Mumbai, May 27 (PTI): Snapping the two-day gaining streak, benchmark Sensex tumbled nearly 625 points on Tuesday due to profit-taking in banking, IT and auto shares.

The 30-share BSE Sensex dropped 624.82 points or 0.76 per cent to settle at 81,551.63 in a volatile session. During the day, the barometer tanked 1,054.75 points or 1.28 per cent to 81,121.70. As many as 25 Sensex shares declined while five advanced.

The 50-issue NSE Nifty declined 174.95 points or 0.70 per cent to 24,826.20. The barometer saw sharp swings in both directions in the first half but sustained profit-taking in heavyweight stocks dragged the index down.

Key indices Sensex and Nifty had advanced around 1.5 per cent in the past two sessions.

Analysts said investors turned cautious ahead of the release of industrial and manufacturing production data for April on Wednesday and the first quarter GDP numbers, scheduled to be announced later this week.

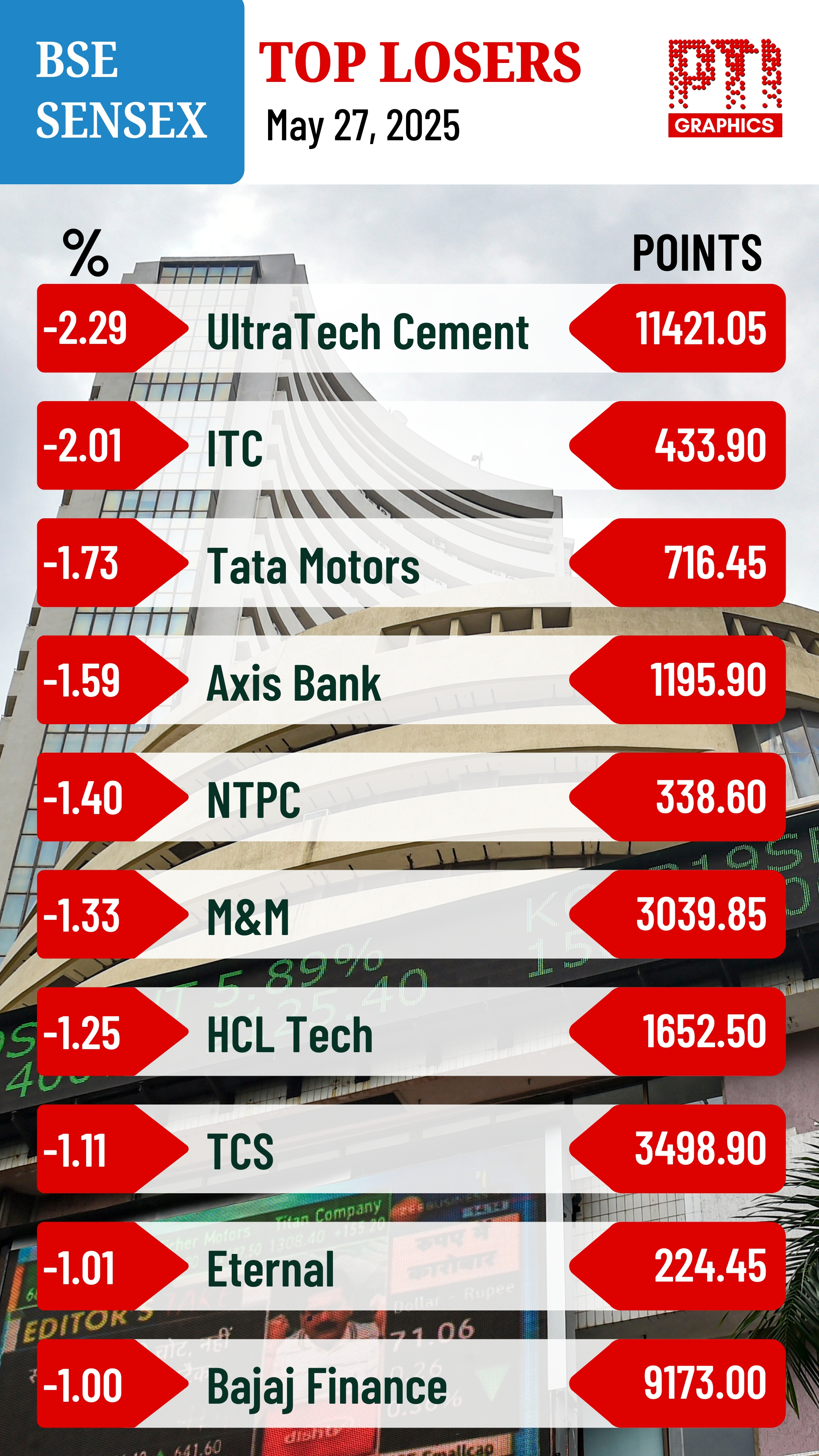

From the Sensex firms, UltraTech Cement fell the most by 2.21 per cent, followed by ITC which declined 2.01 per cent. Tata Motors, NTPC, Axis Bank, HCL Tech, Mahindra & Mahindra, HDFC Bank, ICICI Bank and Eternal were among the laggards.

IndusInd Bank, Sun Pharma, Adani Ports, Nestle and Asian Paints were the gainers.

"The domestic market witnessed volatility and snapped a two-day rally, as investors opted for profit booking driven by valuation concerns and weakness across Asian markets," Vinod Nair, Head of Research, Geojit Investments, said.

Mid- and small-cap segments remained relatively resilient, supported by better-than-estimated Q4 earnings and moderation in premium valuation, Nair added.

The BSE smallcap gauge went up by 0.19 per cent and midcap index climbed 0.18 per cent.

Among sectoral indices, FMCG dropped 0.79 per cent, IT declined 0.71 per cent, BSE Focused IT by 0.68 per cent, auto by 0.66 per cent, bankex by 0.60 per cent, utilities by 0.57 per cent and metal by 0.52 per cent.

Healthcare, industrials, telecommunication, capital goods, realty and consumer durables were the gainers.

"We are currently witnessing a tug-of-war between bulls and bears amid mixed global cues. However, favourable domestic factors such as a good monsoon and strong macroeconomic data are helping maintain a positive undertone," Ajit Mishra – SVP, Research, Religare Broking Ltd said.

In Asian markets, South Korea's Kospi and Shanghai's SSE Composite index settled in the negative territory while Japan's Nikkei 225 index and Hong Kong's Hang Seng ended higher. Markets in Europe were trading in the green. US markets were shut on Monday for Memorial Day.

