Mumbai, Jun 13 (PTI): Equity benchmark indices Sensex and Nifty tumbled nearly 1 per cent on Friday as weak global markets and a spike in Brent crude oil prices after Israel attacked Iran's capital weighed on investor sentiment.

Falling for the second day in a row, the 30-share BSE Sensex dived 573.38 points or 0.70 per cent to settle at 81,118.60. During the morning trade, it tanked 1,337.39 points or 1.63 per cent to 80,354.59.

As many as 2,469 stocks declined while 1,516 advanced and 137 remained unchanged on the BSE.

The 50-share NSE Nifty dropped 169.60 points or 0.68 per cent to 24,718.60.

On a weekly basis, the BSE benchmark tanked 1,070.39 points or 1.30 per cent, and the Nifty declined 284.45 points or 1.13 per cent.

Investors stayed away from riskier assets amid fears of a full-blown war between Israel and Iran and foreign fund outflows.

"Rising tensions in the Middle East after Israel attacked key Iranian areas drove investors to safe-haven assets like gold as riskier equities continued to face battering. Along with fresh concerns of the US likely to impose unilateral tariffs over next few weeks and higher valuations of domestic equities resulted in consolidation of markets," Prashanth Tapse, Senior VP (Research), Mehta Equities Ltd, said.

