New Delhi: After it received a notice from the Central Consumer Protection Authority (CCPA) for selling sweets as 'Shri Ram Mandir Ayodhya Prasad', e-commerce company Amazon on Saturday said it is taking appropriate action against such listings in line with its policies.

Amazon acknowledged that it has received a communication from the CCPA regarding misleading product claims by certain sellers and said it is "investigating them for violations".

"In the interim, we are taking appropriate action against such listings as per our policies," Amazon spokesperson said in a statement.

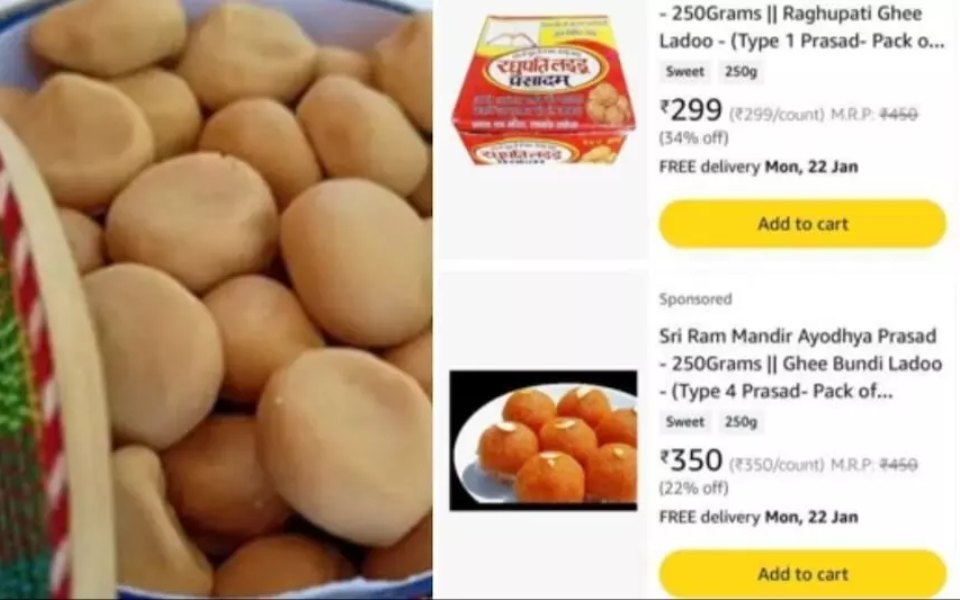

The CCPA has slapped a notice on Amazon for selling sweets under the name 'Shri Ram Mandir Ayodhya Prasad'.

The CCPA has sought a response from Amazon within seven days, failing which necessary action will be initiated against them under the provisions of the Consumer Protection Act, 2019, according to an official statement on Friday.

The CCPA has "initiated action against Amazon Seller Services Pvt Ltd, concerning the sale of sweets on www.amazon.in under the name 'Shri Ram Mandir Ayodhya Prasad'."

The action has been initiated based on a representation by the Confederation of All India Traders (CAIT), alleging that Amazon is engaging in deceptive trade practices involving the sale of sweets under the guise of 'Shri Ram Mandir Ayodhya Prasad'.

The CCPA has observed that various sweets/food products are available for sale on Amazon e-commerce platform (www.amazon.in) claiming it to be 'Shri Ram Mandir Ayodhya Prasad'.

"Enabling the sale of food products online that make false representations misleads consumers regarding the genuine characteristics of the product.

"Such practice falsely influences consumers to make purchase decisions they might not have otherwise taken, had the accurate attributes of the product been mentioned," an official statement said.

As such, under Rule 4(3) of the Consumer Protection (e-commerce) Rules, 2020, no e-commerce entity shall adopt any unfair trade practice, whether in the course of business on its platform or otherwise.

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

Thane (PTI): Authorities have seized illegally stored 1,839 gas cylinders and seven vehicles worth over Rs 67 lakh in the Dombivli MIDC area of Thane district, officials said on Saturday.

A special vigilance team of the Mumbai Rationing Department detected an illegal storage of domestic and commercial LPG cylinders in Phase-2 of Dombivli (East).

Cylinders belonging to multiple gas agencies were found stockpiled in closed vehicles, unauthorised warehouses, and open sheds without mandatory permissions from the Explosives Department, Fire Department, or oil companies, according to an official release.