New Delhi (PTI): The Congress on Wednesday welcomed the decision to confer Bharat Ratna to former Bihar chief minister Karpoori Thakur and said it reflects the Narendra Modi government's desperation and hypocrisy.

Thakur was a champion of social justice and conducting a nationwide caste census would be an appropriate tribute to him, Congress general secretary Jairam Ramesh said.

"Even though it reflects the Modi Govt's desperation and hypocrisy, the Indian National Congress welcomes the posthumously awarded Bharat Ratna to the champion of social justice Jannayak Karpoori Thakurji," Ramesh said in a post on X.

"'Bhagidari Nyay' is one of the five pillars of the Bharat Jodo Nyay Yatra. It will need a nation-wide caste census as a starting point.

"Rahul Gandhi has been consistently advocating this but the Modi Government has all along refused to release the results of the Socio Economic Caste Census 2011 and also refused to commit itself to conduct an updated nation-wide caste census which will be the most appropriate tribute to Jannayak Karpoori Thakurji," he said.

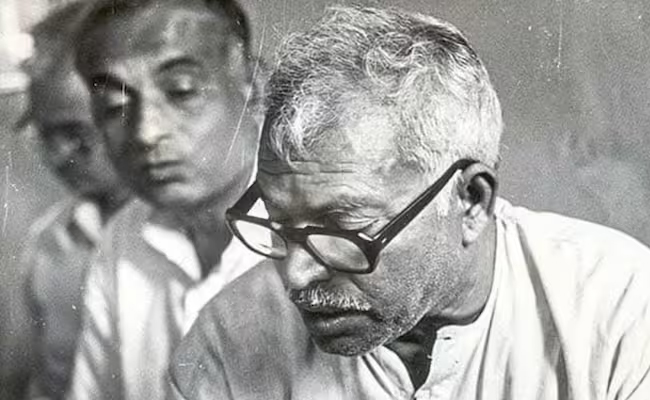

Two-time Bihar chief minister Karpoori Thakur has been named for the country's highest civilian award Bharat Ratna posthumously, a Rashtrapati Bhawan communique said on Tuesday on the eve of the birth centenary of the fountainhead of OBC politics in Bihar.

Thakur, who passed away in 1988, was the first non-Congress socialist leader who became chief minister twice -- first for seven months in December 1970 and later for two years in 1977.

"The President has been pleased to award Bharat Ratna to Shri Karpoori Thakur (posthumously)," the communique said.

Thakur, known affectionately as 'Jan Nayak' (people's leader), is the 49th recipient of the country's highest civilian award. The award was last conferred on late president Pranab Mukherjee in 2019.

Born on January 24, 1924 in Nai samaj (barber society), Thakur is credited in Bihar politics for enforcing total prohibition of alcohol in 1970. The village where he was born in Samistupur district was renamed after him as Karpuri Gram.

STORY | Bharat Ratna award to Karpoori Thakur reflects Modi govt's desperation, hypocrisy: Congress

— Press Trust of India (@PTI_News) January 24, 2024

READ: https://t.co/zXsRIEWCVz pic.twitter.com/7W6OR1JNRc

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

Mumbai, Dec 20: Equity benchmark indices Sensex and Nifty plunged about 1.5 per cent on Friday, taking their downtrend to the fifth straight session, due to risk aversion in the global markets after the hawkish stance of the US Federal Reserve.

An across-the-board selloff in equity markets amid unabated selling by foreign investors added to the pressure, traders said.

The 30-share BSE benchmark tumbled 1,176.46 points or 1.49 per cent to sink below the 79,000 mark to end at 78,041.59. During the day, it slumped 1,343.46 points or 1.69 per cent to 77,874.59.

The NSE Nifty tanked 364.20 points or 1.52 per cent to 23,587.50.

As many as 2,950 stocks declined, while 1,045 advanced and 90 remained unchanged on the BSE.

Investors became poorer by Rs 18.43 lakh crore in five days of the market crash as the market capitalisation of BSE-listed firms eroded by Rs 18,43,121.27 crore to Rs 4,40,99,217.32 crore (USD 5.18 trillion).

"Disappointment regarding the slower-than-anticipated rate cuts by the US Fed has adversely affected global market sentiment. This bearish outlook is particularly impacting the domestic market, which is already contending with high valuations & low earnings growth.

"The sell-off has been widespread, with significant declines in mid and small-cap stocks, where valuations premiumisation is at a historical peak," Vinod Nair, Head of Research, Geojit Financial Services, said.

In the past five days, the BSE benchmark tanked 4,091.53 points or 4.98 per cent, and the Nifty slumped 1,180.8 points or 4.76 per cent.

From the 30 blue-chip Sensex pack, Tech Mahindra, IndusInd Bank, Axis Bank, Mahindra & Mahindra, Tata Motors, Larsen & Toubro, State Bank of India, Tata Consultancy Services, UltraTech Cement and Reliance Industries were the biggest laggards.

In contrast, JSW Steel, Nestle and Titan were the gainers.

"Markets experienced a sharp decline on Friday, shedding nearly one and a half per cent as the corrective phase persisted. After a choppy start, the Nifty index steadily weakened throughout the day," Ajit Mishra - SVP, Research, Religare Broking Ltd, said.

The BSE midcap gauge tanked 2.43 per cent, and smallcap index dropped 2.11 per cent.

All the sectoral indices ended in negative territory.

Realty slumped 4.07 per cent, power tanked 3.55 per cent, capital goods (3.02 per cent), industrials (2.67 per cent), BSE Focused IT (2.61 per cent), IT (2.51 per cent), consumer discretionary (2.32 per cent) and services (2.29 per cent).

"Nervousness continued to grip investors, and stocks across the board went into a tailspin as the dollar's continuing strength against the rupee has been prompting foreign investors to flee local equities and take shelter in safe-haven dollar assets.

"Investors are also apprehensive about Trump's trade policies when he takes charge in mid-January next year, as his aggressive policies could further roil global markets," Prashanth Tapse, Senior VP (Research), Mehta Equities Ltd, said.

In Asian markets, Seoul, Tokyo, Shanghai and Hong Kong settled lower.

Equity markets in Europe were trading in the negative territory. Wall Street ended on a mixed note on Thursday.

Foreign Institutional Investors (FIIs) offloaded equities worth Rs 4,224.92 crore on Thursday, according to exchange data.

Global oil benchmark Brent crude declined 0.96 per cent to USD 72.18 a barrel.

"The hawkish sentiment continued to remain prevalent in today’s trading session as investors remained jittery about the Federal Reserve's projection of fewer rate cuts next year, spurring an exodus of foreign funds. The benchmarks were largely dragged down by the IT and BFSI stocks," Ameya Ranadive, Chartered Market Technician, CFTe, Sr Technical Analyst, StoxBox, said.

Falling for the fourth day running, the 30-share BSE benchmark tanked 964.15 points or 1.20 per cent to settle at 79,218.05 on Thursday. The Nifty tumbled 247.15 points or 1.02 per cent to sink below the 24,000 mark at 23,951.70.