The orignal report was published by Financial Times on October 12, 2023. The story was originally authored by Dan McCrum of Financial Times. This report is only analysis of the findings of the investigation carried by Financial Times.

New Delhi: In a recent investigation conducted by the Financial Times, it has come to light that the Adani Group, a powerful Indian conglomerate, has seemingly engaged in importing coal worth billions of dollars at prices substantially higher than the prevailing market rates, as per customs records scrutinized by the Financial Times. These findings corroborate longstanding accusations that Adani, being the country’s largest private coal importer, has been artificially inflating fuel costs. This practice has consequently resulted in millions of Indian consumers and businesses being overcharged for electricity.

The detailed examination of customs data reveals that over the past two years, Adani employed offshore intermediaries located in Taiwan, Dubai, and Singapore to facilitate the import of coal amounting to $5 billion. Alarmingly, these transactions occurred at prices that, at times, were more than double the market price. Notably, one of the companies involved in these dealings is owned by a Taiwanese businessman recently identified by the Financial Times as a significant covert shareholder in various Adani companies.

Additionally, the Financial Times scrutinized 30 shipments of coal from Indonesia to India, conducted by an Adani company over a span of 32 months between 2019 and 2021. In all instances, the prices stated in the import records significantly exceeded those indicated in corresponding export declarations. What's more, the value of these combined shipments curiously escalated by over $70 million during their transit, raising questions about the legitimacy of these transactions.

The Adani Group has denied any wrongdoing, dismissing the Financial Times report as an "old, baseless allegation" and characterizing it as a "clever recycling and selective misrepresentation of publicly available facts and information." This allegation of inflating fuel costs dates back seven years when it was first raised in a probe by the Directorate of Revenue Intelligence (DRI), the finance ministry's investigative unit responsible for policing economic crime. In 2016, the DRI issued a notice naming five Adani companies and five others supplied by the group among 40 importers under investigation for "artificially inflating" the value of Indonesian coal. The notice indicated a significant overvaluation, ranging from 50% to 100%, as per comparisons of export and import records.

The notice further revealed that despite coal traveling directly from Indonesia to India, "supplier’s invoices are routed through one or more intermediary invoicing agents based in a third country, for the sole purpose of creating layers (typical of Trade-based Money Laundering) and artificially inflating its landed value."

In a separate development, politicians from the opposition in Adani's home state of Gujarat have accused the group of overcharging for electricity since 2018. They cited a letter from the state utility, indicating that Adani procured coal at prices not reflecting the actual market value of Indonesian coal. Adani, however, pointed to the DRI's recent decision to withdraw an appeal to the Supreme Court in a case involving one of the 40 importers named in 2016, claiming that this withdrawal served as conclusive proof that the matter of overvaluation in coal imports had been resolved by India's highest court.

A customs tribunal found that some documents used by the Directorate of Revenue Intelligence (DRI) lacked authenticity, and the DRI's jurisdiction to enforce customs law was limited. The DRI did not respond to requests for comment. This unresolved investigation raises questions about the relationship between Adani and Prime Minister Narendra Modi's administration. Adani, often referred to as "Modi's Rockefeller," heads a group controlling 10 listed companies, including India's largest private thermal power company and port operator. Earlier this year, Adani faced accusations of corporate fraud, leading to a significant drop in his group's value. Hindenburg Research alleged Adani's involvement in financial misconduct, citing documents from closed criminal investigations during Modi's tenure. Adani Group denies these claims, considering them an attack on India's institutions and growth.

The value of his group crashed to less than half its $288bn peak after he was accused in January of running “the largest con in corporate history” by Hindenburg Research

“In a specific instance from January 2019, the DL Acacia, a bulk carrier, transported thermal coal from Indonesia to India. During the voyage, the coal's value doubled, with export records indicating $1.9 million and import records at $4.3 million upon arrival at Mundra port, Gujarat, operated by Adani,” the Financial Times report added.

The Financial Times examined 30 shipments imported into India by Adani Enterprises, including the DL Acacia cargo. Each shipment's customs records in India were cross-referenced with those filed in Indonesia between January 2019 and August 2021, after which Indonesian records became unavailable. The FT ensured accuracy by matching sailing timings recorded by Kpler and Spire, considering shipments where weights perfectly aligned in both records and were irregular, minimizing the chance of false matches.

According to Indonesian declarations, these 30 sailings, totaling 3.1 million tonnes, cost $139 million, with an additional $3.1 million in shipping and insurance costs. However, the values declared in India amounted to $215 million, implying profits of up to $73 million, significantly exceeding plausible shipping costs. In the coal trading industry, where profit margins are typically low, any price significantly above market rates raises concerns. Adani Enterprises, the group’s primary profit generator, conducts the bulk of its sales and profits through its coal trading division, Integrated Resources Management.

