This report is based on an investigative story by Aggam Walia and was originally published by The Reporters’ Collective on January 27, 2026. Click here to read the original story by The Reporter’s Collective

New Delhi: The BJP-led Rajasthan government has once again moved to push a large 3,200 megawatt coal-based power project, months after the state electricity regulator rejected an almost identical proposal, The Reporters’ Collective has reported. As detailed in the investigation by The Reporters’ Collective, the renewed push continues to closely mirror the expansion plans of the Adani Group’s existing thermal plant at Kawai in Rajasthan.

This time, the state government has sought to strengthen its case by projecting an impending long-term power shortage and by proposing the early retirement of several coal-fired power plants that are currently operational. Some of these plants have seen recent investments and upgrades by the state itself and were, until recently, officially described as performing well and capable of operating up to 2030 and beyond.

The Reporters’ Collective report notes that to justify the fresh 3,200 MW tender, Rajasthan has also questioned its own agreements with Union government-owned power companies for joint thermal capacity expansion. It has further raised doubts over nuclear power projects planned by the Narendra Modi-led Union government and argued that renewable energy alone cannot meet the state’s future electricity needs.

According to the state government, these factors will lead to a power supply gap by 2035, which it claims can only be bridged by setting up new coal-based capacity. The eligibility conditions and scale of the proposed project align exactly with Adani Power’s plan to expand the 1,320 MW Kawai thermal plant by another 3,200 MW.

Queries were sent to the Rajasthan government, the Central Electricity Authority (CEA), and the Adani Group seeking responses on detailed issues raised in this report. None had responded by the time this report was published. The story will be updated if and when responses are received.

The Reporters’ Collective had earlier reported on Rajasthan’s first attempt to obtain regulatory approval for a 3,200 MW coal plant that matched Adani Power’s expansion plans. This report examines how the state has doubled down on its efforts after the regulator’s rejection.

Background: The regulator’s rejection

The Rajasthan Electricity Regulatory Commission (RERC) rejected the state government’s proposal for the 3,200 MW coal-based power project on November 18, 2025. The proposal was submitted by Rajasthan Urja Vikas and IT Services Limited (RUVITL), a state-owned entity.

Even in the restrained language typical of regulatory orders, the commission made a series of sharp observations questioning the basis and urgency of the project.

First ground for rejection

According to The Reporters’ Collective, one of the key conditions imposed by the Rajasthan government was that the entire 3,200 MW thermal capacity must be set up within the state. This condition would directly benefit the Adani Group’s proposed expansion of its Kawai power plant.

The RERC questioned this requirement, noting that Rajasthan had failed to provide detailed and specific reasons for insisting that the project be located within state boundaries. Initially, no such condition existed. It was introduced only in June 2025, when the state’s Finance Department decided to mandate it, citing social, economic, and technical benefits for Rajasthan.

The commission noted that the state’s submissions merely asserted, in a general manner, that locating the project within Rajasthan would benefit the state economy. It pointed out that this unsubstantiated claim stood in contrast to data-backed objections from stakeholders, including prospective bidders and thermal power generators. These stakeholders had submitted cost comparisons showing that setting up the plant within Rajasthan would significantly increase annual expenditure.

Second ground for rejection

To justify the scale of the proposed coal project, Rajasthan departed from the projections made by the Central Electricity Authority, the statutory planning body under the Union Power Ministry.

While the CEA had estimated a coal-based capacity gap of 1,905 MW for Rajasthan by 2035, the state government argued that these projections were too conservative. The RERC rejected this argument, stating that Rajasthan had failed to explain how such conservatism would materially affect supply reliability or adequacy planning.

The commission said statutory assessments by the CEA cannot be brushed aside on perception alone and certainly not without clear reasoning or supporting data showing flaws in the authority’s methodology or a mismatch with actual system conditions in the state.

Third ground for rejection

The Reporters’ Collective reported that the commission also faulted Rajasthan for excluding planned coal-based capacities to be developed jointly with Union government-owned power and coal companies while projecting a power deficit.

