Belagavi (PTI): The Congress Working Committee (CWC) meeting named "Nav Satyagraha Baithak" began here on Thursday as the party marks the 100th anniversary of its Belgaum session that was presided over by Mahatma Gandhi and chalks out a plan for the political and electoral challenges in 2025.

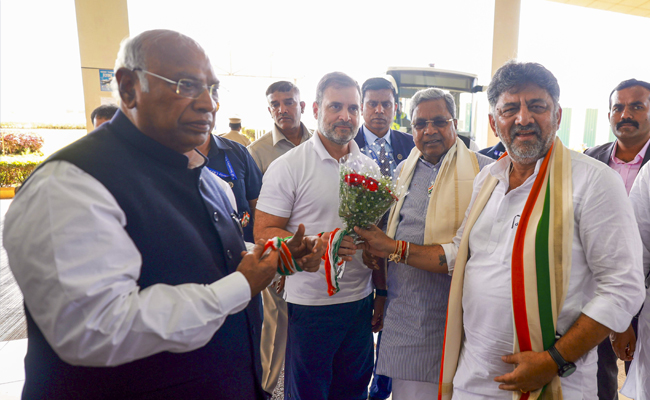

Top Congress leaders, including party chief Mallikarjjun Kharge and former party chief Rahul Gandhi, marched to the venue of the extended CWC meeting here.

The meeting, steeped in historical contexts, began at the same venue where Mahatma Gandhi had assumed the presidency of the party 100 years ago.

Karnataka Chief Minister Siddaramaiah, Deputy Chief Minister D K Shivakumar, Congress general secretaries Jairam Ramesh and K C Venugopal, among others, are attending the "historic" meeting.

A controversy has erupted over the alleged misrepresentation of India's map on the posters displayed by the party to commemorate the centenary of the 1924 Congress session, with the Bharatiya Janata Party (BJP) dubbing it as "vote bank" politics.

The Congress has said the BJP is severely unnerved and peeved by events to celebrate 100 years of Mahatma Gandhi taking the reins of the grand old party and asked the ruling party at the Centre to stop making petty excuses.

Earlier, the Congress said it will re-dedicate itself to protect, preserve and promote Mahatma Gandhi's legacy, which is facing a "systematic assault by the ideological brotherhood that fought him bitterly".

In a bid to get battle-ready for the challenges ahead, the Congress will decide on an action plan for the next year at the CWC meeting.

The opposition party has asserted that the "insult" to B R Ambedkar by Home Minister Amit Shah will be taken up for deliberations at Belagavi and that there will be a "strong follow-up" on the issue.

In a post on X, party general secretary in-charge communications Ramesh said, "Mahatma Gandhi took over as President of @INCIndia on Dec 26th, 1924 -- 100 years ago at what was then called Belgaum, now Belgavi. It was a historic session."

"Today the Extended Working Committee is holding its Nava Satyagraha Baithak at that very same place. It will rededicate itself to protect, preserve, and promote Mahatma Gandhi's legacy -- which is under systematic assault by the ideological brotherhood that fought him bitterly, and that attacked the Constitution when it was adopted," he said.

In another post later, Ramesh said the 39th session of the Indian National Congress began 100 years ago on this day at Belagavi with the singing of Vande Mataram by a group of girls from the National School at Dharwad.

"An 11-year-old girl then sang the song Udayavagali Namma Cheluva Kannada Nadu (Rise, our lovely Kannada land). This song was specially prepared for the Congress and this occasion marked the first time it was used as the state anthem. This 11-year-old girl went on to become a legend of Hindustani classical music -- the melodiously incomparable Gangubai Hangal," Ramesh informed.

Earlier, All India Congress Committee (AICC) general secretary organisation Venugopal said the extended CWC meeting will discuss current political developments in the country and the BJP's alleged attack on the Constitution and its architect, Ambedkar.

After deliberating on several issues being faced by the country, the Congress will come out with "clear-cut" ideas to address those and counter the BJP's alleged attack on the Constitution, Venugopal said.

"Today marks the 100th anniversary of Mahatma Gandhi's presidency of the Indian National Congress. It is a proud moment for all Congressmen across the country to commemorate this occasion," he told reporters.

Addressing a press conference on Tuesday along with Venugopal and AICC media and publicity department head Pawan Khera, Ramesh said the extended CWC meeting has been named "Nav Satyagraha Baithak", which would see two resolutions being passed.

On December 27, a "Jai Bapu, Jai Bhim, Jai Samvidhan" rally will be held in Belagavi, Ramesh said.

