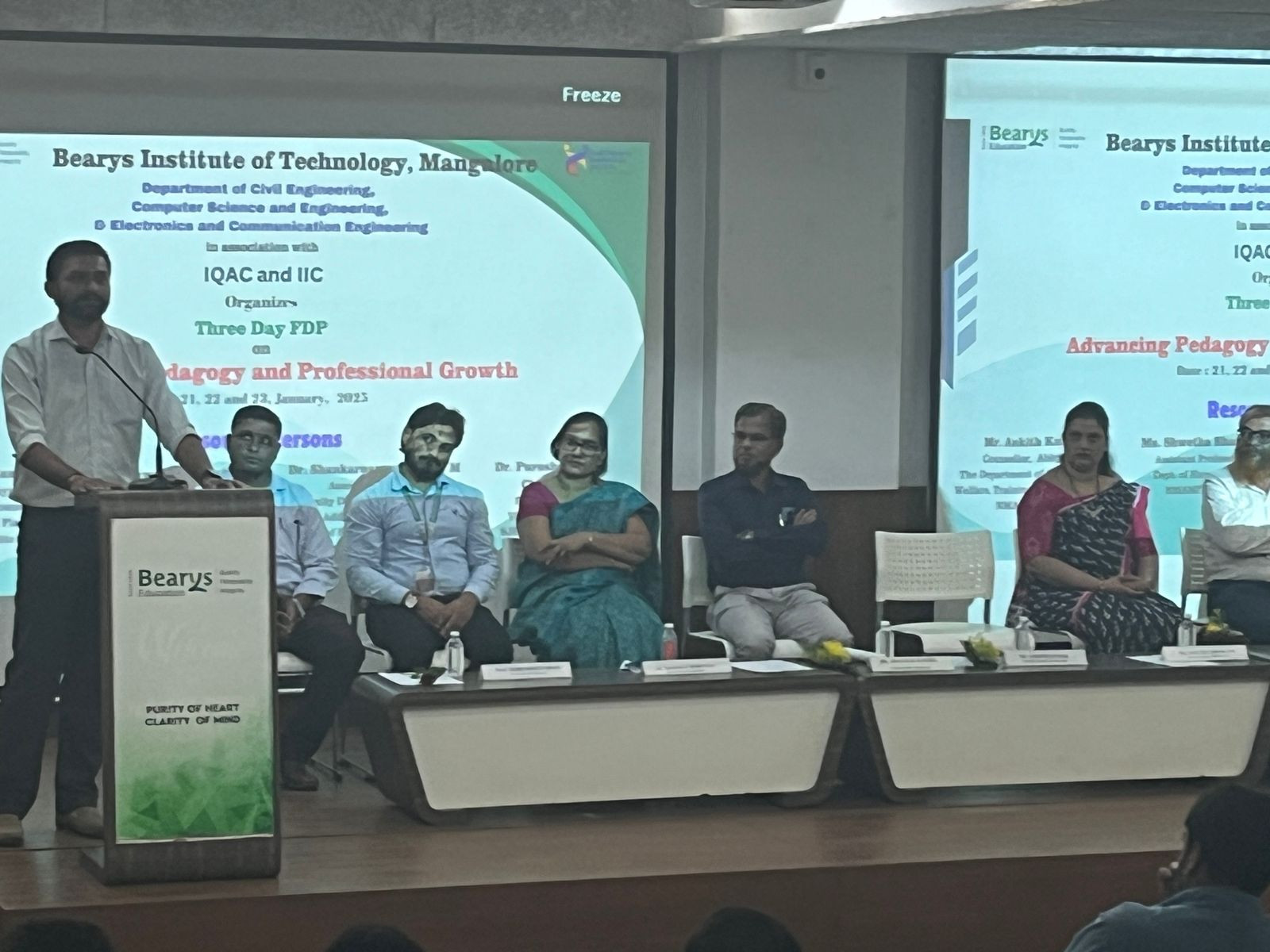

Mangalore, January 21, 2025: A three-day Faculty Development Program (FDP) titled “Advancing Pedagogy and Professional Growth” was inaugurated on January 21, 2025,and concluded on 23rd January 2025 at the Bearys Institute of Technology (BIT), Mangalore. The event was jointly organized by the departments of Civil Engineering, Computer Science and Engineering, and Electronics and Communication Engineering, in collaboration with the Internal Quality Assurance Cell (IQAC) and the Institution’s Innovation Council (IIC).