The RERC described this exclusion as contradictory, especially since these projects were expected to begin supplying power by 2029–30. It observed that when formal memoranda of understanding had already been executed between state utilities and central public sector undertakings, treating such capacity as uncertain lacked reasonableness and consistency.

Fourth ground for rejection

To widen the projected gap between existing and required power capacity, the Rajasthan government informed the RERC that it intended to retire 1,350 MW of existing coal-based capacity. However, it had not shared this plan with the CEA during the preparation of the Resource Adequacy Plan in June 2025.

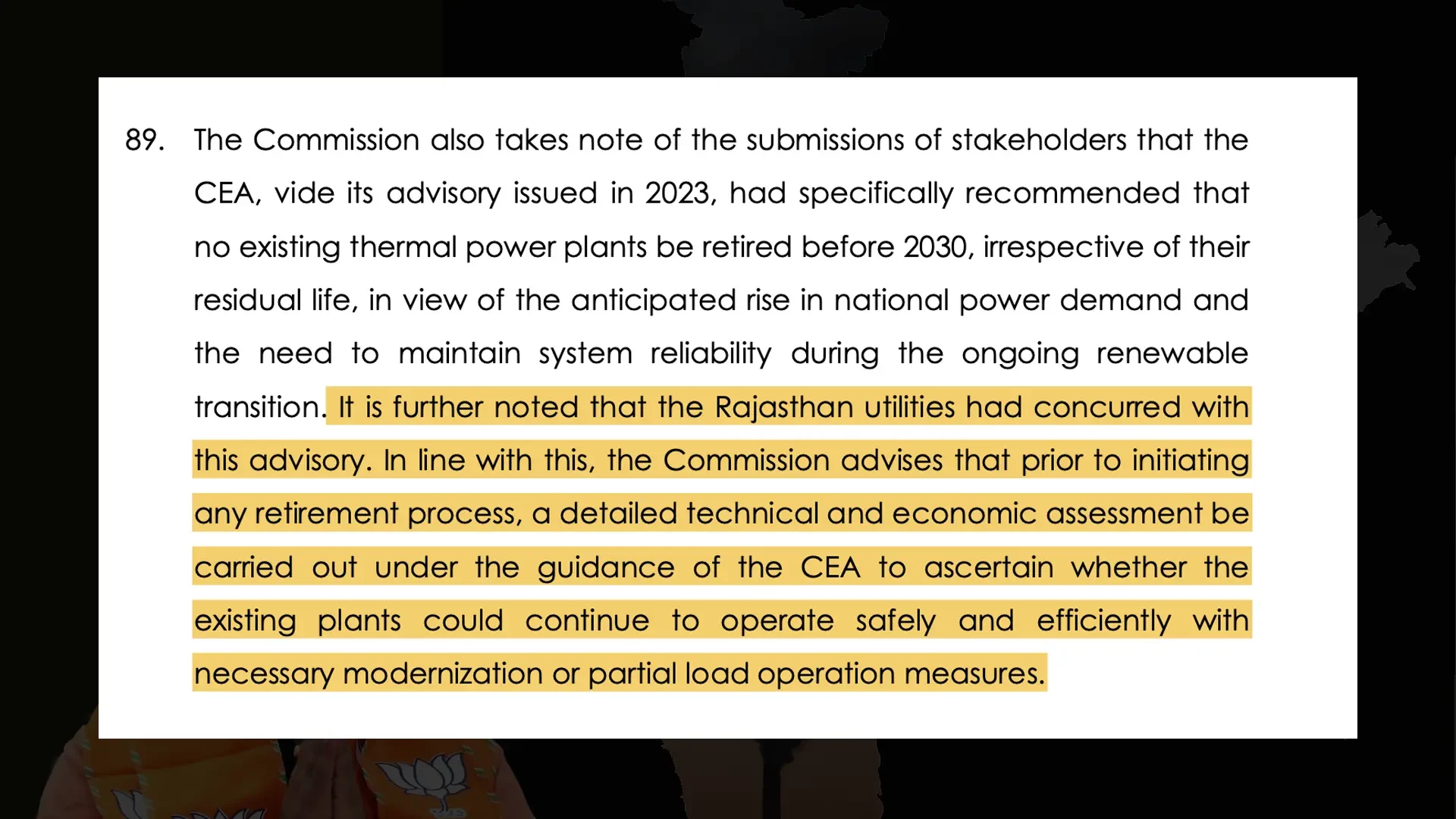

The commission was critical of this approach and said that before initiating any retirement process, a detailed technical and economic assessment must be conducted under the guidance of the CEA. Such an assessment would determine whether the plants could continue operating safely and efficiently with modernisation or partial load operation.

