Mumbai (PTI): Commercial banks maintained robust performance in 2024-25, with the gross non-performing assets (GNPA) ratio declining to a multi-decadal low of 2.2 per cent at March-end, according to a RBI report released on Monday.

The banking sector remained resilient during 2024-25, supported by a strong balance sheet, sustained profitability and improved asset quality, said the Report on Trend and Progress of Banking in India 2024-25.

Bank credit and deposit growth continued in double-digits, albeit with a moderation. Capital and liquidity buffers remained well above the regulatory requirements across bank groups.

"Strong banking sector fundamentals provide a buffer against risks, which, together with prudent regulation, create conditions for sustained credit flow," the report said.

Net profits of commercial banks increased during 2024-25, albeit at a slower pace compared to the previous year, it added.

ALSO READ: UP: Muslim community panchayat in Mathura bans DJs, fireworks at weddings, curbs extravagance

Combined net profit of all scheduled commercial banks (SCBs) rose 14.8 per cent year-on-year to Rs 4.01 lakh crore during 2024-25. In 2023-24, their profit had increased by 32.8 per cent to about Rs 3.5 lakh crore.

The RBI report said the profitability of the SCBs remained robust with the return on assets (RoA) at 1.4 per cent and return on equity (RoE) at 13.5 per cent in 2024-25.

During H1: 2025-26, RoA and RoE of the SCBs stood at 1.3 per cent and 12.5 per cent, respectively.

The capital-to-risk-weighted assets ratio of SCBs was 17.4 per cent at March-end 2025 and 17.2 per cent at the end of September 2025, the report said.

"Asset quality strengthened further, with the gross non-performing assets (GNPA) ratio declining to a multi-decadal low of 2.2 per cent at end-March 2025 and 2.1 per cent at end-September 2025," it pointed out.

Also, the consolidated balance sheet of urban co-operative banks recorded higher growth in 2024-25 than the previous year.

Their asset quality improved for the fourth consecutive year, alongside the strengthening of their capital buffers and profitability.

According to the report, the non-banking financial companies continued to record double-digit credit growth along with robust capital buffers. Their asset quality also improved during the year.

The report presents the performance of the banking sector, including commercial banks, co-operative banks and non-banking financial institutions, during 2024-25 and 2025-26 so far.

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

New Delhi (PTI): Congress leader Shashi Tharoor on Thursday praised the AI Impact Summit, saying the first couple of days had gone "extremely well" and "some glitches" can happen at any "large event".

He said what has been impressive is the attendance of presidents, prime ministers, and world leaders who have come with a strong message of wanting to see a newly integrated world in artificial intelligence development.

While noting that the first couple of days went “extremely well” at the summit, Tharoor said there have been “some glitches” but such issues can happen at big events.

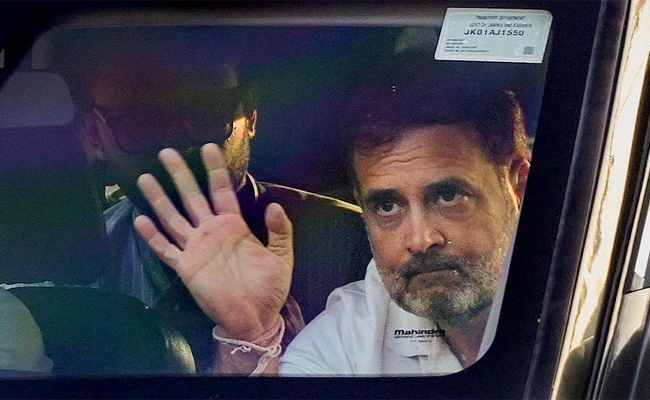

His remarks come a day after former Congress president Rahul Gandhi dubbed the ongoing AI Summit in Delhi a "disorganised PR spectacle" and alleged that Chinese products were being showcased there.

ALSO READ: Chhatrasal Stadium murder case: Delhi HC seeks police's stand on wrestler Sushil Kumar's bail plea

Congress president Mallikarjun Kharge and other senior party leaders have also criticised the event, saying alleged mismanagement has resulted in "embarrassment" for the country.

Responding to a reporter's question after the launch event of his new book on Narayana Guru, Tharoor said, "Though I have not had the chance to go to the summit, I am speaking there tomorrow. From what I understand, these first couple of days have gone extremely well. There have been some glitches, some organisational things, these things happen in a large event."

"But by and large what has been impressive is the attendance... a number of presidents, prime ministers, and world leaders are here, and they've come with a strong message of wanting to see a newly integrated world in AI development, where the impact upon society would be the principle," Tharoor said.

"Preoccupation in India has clearly led the drive in this area," he added.

Asked about French President Emanuel Macron's remarks about procurement of Rafale jets by India and the Make in India component of the deal, Tharoor said as far as the French Rafale is concerned, parts of it are being manufactured in India.

That is a very important aspect of the deal because it is part of strengthening defence, but also increasing our self-reliance in the defence sector, he said.

"Defence is important for India not because we want to go to war, but because we don't want others to think that we are so weak that they can be tempted to go to war. It is a defensive defence literally, and that is what we are working for and I support the government on that,” he said.

On the upcoming film Kerala Story 2, Tharoor said the first film, Kerala Story, was a “hate-mongering film”.

“They were saying that thousands of people were converted, which is not true. I think there were around 30 such cases over a number of years. Ours is a very big country. If a case occurs here and there, it doesn't mean you should turn it into a big story and use it as propaganda,” Tharoor said.

“In our childhood, films like Amar Akbar Antony used to get entertainment tax exemptions,” he added.