Foreign Institutional Investors (FIIs) bought equities worth Rs 135.98 crore on Monday, according to exchange data.

Global oil benchmark Brent crude climbed 0.51 per cent to USD 65.07 a barrel.

The BSE Sensex jumped 455.37 points or 0.56 per cent to settle at 82,176.45 on Monday. The Nifty climbed 148 points or 0.60 per cent to 25,001.15.

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

Mumbai (PTI): The rupee depreciated 31 paise to settle at 91.99 against the US dollar on Wednesday, touching the lowest closing level for the second time in less than a week, amid increased month-end demand for the greenback.

Forex traders said the rupee opened higher as the US dollar index softened and a long-awaited trade breakthrough with Europe offered quiet reassurance. However, increased month-end demand for the American currency as well as the ongoing geopolitical tensions dented investors' sentiments.

At the interbank foreign exchange, the rupee opened at 91.60 and touched an early high of 91.50, but pared all the gains to touch an intra-day low of 91.99 against the greenback.

The domestic unit settled 31 paise down, revisiting its lowest-ever closing level of 91.99 against the greenback. The Indian currency previously ended at this level on January 23 when it also hit its all-time intraday low of 92 against the US dollar.

On Tuesday, the rupee rebounded from its all-time low levels and gained 22 paise to close at 91.68 against the US dollar.

Analysts said the rupee opened higher as the US dollar index softened and a long-awaited trade breakthrough with Europe bolstered investor sentiment.

India and the European Union on Tuesday announced the conclusion of negotiations for the free trade agreement (FTA), under which a number of domestic sectors such as apparel, chemicals and footwear will get duty-free entry into the 27-nation bloc, while the EU will get access to the Indian market at concessional duty for cars and wines, an official said.

The deal has been dubbed the "mother of all deals" as it will create a market of about 2 billion people.

Meanwhile, the dollar index, which gauges the greenback's strength against a basket of six currencies, was trading 0.07 per cent lower at 96.14.

Brent crude, the global oil benchmark, was trading 0.43 per cent lower at USD 67.28 per barrel in futures trade.

On the domestic equity market front, Sensex jumped 487.20 points to settle at 82,344.68, while Nifty surged 167.35 points to 25,342.75.

Foreign Institutional Investors turned net buyers and purchased equities worth Rs 480.26 crore on Wednesday, according to exchange data.