The RERC also criticised Rajasthan Vidyut Prasaran Nigam (RVPN), the state transmission utility, for offering no substantive assistance during the hearings. The order noted that RVPN had not commented on the CEA’s Resource Adequacy Plan, even though such input could have been relevant.

Tender issued in haste

An earlier investigation by The Reporters’ Collective had revealed that RUVITL published the 3,200 MW tender on October 1, 2025, without securing the mandatory approval from the RERC. Regulatory proceedings were still underway at the time.

During the final hearing before the commission, stakeholders argued that issuing the tender before obtaining approval amounted to a gross violation of the Union Power Ministry’s guidelines on long-term thermal power procurement. The commission, however, did not record any specific findings on this issue in its order.

A narrow opening left by the regulator

Despite rejecting the proposal, the RERC left a limited window open. It directed the Rajasthan government to consult the CEA and reassess the quantity of power capacity proposed. The commission said RUVITL could file a fresh petition only after submitting a comprehensive and properly justified proposal.

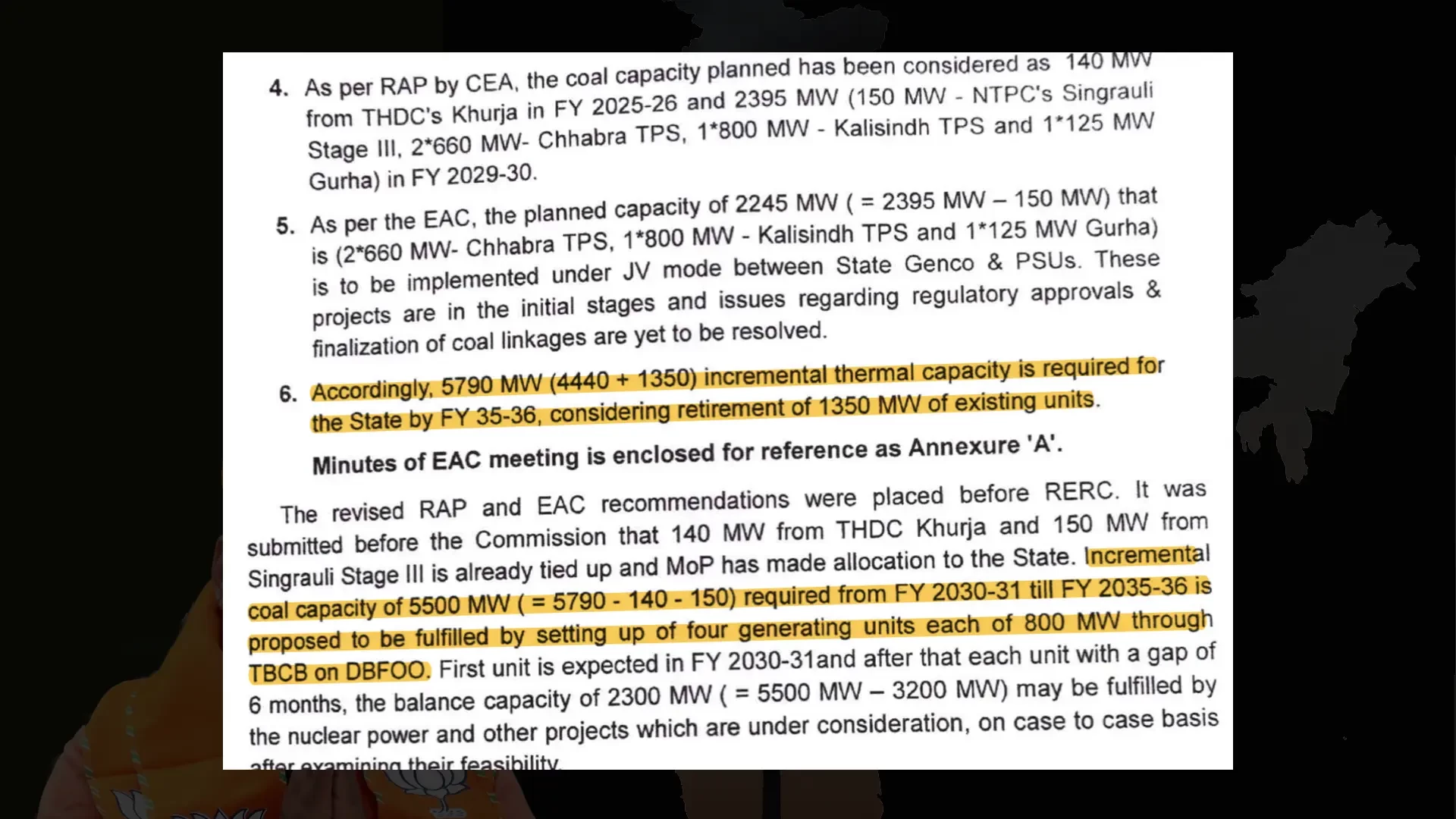

The state moved quickly. Within six days, it wrote to the Central Electricity Authority challenging the June 2025 Resource Adequacy Plan and claiming that the unplanned capacity gap was not 1,905 MW but 5,500 MW.

In its letter, RUVITL said that 2,245 MW of planned capacity was still at an initial stage, with unresolved regulatory approvals and coal linkage issues. It also included the proposed retirement of 1,350 MW of existing state-sector coal capacity by 2030 in its calculations.

The CEA responded on November 27, stating that Rajasthan itself had informed the authority during the preparation of the Resource Adequacy Plan that 2,535 MW had already been planned or identified. The CEA added that the state had not provided any information about proposed retirements during the planning exercise, which is carried out in close coordination with state utilities.

The authority concluded that after accounting for the new retirement plans, the requirement for coal-based capacity may increase, but only after a detailed analysis is conducted.

No such detailed analysis has been made public so far. Nor was any such study attached by the Rajasthan government to its revised submissions before the state regulator.

Despite this, Rajasthan has relied on the CEA’s letter to return to the RERC and seek approval once again for the 3,200 MW coal project.

