chief electoral officer. They alleged widespread legal violations, political interference and selective targeting of genuine voters during the SR exercise, describing it as arbitrary, unlawful and unconstitutional.