New Delhi: Cigarettes, pan masala and other tobacco products have become more expensive from today following the implementation of a new excise duty regime introduced by the Centre, reported NDTV.

The revised tax structure, aimed at tightening regulation on so-called “sin goods”, brings back excise duty along with additional cesses, replacing the earlier GST-linked compensation cess system.

Under the new framework, tobacco products will no longer be taxed only under the 28 percent GST slab with compensation cess, a structure that had been in place since the rollout of GST in July 2017.

Instead, the government has imposed a fresh excise duty on cigarettes and introduced a health and national security cess on pan masala and similar products.

According to the notified rules, excise duty on non-standard or uniquely designed cigarettes will range between Rs 2,050 and Rs 8,500 per 1,000 sticks, depending on their length and type. In certain categories, the duty could go as high as Rs 11,000 per 1,000 cigarettes. Short non-filter cigarettes of up to 65 mm length will attract an excise duty of around Rs 2.05 per stick, while short filter cigarettes of the same size will be taxed at approximately Rs 2.10 per stick. Medium-length cigarettes will face a duty of about Rs 4 per stick, and longer cigarettes around Rs 5.40 per stick.

With the new levies in place, the overall tax burden on cigarettes is expected to rise sharply to nearly 60–70 per cent, compared to the earlier range of 50–55 per cent. Experts estimate that the price of a cigarette, currently around Rs 18, could climb to Rs 70–72 in the long run as the higher taxes are passed on to consumers.

Alongside Cigarettes, raw tobacco will now attract an excise duty ranging between 60 and 70 per cent, while e-cigarettes and other nicotine delivery products will be taxed at 100 per cent. Pan masala and gutkha will additionally be subject to the newly introduced health and national security cess, further pushing up retail prices.

The government has maintained that the primary objective behind the steep tax hike is to discourage consumption of harmful products and encourage people to quit smoking and chewing tobacco.

However the report quoting experts stated that they have raised concerns that excessive taxation could have unintended consequences, and may push consumers towards cheaper, illegal or smuggled tobacco products, potentially undermining regulatory efforts.

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

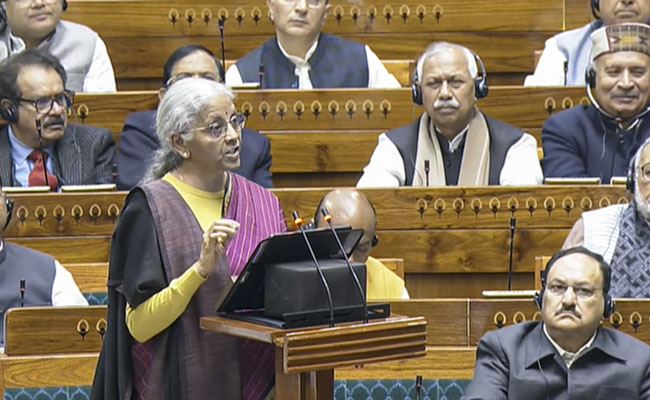

New Delhi: Finance Minister Nirmala Sitharaman has announced the creation of dedicated rare earth corridors as part of the Union Budget, a move aimed at strengthening India’s domestic manufacturing ecosystem and reducing dependence on imported critical minerals that are vital for modern technology.

Presenting the Budget, Sitharaman said the Centre will support mineral-rich states to establish dedicated corridors for rare earth elements, specifically linking Odisha, Kerala, Andhra Pradesh and Tamil Nadu. She said the proposal builds on the government’s scheme for rare earth permanent magnets, which was launched in November 2025.

“A scheme for rare earth permanent magnets was launched in November 2025. We now propose to support the mineral-rich states of Odisha, Kerala, Andhra Pradesh and Tamil Nadu to establish dedicated rare earth corridors,” the finance minister said in her Budget speech.

Rare earth elements are a group of minerals that play a critical role in many technologies that underpin modern life and future industries. They are used in electric vehicles, wind turbines, mobile phones, defence systems, advanced electronics and renewable energy equipment. Permanent magnets made from rare earth minerals are especially important for clean energy applications and high-end manufacturing, as they improve efficiency and performance.

The proposed rare earth corridors are meant to create a structured domestic network covering the entire value chain, from mining and processing to transportation and manufacturing. By linking mineral-rich regions through focused infrastructure and policy support, the government aims to improve supply chains, reduce logistical costs and make domestic production of rare earth-based components faster and more reliable.

The choice of Odisha, Kerala, Andhra Pradesh and Tamil Nadu is linked to the availability of rare earth deposits in these regions, particularly along coastal belts and mineral-rich zones. These states also have ports, industrial clusters and existing transport infrastructure, which can support processing, export and movement of materials within the country. The government believes concentrated investment in these regions can help India develop a strong and integrated rare earth ecosystem.

The corridor plan is closely connected to the rare earth permanent magnet scheme announced last year. That scheme was designed to encourage local manufacturing of magnets used in electric vehicles, renewable energy systems and electronics. However, without assured access to raw minerals, large-scale domestic production remains difficult. The corridors are expected to address this gap by ensuring a steady flow of rare earth materials from source to factory.

The finance minister said India must remain connected to global markets while reducing its dependence on imports in sensitive and strategic sectors. She added that policy reforms, controlled inflation and steady growth have helped maintain macroeconomic stability, even in a challenging global environment, and that the Budget aims to turn aspiration into achievement with a focus on young people, inclusion and long-term resilience.

Globally, rare earth supply chains are concentrated in a small number of countries, and disruptions can have serious consequences for clean energy, electronics and defence industries. By developing its own rare earth corridors, India is seeking to reduce vulnerability to global shocks and secure key inputs needed for future growth.