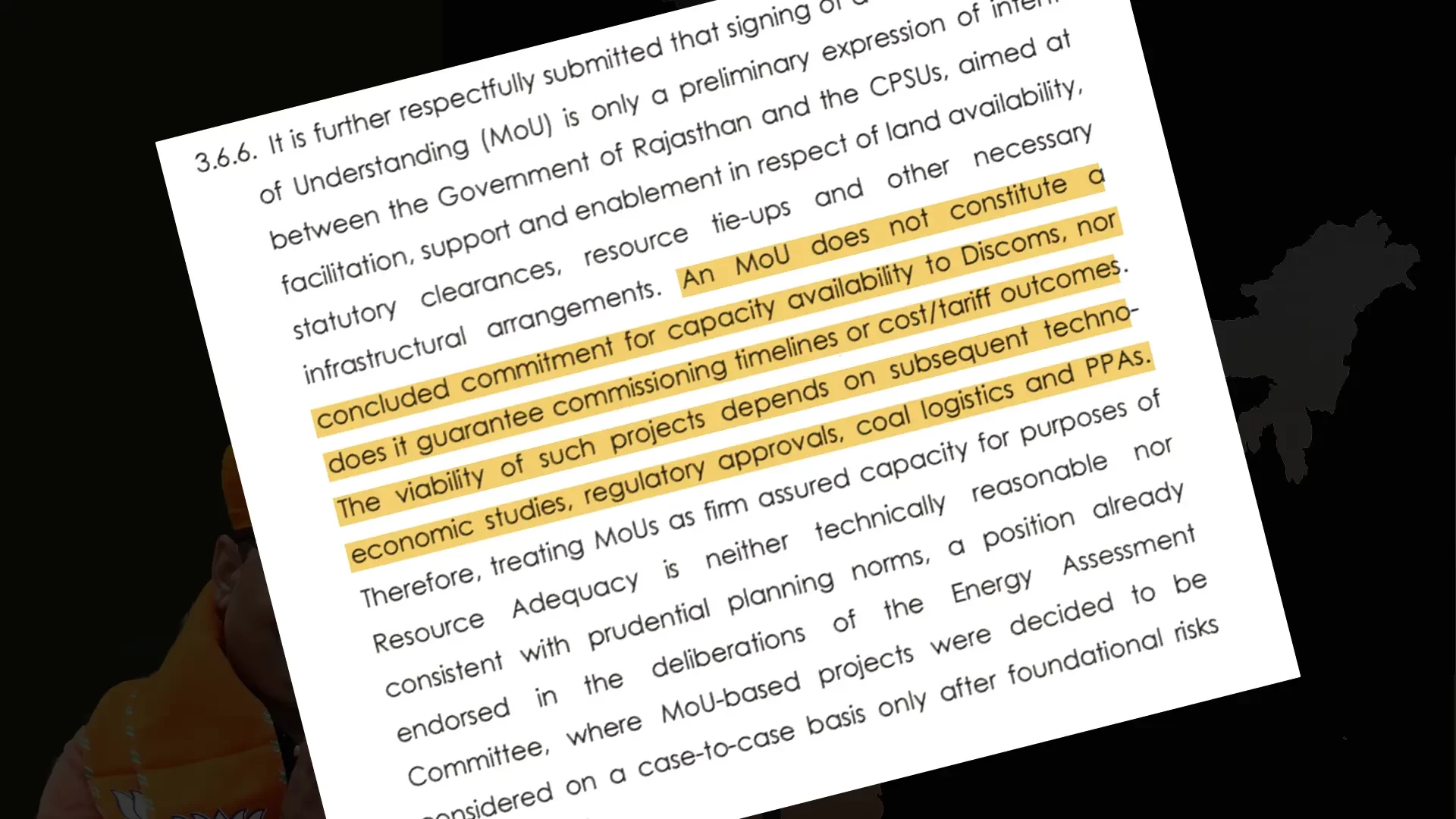

On planned capacities under MoUs with central public sector undertakings, RUVITL argued that a memorandum of understanding does not amount to a concluded commitment for capacity availability to discoms. It said project viability depends on further techno-economic studies, regulatory approvals, coal logistics, and power purchase agreements.

Contradictions over plant retirements

As detailed by The Reporters’ Collective, the proposed retirement of 1,350 MW includes five units at the Kota Super Thermal Power Station and two units at the Suratgarh Super Thermal Power Station.

By 2035, the Kota units would have completed between 41 and 52 years of operation, while the Suratgarh units would be between 25 and 27 years old. Rajasthan Rajya Vidyut Utpadan Nigam Limited, which operates these plants, is currently carrying out repairs and maintenance works to extend their operational life.

