New Delhi, Jul 28: In a bid to ensure timely support to depositors of stressed banks, the Union Cabinet on Wednesday approved amendment to the DICGC Act to provide account holders access to up to Rs 5 lakh funds within 90 days of a bank coming under moratorium.

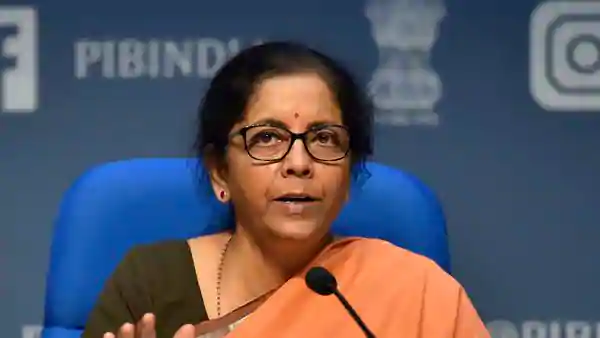

Finance Minister Nirmala Sitharaman in her Budget speech had announced that changes will be made to the Deposit Insurance and Credit Guarantee Corporation (DICGC) Act, 1961.

Last year, the government raised insurance cover on deposit five-fold to Rs 5 lakh to provide support to depositors of ailing lenders like Punjab and Maharashtra Co-operative (PMC) Bank.

Following the collapse of PMC Bank, Yes Bank and Lakshmi Vilas Bank too came under stress, leading to restructuring by the RBI and government.

"The Deposit Insurance and Credit Guarantee Corporation Bill 2021 has been cleared by the Cabinet today," Sitharaman said while sharing details about the Cabinet meeting.

The Bill is expected to be introduced in the monsoon session, she said.

Once the Bill becomes law, it will provide immediate relief to thousands of depositors, who had their money parked in stressed lenders such as PMC Bank and other small cooperative banks.

As per the current provisions, the deposit insurance of up to Rs 5 lakh comes into play when the licence of a bank is cancelled and the liquidation process starts.

DICGC, a wholly-owned subsidiary of the Reserve Bank of India, provides insurance cover on bank deposits.

Deposit Insurance Credit Guarantee Cooperation (DICGC) insures all bank deposits, such as savings of fixed or current deposits or recurring deposits, and it covers all commercial banks, including foreign bank branches in India, Sitharaman said.

With the proposed amendment, each account holder's deposit in banks is insured up to a maximum of Rs 5 lakh, for both principal and interest, she said.

"Now, what is the international coverage and what is Indian coverage...in India with the increase of insurance amount from Rs 1 lakh to Rs 5 lakh is going to cover 98.3 per cent of all deposit accounts...in terms of deposit value 50.9 per cent deposits value will be covered. Globally, deposit insurance coverage is only 80 per cent of all deposit accounts and it covers only 20-30 per cent deposit value," she said.

At present, it takes 8-10 years for depositors of a stressed bank to get their insured money and other claims.

Observing that accessing depositors money has been an issue, Sitharaman said, " now, what we're saying is, even if there is a moratorium on a bank, which means everything is frozen and depositors are not able to take their money out of their accounts, even at that time this measure will set in".

The first 45 days will go for the bank, which has come under stress, to collect all the accounts where the claims will have to be made, and then it will be given to this insurance company, which in real-time will check it all up, and nearer the 90th day, depositors will get the money, she added.

Every bank used to pay 10 paise as an insurance premium per Rs 100 of deposit.

"This is now being raised to 12 paise. We are saying it should not be more than 15 paise at any point in time per Rs 100 deposit. So, that is being made explicit...we will have an enabling provision in case banks feel that this has to go up but within a certain prescribed limit, which will be determined by the government in consultation with the RBI," she said.

The Finance Minister in the Budget speech in February said the government had approved an increase in the Deposit Insurance cover from Rs 1 lakh to Rs 5 lakh for bank customers.

"I shall be moving amendments to the DICGC Act, 1961 in this session itself to streamline the provisions, so that if a bank is temporarily unable to fulfil its obligations, the depositors of such a bank can get easy and time-bound access to their deposits to the extent of the deposit insurance cover. This would help depositors of banks that are currently under stress," she had said.

It could not be presented in the Budget session due to curtailment of the session following the spread of the second wave of the COVID-19 pandemic.

It is to be noted that the enhanced deposit insurance cover of Rs 5 lakh is effective from February 4, 2020. The increase was done after a gap of 27 years as it has been static since 1993.

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

Satna/Bhopal (PTI): Four children suffering from thalassemia have tested HIV positive at Satna District Hospital in Madhya Pradesh allegedly due to contaminated blood transfusions, officials said on Tuesday.

The case is four months old and an investigation is underway into it, an official said.

Officials suspect the use of contaminated needles or blood transfusions for the spread of infection to the children.

ALSO READ: 3 Indian students among those injured in Australia’s Bondi Beach attack

MP Health Minister Rajendra Shukla told reporters in Bhopal that he has ordered a probe into the matter and sought a report.

“It is also being investigated whether the blood transfusion took place in other hospitals also or only in the government hospital,” he said.

The affected children, aged between 12 and 15 years, received blood transfusions from the hospital's blood bank, as per an official.

Devendra Patel, in-charge of the blood bank at Sardar Vallabhbhai Patel District Hospital in Satna, said four children have tested HIV positive and an investigation is underway to determine how they got infected.

"Either an infected needle was used or a blood transfusion occurred. These are the two main reasons I believe. Blood transfusion seems to be the most likely cause," he told PTI Videos.

All these children suffer from thalassemia, and some have received 80 or 100 blood transfusions, he said.

A family member of one of the affected children said that their child was found to be HIV positive during a routine checkup about four months back, and he has been receiving medication, but it had proven to be of no use.

After taking the medication for HIV, the child starts vomiting, feels low and becomes ill, he said.

After the four children were detected with HIV infection, their family members were also tested and the results came out negative, he added.

The Opposition Congress targeted the government over the matter and demanded the resignation of Health Minister Shukla.

Speaking to reporters in Bhopal, Congress MLA and former minister Sachin Yadav claimed such incidents were continuously occurring in Madhya Pradesh.

Earlier, a case of toxic cough syrup came to light in Chhindwara, followed by incidents of rat bites at hospitals in Indore and Satna, and now children have been given HIV-infected blood, he said.

"The health minister is unable to manage the department. He should resign. A murder case should be filed against those responsible for the Satna incident," Yadav said.

Senior Congress leader Sajjan Singh Verma termed it a failure of the government. Chief Minister Mohan Yadav's government has no connection with ground realities, he charged.

"Somewhere rats are roaming in hospitals, somewhere children are being given HIV-infected blood. Instead of preventing HIV, you are spreading it. Mohan Yadav should wake up from his slumber. Children are the nation's heritage and should be taken care of," he added.