Dr. Nalini E. Rebello, Head of IQAC, delivered the welcome address, outlining the program’s goals and the need for adopting innovative teaching methodologies to meet the challenges of modern education. The event was graced by the presence of department heads and principals from affiliated institutions. Dr. S.I. Manjur Basha, Principal of BIT, highlighted the importance of professional development programs in shaping faculty members for holistic growth and impactful teaching.

Day 1 Highlights

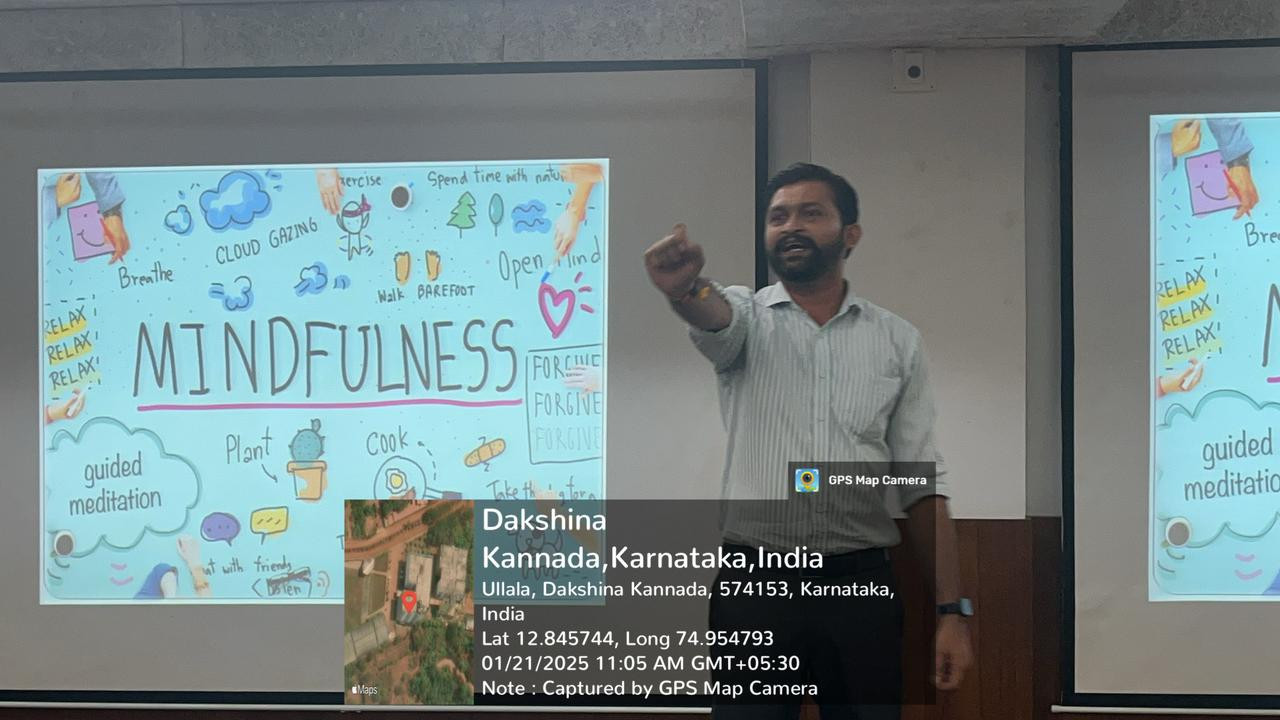

First Half: Mindfulness for Effective Teaching Proficiency

The day began with an engaging session by Mr. Ankith Kumar on strategies for stress management, integrating technology breaks, and fostering empathy towards students. Participants were introduced to mindfulness practices and self-care routines, coupled with interactive exercises that provided practical tools to enhance their teaching proficiency and overall well-being.