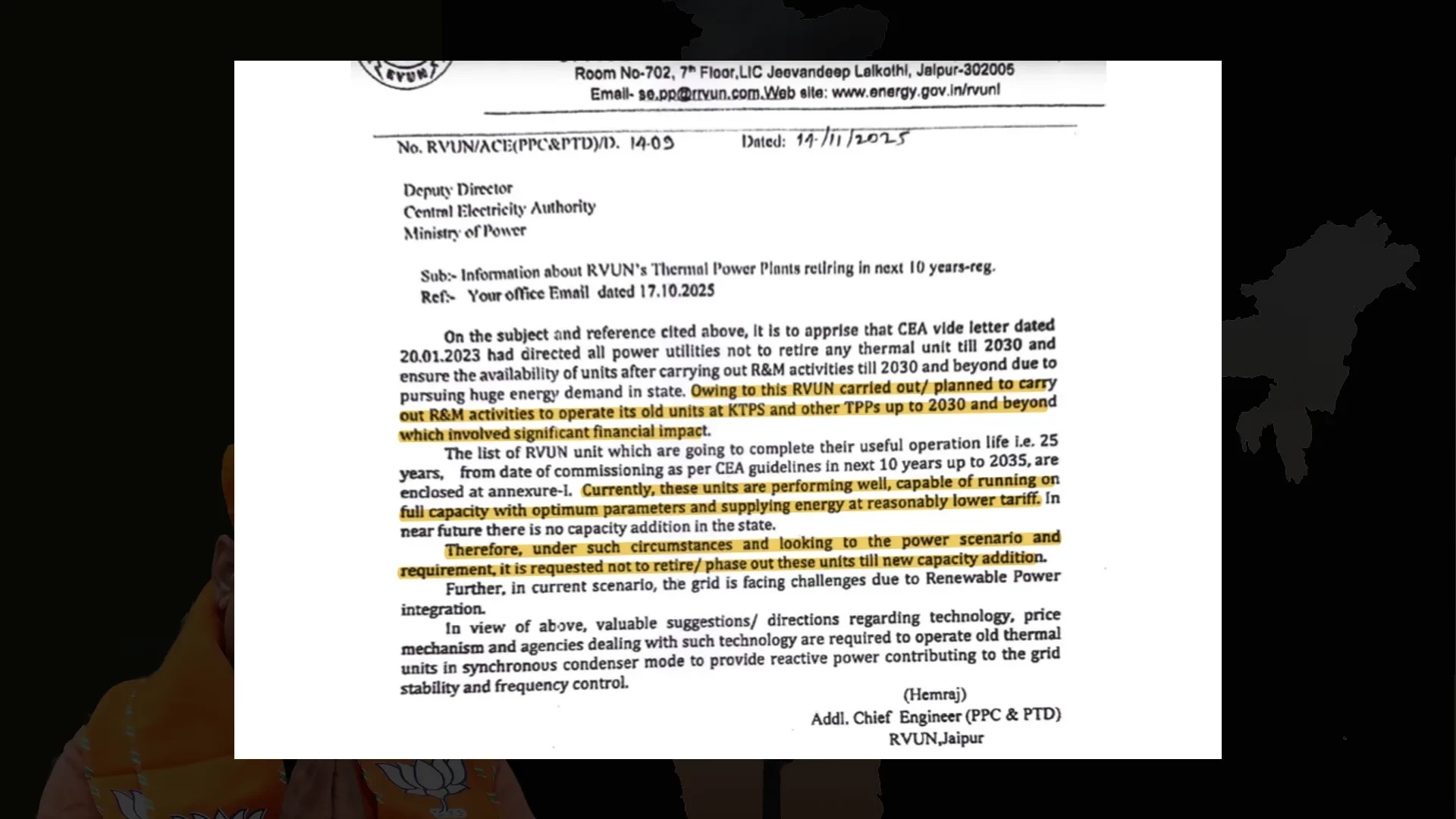

Documents submitted to the regulator show that as recently as November 14, another state-owned power generation company had requested that these units not be retired. It stated that the plants were performing well and supplying power at reasonably lower tariffs. It also highlighted that significant financial investments had already been made to keep them operational up to 2030 and beyond.

However, in its review petition before the RERC, RUVITL has taken a contrary position. It claimed there was no available option except to retire the Kota units, citing lack of space to install mandatory cooling towers and emission control equipment required under Environment Ministry rules.

While the petition points to environmental compliance challenges at some units, it does not provide the detailed technical and economic assessment for retiring the entire 1,350 MW capacity that the RERC had explicitly sought in its November 18 order.

The review petition was briefly heard on January 13 and is scheduled to be taken up again by the RERC on January 27. Approval of the tender is required as it deviates from the model bidding guidelines.

Nuclear and renewables pushed aside

The Reporters’ Collective reported that Prime Minister Narendra Modi inaugurated the 2,400 MW nuclear project at Mahi Banswara on September 28, 2025, with half the capacity allocated to Rajasthan.

In its November 18 order, the RERC observed that if the 1,400 MW share from the nuclear project was factored into the CEA’s Resource Adequacy Plan, the need for additional capacity might not arise at all even by 2035–36, even after allowing for reasonable delays in commissioning. It directed RUVITL to include the nuclear project in its demand-supply assessment.

