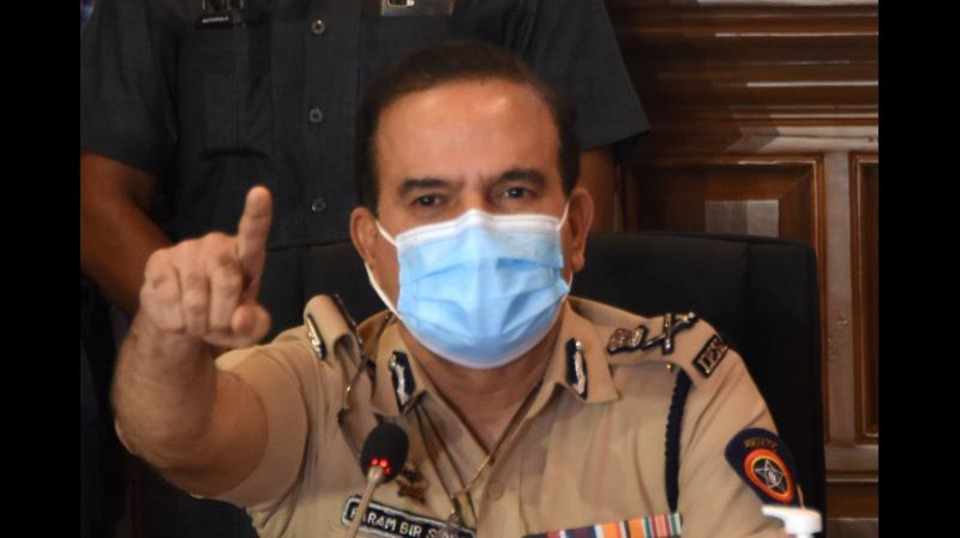

Mumbai:The names of two more TV channels have surfaced during the investigation of alleged fake Television Rating Points (TRP) scam, police said on Wednesday.

While one is a news channel, the other one is an entertainment channel, the official said.

"During the investigation, it came to light that these two channels were also involved in fixing the TRP by paying money to households for watching them," he said.

"While investigating the fake TRP racket, the police have added fresh sections of IPC, including 174, 179, 201, 204," he said.

According to the official, the police had earlier registered an offence under section 409 (criminal breach of trust), 420 (cheating), 120(B), 34 of IPC in the case, he said adding the crime branch submitted the letter to the court about adding new sections.

Earlier three channels, including Republic TV, was found allegedly involved in the TRP racket.

Meanwhile the probe team on Wednesday once again recorded statements of Republic TV CFO S Sundaram and executive editor Niranjan Narayanswami, he said.

The alleged fake TRP scam came to light when ratings agency Broadcast Audience Research Council (BARC) filed a complaint with the police through Hansa Research Group, alleging that certain channels were rigging TRP numbers to lure advertisers.

It was alleged that some families at whose houses meters for collecting data of viewership were installed were being bribed to tune into a particular channel.

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

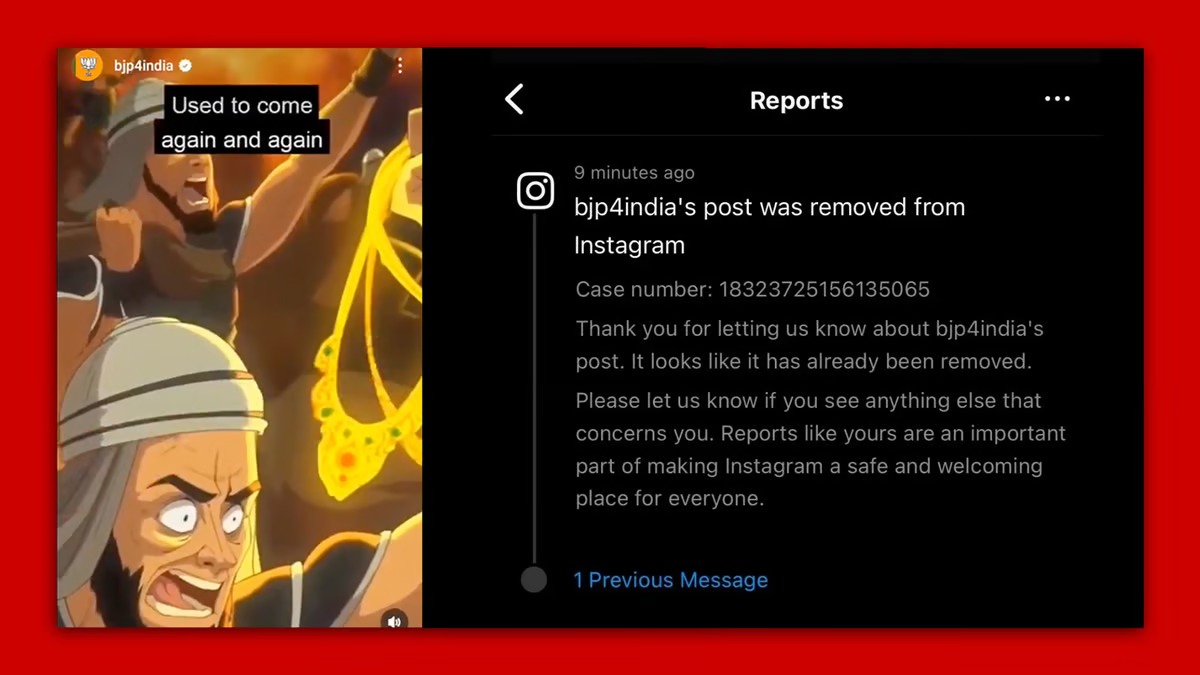

New Delhi: An animated video post shared on BJP’s official Instagram handle, asserting that the Congress party would snatch wealth from non-Muslims to ‘distribute it to its favorite community of invaders,’ has sparked significant backlash. Following the uproar, the photo sharing platform has taken down the post, reports Newslaundry.com.

Meanwhile, it is uncertain whether the post was removed by the BJP or by Instagram following mass reporting by several users as “misinformation” and “hate speech”. The video depicted Rahul Gandhi holding the Congress manifesto which transforms into the logo of the Muslim league. Furthermore, it sought support for PM Modi from every ‘Bharatiya,’ who is also shown wearing a saffron turban.

According to the report, it also contained a clip of PM Modi alleging that the former PM Manmohan Singh had said, “Muslims have the first claim on our resources,” insinuating that if the Congress were to assume power, it would confiscate the money and assets of non-Muslims, redistributing them to Muslims, whom it favored. Labeling Muslims as ‘infiltrators’, the video depicted historical invaders as looters who plundered India's resources and suggested that the Congress party continues to empower individuals from the same community.

The video then communicated that the Congress party’s manifesto is “nothing but Muslim league’s ideology in disguise. If you are a non-Muslim, Congress will snatch your wealth and distribute it to Muslims.” It also slinged the BJP’s official slogan ‘abki baar, 400 paar,’ and called that it was the need of the hour, since Modi only has the “strength to stop the Congress party’s evil plans.”

Similar claims have also been made by several BJP leaders. Recently, Union Minister Anurag Thakur stated that the Congress intends to “Give your children's property to Muslims.”