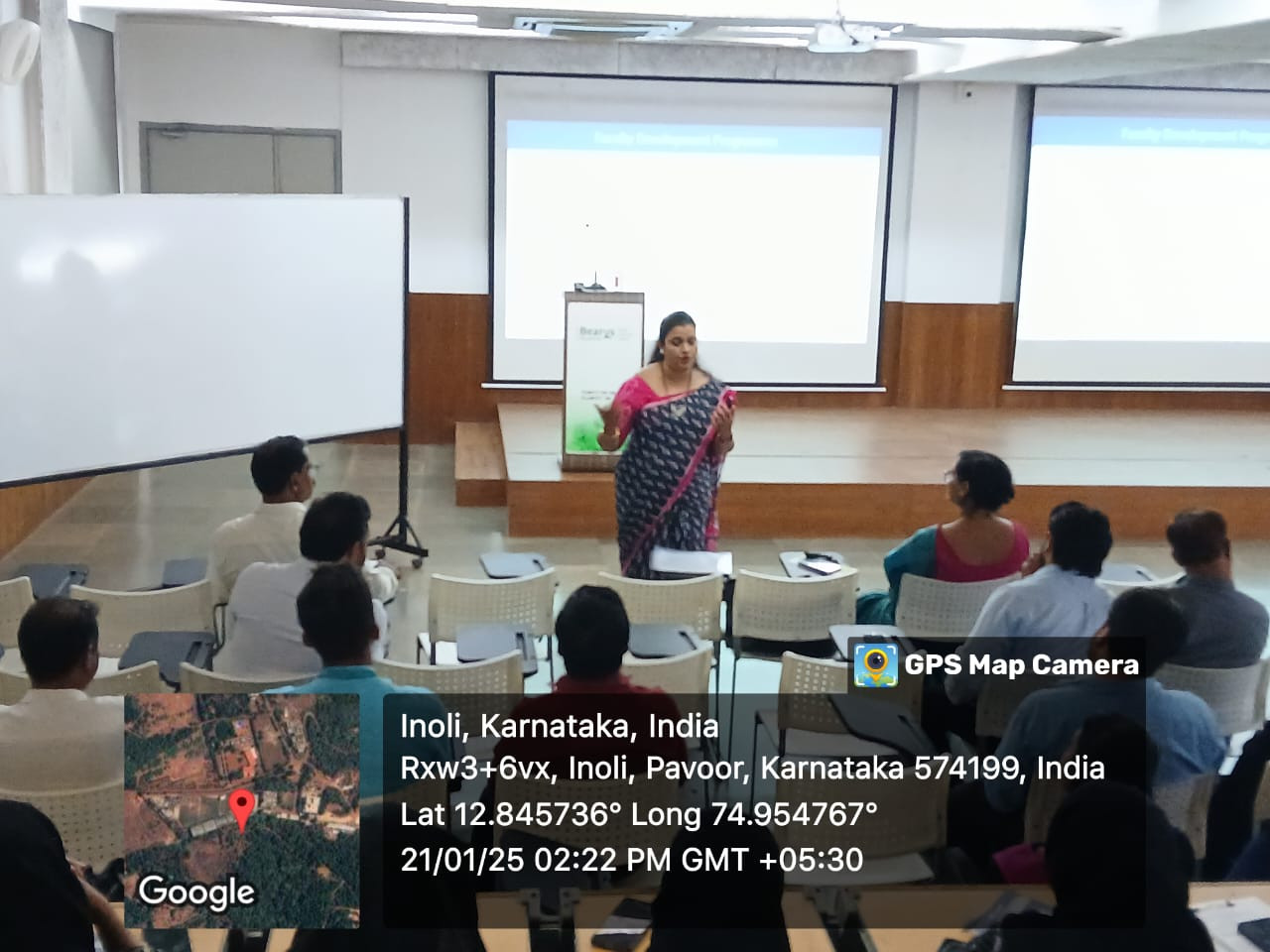

Second Half: Teaching Skills for Effective Learning

In the afternoon, Ms. Shwetha Bharath conducted a session that focused on innovative teaching techniques, such as activity-based learning, improving communication, and designing engaging lesson plans. Participants explored the importance of constructive feedback and creative strategies to boost classroom interaction and student engagement.