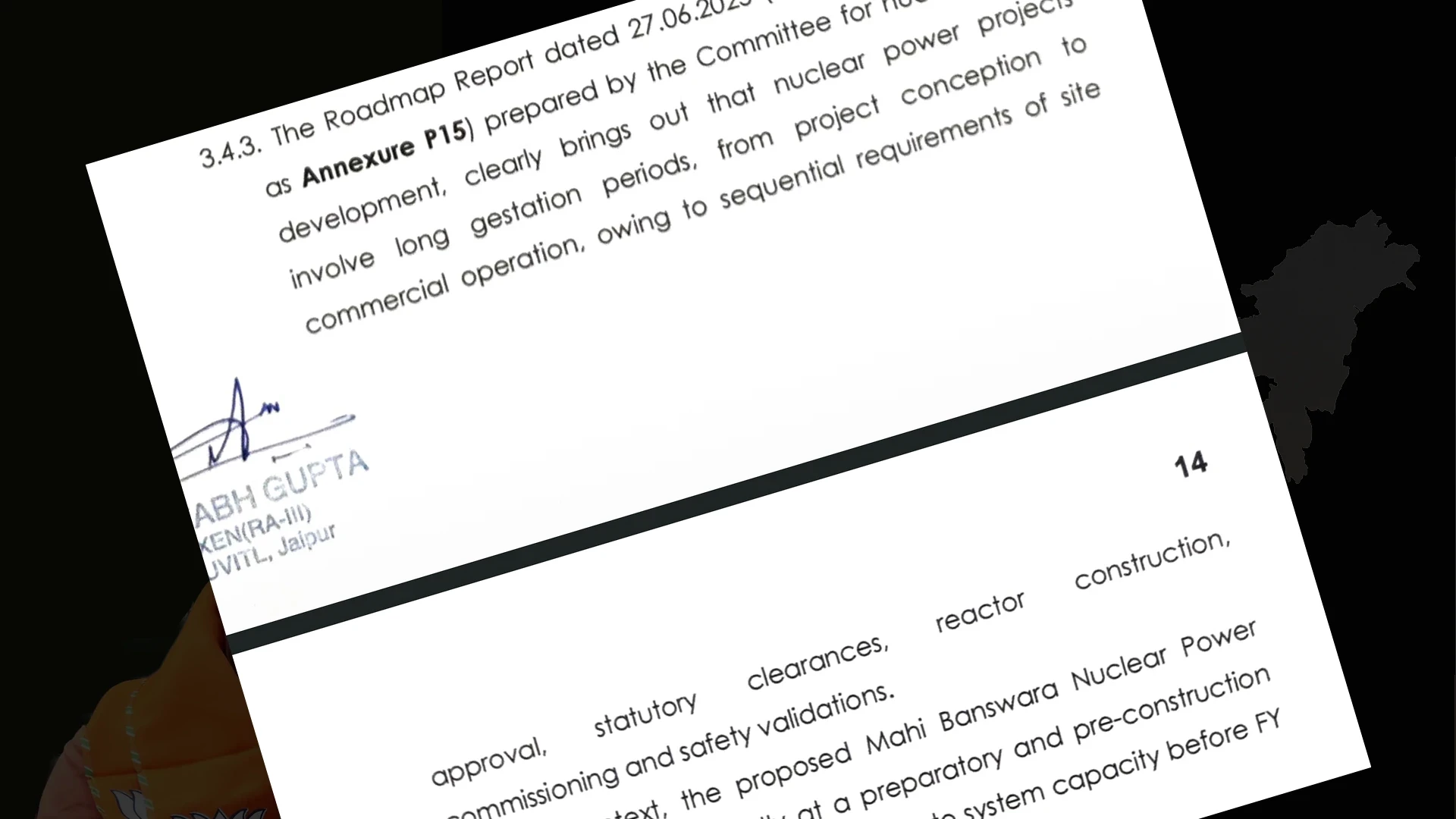

In its review petition, however, RUVITL dismissed the nuclear project as being at a preparatory and pre-construction stage and claimed it would come online only after 2035–36. Official projections in 2018 had estimated commissioning by 2031.

