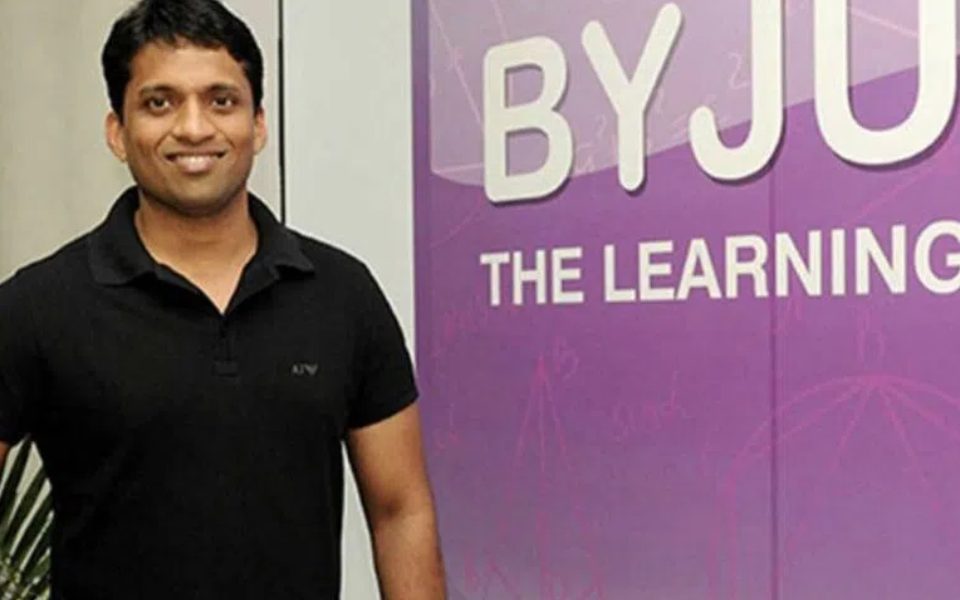

New Delhi, Feb 24: A day after investors of the troubled edtech firm Byju's voted for a leadership change, Byju Raveendran has penned a note to employees saying he continues to remain CEO and the management remains unchanged, as he dubbed Friday's EGM as a "farce".

The note to employees assumes significance as it comes after Byju's shareholders (prominent investors) on Friday voted for removing Founder-CEO Raveendran and his family from the board over alleged "mismanagement and failures" at what was once India's hottest tech startup, but the company dug in its heels, calling the voting done in absence of founders as invalid and ineffective.

In a note to employees on Saturday, Raveendran alleged that a lot of essential rules were "violated" at Friday's Extraordinary General Meeting (EGM).

"This means that whatever was decided in that meeting does not count, because it didn't stick to the established rules... It is crucial for everyone to understand the specific issues that make this EGM a farce," he wrote.

PTI has seen a copy of the letter.

Raveendran said he firmly believes that the truth will inevitably prevail, despite the "relentless trial by the media".

"I am writing this letter to you as the CEO of our company. Contrary to what you may have read in the media, I continue to remain CEO, the management remains unchanged, and the board remains the same," he said, adding it is "business as usual" at BYJU'S.

"To reemphasise, the rumours of my firing have been greatly exaggerated and highly inaccurate," Raveendran said.

Outlining what he claimed were "key discrepancies" at the EGM, he said the meeting was convened without following the proper procedure set out by the law and the company's Articles of Association.

"To pass any resolution the meeting needs to have a proper quorum, a set of people who are mandatory. Our articles are clear on the quorum requiring the presence of at least one founder director. Consequently, any resolutions taken at the meeting are not enforceable as per law," he said.

He also stated, "The claims made by a small group of select minority shareholders that they have unanimously passed the resolution in the EGM is completely wrong. Only 35 out of 170 shareholders (representing around 45 per cent of shareholding) voted in favour of the resolution. That in itself shows the very limited support that this irrelevant meeting received."

BYJU'S Founder CEO Raveendran Byju, his wife and brother -- the only three members on the company board as of now -- stayed away from the EGM called by a group of six investors, who collectively hold more than 32 per cent in Think & Learn (T&L), the firm that operates online tuition platform Byju's.

At the end, more than 60 per cent of the shareholders voted in favour of all the seven resolutions, which included removing the current management, reconfiguration of the board and a third party forensic investigation into acquisitions by the company, sources close to the investors said.

However, sources close to Byju's put the number at 47 per cent on Friday.

Prosus -- one of the six investors who had called the EGM -- in a statement on Friday said, "shareholders unanimously passed all resolutions put forward for vote".

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

Mumbai (PTI): Rupee depreciated 9 paise to an all-time low of 90.58 against US dollar in early trade on Monday, weighed down by uncertainty over an India-US trade deal and persistent foreign fund outflows.

Forex traders said rupee is trading with a negative bias as investors are in wait and watch mode and awaiting cues from the India-US trade deal front.

At the interbank foreign exchange market, the rupee opened at 90.53 against the US dollar, then fell further to an all-time intraday low of 90.58 against the greenback, registering a fall of 9 paise over its previous close.

On Friday, the rupee had slipped 17 paise to close at an all-time low of 90.49 against the American currency.

Meanwhile, the dollar index, which gauges the greenback's strength against a basket of six currencies, was trading 0.05 per cent lower at 98.35.

Brent crude, the global oil benchmark, was trading higher by 0.52 per cent at USD 61.44 per barrel in futures trade.

On the domestic equity market front, the 30-share benchmark index Sensex was trading 298.86 points lower at 84,968.80, while the Nifty was down 121.40 points at 25,925.55.

Foreign Institutional Investors sold equities worth Rs 1,114.22 crore on Friday, according to exchange data.

"FPIs continue to be in selling mode in equity and debt while RBI has been selling dollars to fund their long positions," said Anil Kumar Bhansali, Head of Treasury and Executive Director Finrex Treasury Advisors LLP.