Day 2 Highlights

Day 2 featured an enlightening session on Outcome-Based Education (OBE) by Dr. Shankarnarayana Bhat, Professor of the ECE Department, MIT, Manipal. The session provided a detailed understanding of OBE’s principles, frameworks, and its role in bridging the gap between academic outcomes and industry expectations. Faculty members gained practical insights into aligning curriculum objectives with measurable student achievements.

Day 3 Highlights

On Day 3, Dr. Purushotham Chippar, Professor at SJEC, Mangalore, delivered a thought-provoking session on “Navigating Research Success: Insights into Publications, Ethics, and Funding.” Dr. Purushotham Chippar elaborated the need for doing Research. Research should be taken up as passion and to balance work and other academic duties there should be a fire within oneself. He emphasized the importance of adhering to ethical research practices, identifying funding opportunities, and producing impactful publications.

He gave ideas how to prepare Research paper starting from Methodology to Abstract writing the various steps were explained. The process of writing Research paper, Submission and Review of papers, and revising takes time but with focused approach and setting deadlines everything is possible.

Further he gave ideas to apply for research funding/ patents, and to select topics from the vast pool of resources using different search engines. The session also included strategies to improve research visibility and collaborative opportunities.

The program concluded with a vote of thanks by Dr. Imran Mokashi, IIC Coordinator, who acknowledged the contributions of speakers, organizers, and participants in making the event a success. The master of ceremony was , Prof. Joyson M. from the Basic Science Department.

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

Mumbai (PTI): The rupee appreciated 24 paise to 89.96 against the US dollar in early trade on Friday, supported by corporate dollar inflows and easing crude oil prices.

Forex traders said the gain in the USD/INR pair follows the rupee’s string of record lows in recent weeks on likely intervention from the Reserve Bank of India.

Moreover, crude oil prices hovering around USD 59 per barrel level supported market sentiment.

ALSO READ:Rupee trades in narrow range against US dollar in early trade

At the interbank foreign exchange market, the rupee opened at 90.19 against the US dollar, then gained some ground and touched 89.96 against the US dollar, registering a gain of 24 paise over its previous close.

In initial trade it also touched 90.22 against the American currency. On Thursday, the rupee appreciated 18 paise against the US dollar to close at 90.20 against the greenback.

The rupee sank to a fresh record low, breaching the 91-a-dollar mark for the first time on Tuesday.

"Since the speculators are out of the market the buying of US dollar syndrome has come down a bit though intra-day we could see spikes," said Anil Kumar Bhansali Head of Treasury and Executive Director Finrex Treasury Advisors LLP.

The US CPI came lower than expected but was also due to non-collection of sufficient data and therefore, the next month’s CPI becomes more important, Bhansali said, adding that "Rupee remains in a range of 90-90.50".

Meanwhile, the dollar index, which gauges the greenback's strength against a basket of six currencies, was trading 0.04 per cent higher at 98.46.

Brent crude, the global oil benchmark, was trading lower by 0.27 per cent at USD 59.66 per barrel in futures trade.

On the domestic equity market front, the 30-share benchmark index Sensex climbed 375.98 points to 84,857.79, while the Nifty was up 110.60 points to 25,934.15.

Foreign Institutional Investors purchased equities worth Rs 595.78 crore on Thursday, according to exchange data.

Meanwhile, Economic Advisory Council to the Prime Minister (EAC-PM) member Sanjeev Sanyal on Thursday said he is not concerned about the rupee at all, arguing that even China and Japan witnessed exchange rate weaknesses during their high growth phases.

Speaking at 'Times Network's India Economic Conclave 2025', Sanyal said since the 90s, the rupee has mostly been allowed to find its own level, but the RBI uses its reserves to intervene in either direction to stop excessive volatility.

"I am not concerned about the rupee at all... Let me say that the rupee and its current weakness should not be necessarily conflated with some economic worry, because historically, if you go over time, you will see that economies that are in their high growth phase very often go through a phase of exchange rate weakness," he said.