About 200 leaders, including CWC members, permanent invitees, special invitees, the party's central election committee members, Pradesh Congress Committee members, CLP leaders of the state, parliamentary party office-bearers and former party chief ministers are attending the "historic session".

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

Tokyo (AP): The Bank of Japan raised its key policy rate to a 30-year high on Friday in a widely anticipated move that could rattle world markets.

The two-day BOJ policy meeting wrapped up with the 0.25 per cent hike in its benchmark short-term rate. That took the policy rate to 0.75 per cent, its highest level since September 1995.

In a statement, the central bank said the decision was unanimous and that it expected to raise rates further if there are no major changes in the outlook for the economy.

The 0.75 per cent rate is still low by most standards, but the BOJ has kept that rate near or below zero for years, trying to pull the economy out of a deflationary funk. Since the pandemic, most other central banks, like the US Federal Reserve, have raised rates to counter spiking inflation and then begun cutting them to help their slowing economies recover momentum.

Japan's own economy contracted at a 2.3 per cent annual rate in the last quarter, but improved business sentiment and price pressures have led the BOJ to relent and raise rates. Here are some things to know about its decision.

ALSO READ:PM Modi recalls sacrifices of freedom fighters on Goa Liberation Day

Japan's interest rates rise while other countries' fall

Since Japan's economic bubble burst in the early 1990s, the central bank has kept borrowing costs low to encourage more spending by businesses and consumers.

Lower interest rates have also helped the central bank manage the country's massive national debt, which amounts to nearly triple the size of the economy.

As Japan's population has aged and begun declining, its economy has slowed and that led to deflation, or falling prices due to weak demand. Even with cheap credit, investment has lagged, stunting economic growth.

In early 2013, the central bank launched what was dubbed a “big bazooka” of monetary easing, cutting interest rates and purchasing government bonds and other securities to help channel more money into the economy.

When the COVID-19 pandemic struck, the benchmark interest rate was at minus 0.1 per cent. The BOJ only began raising it in 2024, the first hike in 17 years, after inflation stabilised above its target of about 2 per cent.

A weaker Japanese yen has pushed inflation higher

The Japanese yen has weakened against the US dollar and many other major currencies. That has raised the cost, in yen terms, of imported food, fuel and other items needed to keep the world's fourth largest economy running.

The strong appetite for investing in dollar-denominated shares of companies linked to the artificial intelligence boom has also pulled money out of the yen and into dollars.

So inflation has risen faster than wages, squeezing household budgets and raising costs for businesses.

Higher interest rates are expected to raise the value of the yen against the dollar as investments flow into Japan seeking higher yen-denominated yields. Friday's move would signal the central bank's intention of continuing to “normalise” its monetary policy with further rate hikes next year.

“The BOJ's stance towards rate hikes reflects the fact that inflation is becoming entrenched," Kei Fujimoto, a senior economist at SuMi Trust, said in a commentary. “If drivers such as a further depreciation of the yen accelerate inflation going forward, it is possible that the pace of rate hikes will also increase accordingly.”

The dollar is worth about 156 Japanese yen, nearly twice its level in 2012 and near its highest level this year.

World markets are bracing for impact

Even small changes in interest rates can have a big impact on markets. A rate hike in Japan would undermine an investment strategy known as the “carry trade.” That involves investors borrowing cheaply in yen and then using that money to invest in higher paying assets elsewhere.

Any such major shift is likely to reverberate across world markets. Carry trades are lucrative when stocks and other investments are climbing, but losses can snowball when many traders face pressure to sell stocks or other assets all at once.

A rate hike also is expected to crimp demand for other assets, including cryptocurrencies. Reports last week that the BOJ would go ahead and raise rates caused the price of bitcoin, for example, to drop below USD 86,000. The original cryptocurrency had bolted to record highs near USD 125,000 in early October.

Risks for Japan

Judging the timing and scale of changes to interest rates and other monetary policies are the biggest challenge for central banks, given the time it takes for such moves to ripple throughout the real economy and financial markets.

Like the Federal Reserve, Japan's central bank struggles to balance the need to boost business activity and create jobs with the imperative of containing inflation.

The BOJ held off on raising rates earlier given uncertainties over how US President Donald Trump's tariffs might hit automakers and other exporters. A deal setting US duties on imports from Japan at 15 per cent, down from the earlier plan for a 25 per cent rate, has helped ease those concerns.

BOJ Gov. Kazuo Ueda has indicated he believes wages will continue to rise in Japan as companies compete for a shrinking pool of workers, helping to support growth.

Market watchers will be watching closely to see what Ueda says Friday about the outlook for future rate increases.