Mumbai: A fresh political controversy has erupted in Maharashtra after full-page advertisements and hoardings across Mumbai projected Chief Minister Devendra Fadnavis as “Devabhau,” while sidelining Deputy Chief Ministers Eknath Shinde and Ajit Pawar. The publicity campaign has raised questions about unity within the ruling Mahayuti alliance.

The row comes soon after the Maratha reservation protests in Mumbai, where Fadnavis appeared politically isolated as both Shinde and Pawar distanced themselves. Now, the sudden visibility of advertisements focusing solely on the Chief Minister has intensified speculation of a power struggle and credit wars within the coalition.

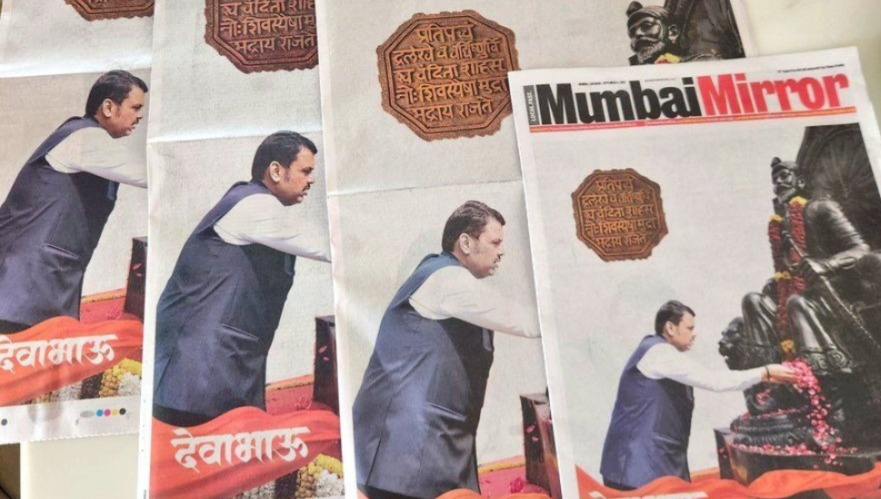

The advertisements, published on Saturday, depicted Fadnavis offering flowers to Chhatrapati Shivaji Maharaj and performing Ganesh puja on Anant Chaturdashi, with the tagline “Devabhau.” No mention was made of his coalition partners. While the sponsor remains unidentified, the scale and cost have fueled political debate.

Shiv Sena (UBT) leader Sanjay Raut alleged that ₹40–50 crore was spent in a single day, accusing the BJP of misusing Shivaji Maharaj’s image for political gain. He questioned the source of funding and hinted at the use of black money. “At a time when Maharashtra is reeling under farmer suicides and heavy rains, such extravagance is shameful,” Raut remarked, further challenging the RSS to prove its respect for Shivaji Maharaj by installing his portrait or statue at its Nagpur headquarters.

Adding another twist, NCP (Sharad Pawar faction) MLA Rohit Pawar claimed that the BJP did not fund the advertisements. Instead, he alleged that a minister from an allied party sponsored the campaign without informing Fadnavis. “Who is this minister and where did the crores come from? Maharashtra deserves answers,” Rohit Pawar wrote on social media.

Meanwhile, Deputy CM Eknath Shinde downplayed the controversy, asserting that there was no internal rivalry. “There is no competition for credit. We are working together as a team under the Mahayuti government. Fadnavisji and I are in our second innings with the same agenda of development and welfare of the poor,” Shinde told reporters in Thane.

एकीकडे राज्यात रोज ८ शेतकरी आत्महत्या होत असताना आणि अतिवृष्टीने संपूर्ण महाराष्ट्र झोडपला असताना वृत्तपत्रांच्या पहिल्या पानावर तसेच अनेक विमानतळांवर कोट्यवधी रुपये उधळून मुख्यमंत्र्यांच्या मोठमोठ्या जाहिराती देण्याची सरकारची वृत्ती बघून मोठी चीड आली, परंतु मा. देवेंद्र फडणवीस… pic.twitter.com/IpLZjm8DUv

— Rohit Pawar (@RRPSpeaks) September 7, 2025

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

Mumbai (PTI): Rupee depreciated 9 paise to an all-time low of 90.58 against US dollar in early trade on Monday, weighed down by uncertainty over an India-US trade deal and persistent foreign fund outflows.

Forex traders said rupee is trading with a negative bias as investors are in wait and watch mode and awaiting cues from the India-US trade deal front.

At the interbank foreign exchange market, the rupee opened at 90.53 against the US dollar, then fell further to an all-time intraday low of 90.58 against the greenback, registering a fall of 9 paise over its previous close.

On Friday, the rupee had slipped 17 paise to close at an all-time low of 90.49 against the American currency.

Meanwhile, the dollar index, which gauges the greenback's strength against a basket of six currencies, was trading 0.05 per cent lower at 98.35.

Brent crude, the global oil benchmark, was trading higher by 0.52 per cent at USD 61.44 per barrel in futures trade.

On the domestic equity market front, the 30-share benchmark index Sensex was trading 298.86 points lower at 84,968.80, while the Nifty was down 121.40 points at 25,925.55.

Foreign Institutional Investors sold equities worth Rs 1,114.22 crore on Friday, according to exchange data.

"FPIs continue to be in selling mode in equity and debt while RBI has been selling dollars to fund their long positions," said Anil Kumar Bhansali, Head of Treasury and Executive Director Finrex Treasury Advisors LLP.