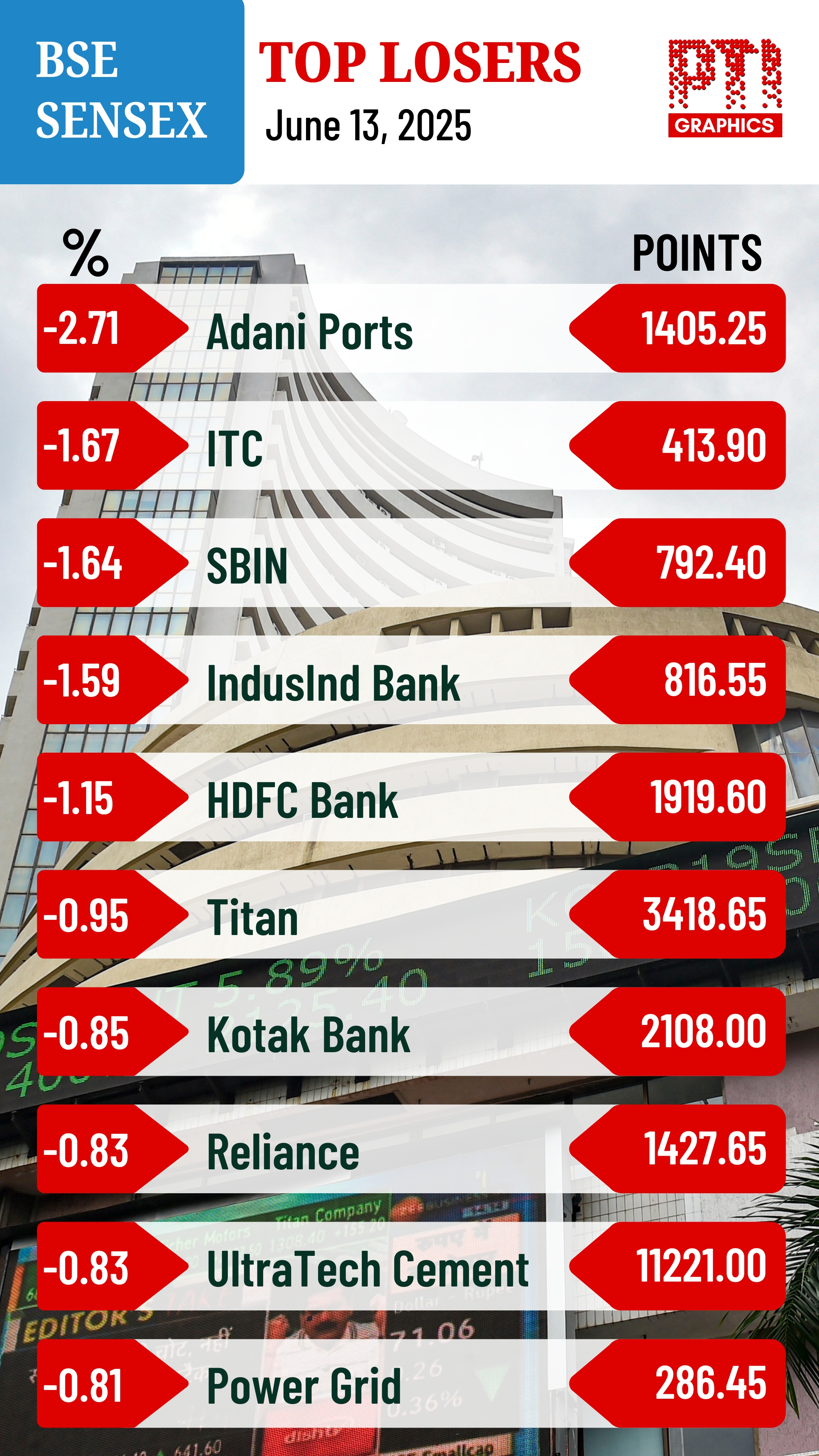

Among the Sensex firms, Adani Ports, ITC, State Bank of India, IndusInd Bank, HDFC Bank, Titan, Kotak Mahindra Bank and UltraTech Cement were the major laggards.

On the other hand, Tech Mahindra, Tata Consultancy Services, Sun Pharma and Maruti were the gainers.

The BSE midcap gauge declined 0.32 per cent and smallcap index dipped 0.30 per cent.

Among BSE sectoral indices, services tumbled 2.06 per cent, bankex (1.01 per cent), FMCG (0.94 per cent), financial services (0.85 per cent), metal (0.81 per cent) and power (0.75 per cent).

Healthcare index and realty were the only winners.

"Indian equity benchmarks experienced downward pressure, driven by weak global cues and foreign institutional outflows. Market sentiment was notably impacted by heightened geopolitical tensions following Israel’s military strike on Iran, which significantly increased risk aversion among investors. Although India’s CPI for May eased below the RBI’s comfort threshold, offering a positive macro signal, this was largely overshadowed by external headwinds.

"Brent crude prices climbed to near USD 76/barrel, their highest this year, raising fears of inflation if tensions persist," Vinod Nair, Head of Research, Geojit Investments Limited, said.

Global oil benchmark Brent crude jumped 7.44 per cent to USD 74.52 a barrel.

In Asian markets, South Korea's Kospi, Japan's Nikkei 225 index, Shanghai's SSE Composite index and Hong Kong's Hang Seng settled lower.

European markets were quoting lower.

US markets ended in positive territory on Thursday.

Foreign Institutional Investors (FIIs) offloaded equities worth Rs 3,831.42 crore on Thursday, according to exchange data.

Meanwhile, a London-bound Air India plane carrying 242 passengers and crew crashed in Ahmedabad minutes after taking off from the airport on Thursday afternoon.

Air India has confirmed the death of 241 people in the plane crash. One passenger miraculously escaped.

On Thursday, the 30-share BSE Sensex dropped 823.16 points or 1 per cent to settle at 81,691.98. The Nifty tumbled 253.20 points or 1.01 per cent to 24,888.20.

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

Bengaluru (PTI): Chartered Speed Limited and EKA Mobility on Wednesday secured a Letter of Confirmation of Quantity for the deployment of 1,750 electric buses here, officials said.

The development marks a significant milestone in strengthening sustainable public electric transport infrastructure in one of India’s major metropolitan regions.

According to Chartered Speed Limited, a leading player in passenger bus mobility services, the allocation accounts for nearly 39 per cent of Bengaluru’s planned induction of 4,500 electric buses under the PM E-Drive Scheme, underscoring the company’s role in advancing the city’s public transport electrification efforts.

Bengaluru has emerged as one of India’s leading cities in electric public transport adoption, with the Bengaluru Metropolitan Transport Corporation steadily expanding its electric bus network in line with Karnataka’s clean mobility vision and the Centre’s decarbonisation roadmap, the company said in a statement.

Emphasising that safety remains a core pillar of its EV operations, Chartered Speed Limited said it follows structured safety protocols, including preventive maintenance, battery health monitoring, and specialised driver training to ensure reliable and commuter-focused services.

The partnership combines Chartered Speed’s operational expertise with EKA Mobility’s electric vehicle manufacturing and technology capabilities to deliver accessible and dependable urban transport solutions for Bengaluru commuters, it added.

"Bengaluru is a key mobility hub in India, and electric buses are central to efforts to build a cleaner and more efficient public transport system," said Sanyam Gandhi, Whole-Time Director, Chartered Speed Limited.

"As an early adopter of e-mobility, we aim to convert around 25 per cent of our fleet to electric by fiscal 2027, supported by strong infrastructure investments to deliver commuter-centric services with lasting socio-economic impact," he added.