The petition also downplays the role of renewable energy and battery storage. It argues that coal will continue to be central to Rajasthan’s power system. It states that even under a future with heavy reliance on renewables and battery energy storage systems, firm coal-based capacity remains essential for long-term adequacy, grid stability, and inertia, particularly in a high-renewable state like Rajasthan.

The petition questions the effectiveness of battery energy storage systems, noting that Rajasthan has approved 6,000 megawatt-hours of storage with discharge durations of only two to four hours. It raises concerns about technology maturity, degradation, and lifecycle uncertainties over 12-year power purchase agreement periods, and states that battery systems can support peak demand but cannot replace round-the-clock thermal generation.

This report is based on an investigative story by Aggam Walia and was originally published by The Reporters’ Collective on January 27, 2026. Click here to read the original story by The Reporter’s Collective

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

Houston (US) (PTI): Texas Governor Greg Abbott has ordered state agencies and public universities to immediately halt new H-1B visa petitions, tightening hiring rules at taxpayer-funded institutions, a step likely to impact Indian professionals.

The freeze will remain in effect through May 2027.

The directive issued on Tuesday said that the state agencies and public universities must stop filing new petitions unless they receive written approval from the Texas Workforce Commission.

The governor's order, in a red state that is home to thousands of H-1B visa holders, comes as the Trump administration has initiated steps to reshape the visa programme.

“In light of recent reports of abuse in the federal H-1B visa programme, and amid the federal government’s ongoing review of that programme to ensure American jobs are going to American workers, I am directing all state agencies to immediately freeze new H-1B visa petitions as outlined in this letter,” Abbot said.

Institutions must also report on H-1B usage, including numbers, job roles, countries of origin, and visa expiry dates, the letter said.

US President Donald Trump on September 19 last year signed a proclamation ‘Restriction on entry of certain non-immigrant workers’ that restricted the entry into the US of those workers whose H-1B petitions are not accompanied or supplemented by a payment of USD 1,00,000.

The H1-B visa fee of USD 1,00,000 would be applicable only to new applicants, i.e. all new H-1B visa petitions submitted after September 21, including those for the FY2026 lottery.

Indians make up an estimated 71 per cent of all approved H-1B applications in recent years, according to US Citizenship and Immigration Services (USCIS), with China in the second spot. The major fields include technology, engineering, medicine, and research.

Tata Consultancy Services (TCS) is the second-highest beneficiary with 5,505 approved H-1B visas in 2025, after Amazon (10,044 workers on H-1B visas), according to the USCIS. Other top beneficiaries include Microsoft (5,189), Meta (5,123), Apple (4,202), Google (4,181), Deloitte (2,353), Infosys (2,004), Wipro (1,523) and Tech Mahindra Americas (951).

Texas public universities employ hundreds of foreign faculty and researchers, many from India, across engineering, healthcare, and technology fields.

Date from Open Doors -- a comprehensive information resource on international students and scholars studying or teaching at higher education institutions in the US -- for 2022-2023 showed 2,70,000 students from India embarked on graduate and undergraduate degrees in US universities, accounting for 25 per cent of the international student population in the US and 1.5 per cent of the total student population.

Indian students infuse roughly USD 10 billion annually into universities and related businesses across the country through tuition and other expenses – while also creating around 93,000 jobs, according to the Open Doors data.

Analysts warn the freeze could slow recruitment of highly skilled professionals, affecting academic research and innovation.

Supporters say the directive protects local jobs, while critics caution it could weaken Texas’ competitiveness in higher education and research.

The order comes amid broader debate in the US over skilled immigration and state-level interventions in federal programmes.

H-1B visas allow US companies to hire technically-skilled professionals that are not easily available in America. Initially granted for three years, these can be extended for another three years.

In September 2025, Trump had also signed an executive order ‘The Gold Card’, aimed at setting up a new visa pathway for those committed to supporting the United States; with individuals who can pay USD 1 million to the US Treasury, or USD 2 million if a corporation is sponsoring them, to get access to expedited visa treatment and a path to a Green Card.