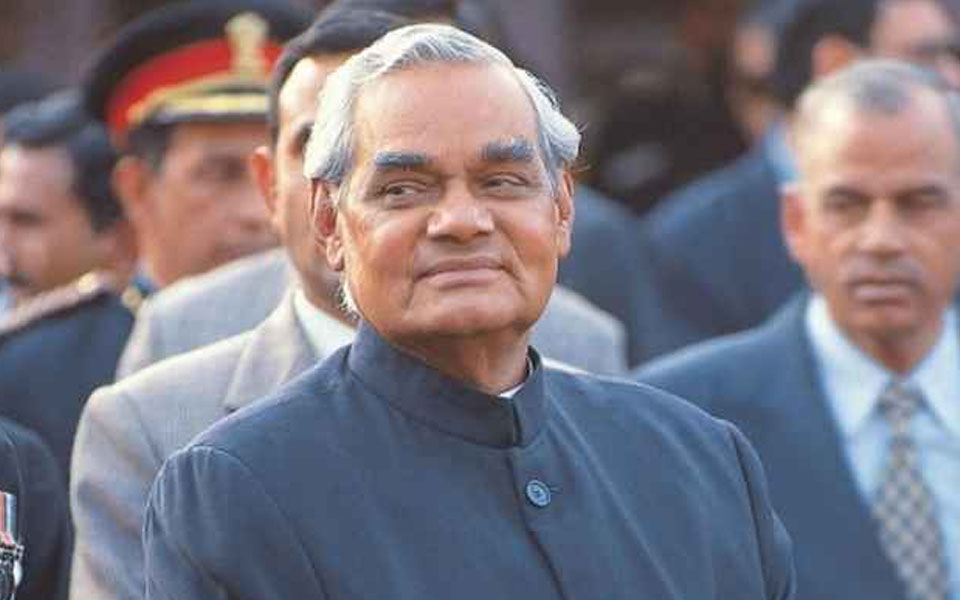

LUCKNOW: Not many know that BJP stalwart Atal Bihari Vajpayee and his father Krishna Bihari Vajpayee had enrolled in for a course in law at the same college in Kanpur. Vajpayee and his father were not only classmates, but also shared room no. 104 in DAV hostel. “Vajpayee was a very obedient son. He stayed together with his father in the boys’ hostel of the college,” said Vajpayee’s college friend, Ram Mohan Singh, who completed his master’s degree in Political Science with the former Prime Minister.

Quite understandably, Vajpayee was uncomfortable to attend classes with his father. A solution was worked out: Atal attended classes on Monday, while his father’s turn came on Tuesday and so on. It, however, did not work out for the future Prime Minister: Vajpayee didn’t finish the course as he became actively involved with Jan Sangh.

Kanpur was where Vajpayee spend his most crucial phase of his academic life. After graduating from Victoria College of Gwalior, Vajpayee enrolled for post-graduation course in Political Science in Kanpur’s DAV College which was then affiliated to Agra University. He passed the MA exams with flying colours and stood second in the university in 1947.Dr. Vijay Pratap Singh, associate professor, political science department of the DAV College, said that late Dr Madan Mohan Pandey, the then head of political science department, was very close to Vajpayee’s heart.

“Atalji was a simple, dedicated and hardworking student who had a vision and was very focused in his studies. He used to call Dr MM Pandey “guruji”. After classes, he often used to visit his ‘Guruji’s house to discuss political issues and those related to academics,” said the associate professor.Vajpayee had to give up his law course mid-way during the turmoil caused by the Partition in 1947. He was sent as a ‘vistarak’ (probationary pracharak) to UP, which was later to become his ‘karma bhoomi’ (work place).

courtesy : newindianexpress.com

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

New Delhi, Aug 13 (PTI): The Enforcement Directorate said on Wednesday it has arrested a woman, who claims to be an actor and a cosmetologist, under the anti-money laundering law in a case of alleged fraud and misrepresentation.

The agency said the purported links of the woman, Sandeepa Virk, with a Reliance Group executive, Angarai Natarajan Sethuraman (President, Corporate Affairs), are also under its scanner. Sethuraman, in a statement, denied any connection with Virk or any transactions related to her.

Virk was taken into custody under the Prevention of Money Laundering Act (PMLA) on Tuesday after searches were conducted against her and her associates in Delhi and Mumbai over the last two days.

A special court sent her to the ED's custody till August 14, the agency said. The woman claims to be the owner of a skin care products selling website named hyboocare.com, which the ED claimed was a "front" for money laundering.

She and her associates are being probed for allegedly exerting undue influence through "misrepresentation" and "defrauding" individuals by soliciting money under false pretences.

According to an Instagram ID of Virk, she is an actor and entrepreneur and the founder of the said website.

The federal agency said in a statement that the woman was also "in touch with" Sethuraman, former director of erstwhile Reliance Capital Limited.

She was communicating with him regarding "illegal liaisoning", the ED claimed, adding that the searches at Sethuraman's residence "confirmed" these allegations.

"Besides, diversion of funds for personal benefit has also been unearthed during the course of the search action," it said.

The ED alleged that public money worth about Rs 18 crore belonging to Reliance Commercial Finance Limited (RCFL) was disbursed to Sethuraman in 2018 by "flouting" prudent lending norms.

The funds were lent under terms that allowed a deferment of the principal amount as well as the interest, with multiple waivers granted and no due diligence conducted, it said.

The ED claimed that besides this, a home loan of Rs 22 crore was provided by Reliance Capital Limited by "violating" the prudential norms. "A large part of these loans are seen to have been eventually siphoned off and remained unpaid," it alleged.

Sethuraman, in a statement, dismissed the allegations as "baseless". He denied any connection with Virk or any transactions related to her.

Detailing about Virk's web portal, the agency said it purportedly sold FDA-approved beauty products. However, the ED said the products listed on the website have been found to be non-existent and the portal lacks a user registration option and is plagued by persistent payment gateway issues.

A scrutiny of the website uncovered minimal social-media engagement, an inactive WhatsApp contact number and an absence of transparent organisational details, all of which reinforce the finding of "non-genuine" commercial activity, the ED claimed.

"These factors, including limited product range, inflated pricing, false claims of FDA approval and technical inconsistencies, indicate that the website serves as a front for laundering funds," it said.

Another social media-hosted bio data of the woman said she is a certified cosmetologist.

The ED said several "incriminating" documents were seized during the searches and the statement of a man named Farrukh Ali, stated to be an associate of Virk, was recorded.

The money-laundering case stems from an FIR lodged by the Punjab Police.

Sethuraman said that the home loan he received from Reliance Capital was granted following due process and was secured by the property offered as collateral.