Adani's Integrated Resources Management (IRM) division, backed by a team of 200 experienced professionals across four global offices and 19 Indian locations, reported trading 88 million tonnes of coal in its last financial year, ending in March. Despite a market downturn where coal prices halved, IRM demonstrated resilience, posting a 24% increase in earnings before tax and interest to Rs8.3 billion ($101 million) on a 6% rise in sales to Rs186 billion ($2.3 billion). Adani Enterprises, the parent company, experienced significant growth, with annual profits quadrupling over the past five years, reaching earnings before interest, tax, depreciation, and amortization of $1.2 billion in the most recent financial year.

Although IRM maintained a 3.5% operating profit margin, consistent with industry standards, three intermediary companies - Hi Lingos in Taipei, Taurus Commodities General Trading in Dubai, and Pan Asia Tradelink in Singapore - supplying coal to Adani made substantial profits. Adani reportedly paid these intermediaries a total of $4.8 billion for coal sourced at significant premiums to market prices, according to Indian import data since July 2021, the report added.

During the period from September 2021 to July 2023, Adani companies declared 73 million tonnes of coal imports in the Export Genius database. Adani Enterprises declared an average price of $130 per tonne for the 42 million tonnes of coal supplied by its own operations during this time.

According to the report, Adani's three intermediaries supplied 31 million tonnes of coal at an average declared price of $155 per tonne, a 20% premium totaling nearly $800 million. Hi Lingos, based in a residential address in Taipei, was the declared supplier for 12.9 million tonnes of coal in 428 shipments from Australia and Indonesia. Adani paid approximately $2 billion for this coal. The company is owned by Chang Chung-Ling, a Taiwanese businessman previously linked to Adani stock ownership. Documents obtained by the Organised Crime and Corruption Project revealed that Chang was secretly one of the largest shareholders in Adani companies from 2013 to at least early 2017. Chang's identity was obscured through complex paperwork in tax havens, and the investments were overseen from Dubai by an employee of Vinod Adani, Gautam’s brother. Despite attempts to contact him, Chang declined to comment when approached by the Financial Times at the Hi Lingos address.

Following Hi Lingos, the second-largest coal supplier to Adani in the last two years was the Dubai-based company Taurus, owned by Mohamed Ali Shaban Ahli, with unclear relations to Nasser Ali Shaban Ahli. Adani paid Taurus $1.8 billion for 11.3 million tonnes of coal supplied since September 2021. Despite an active office in Dubai's free trade zone, Taurus's website lacks specific information, listing a post office box as its corporate address. The company's manager did not respond to questions from the Financial Times.

Adani also procured coal from Pan Asia Tradelink, a Singapore business run by a former employee, paying $1.1 billion for 6.6 million tonnes since September 2021. The average price of $169 per tonne represented a 30% premium over the coal Adani sourced independently. Primarily supplying Adani Power, Pan Asia Tradelink had no other Indian customers in the records reviewed by the FT. Despite sharing a small office with two other companies, Pan Asia declined to communicate with the FT and did not respond to emailed or written questions.

Hi Lingos also supplied $157 million worth of coal to Throns Infrastructure and $40 million worth to Adi Tradelink, a partnership linked to India's Adicorp Enterprises. These two companies, along with Taurus, were the only non-Adani customers listed in the Indian customs records reviewed by the Financial Times.

Adi Tradelink, as per a credit rating report published last year, orders coal on behalf of Adani, while a co-owner of Throns was a director of an Adani family business until 2020. Despite these connections, industry experts questioned the use of lesser-known trading houses. “Typically, large coal buyers prefer reputable trading houses with strong credit ratings and a proven track record for handling substantial commodity deals involving hundreds of millions of dollars. Senior industry traders emphasized the importance of having well-known counterparties to mitigate business risks, especially concerning potential defaults,” the report further added.

While it's plausible that the three middlemen supplied high-quality coal commanding higher prices, the customs records suggest that their pricing was significantly above industry benchmark assessments. Data provider Argus maintains benchmark prices for Indonesian coal based on calorific values. Out of the 311 shipments listed in Indian import records, nearly all had coal with calorific content priced at a premium compared to the closest Argus benchmark prices from two to four weeks earlier, aligning with the typical shipping time from Indonesia to Gujarat. The median premium was 14%, with some instances, like Hi Lingos' shipments in August 2022, displaying much higher premiums. For instance, Hi Lingos landed four shipments from Indonesia with a declared calorific content of 5,004 Kcal per kg at a price of $179 per tonne, whereas the highest Argus 5,000 calorie benchmark price in the preceding three months was $145 per tonne.

Adani Group's pricing practices for coal have raised concerns, not just in the context of the company itself, but also among other suppliers in the industry. Analysis of 508 shipments where Adani companies acted as both suppliers and importers revealed that 87% of these transactions were priced higher than the closest Argus benchmark, with a median premium of 24%. Even when examining imports by companies other than Adani during the same period, the median premium was 17%.

This pricing disparity, both in terms of loaded and unloaded prices, and the deviation from established coal benchmarks, has been questioned by experts in coal trading. Henning Gloystein, an analyst at the Eurasia Group, noted that a consistent pattern of cargoes priced over global or regional benchmarks raises significant concerns.

India's power generators typically operate under long-term "cost-plus" contracts, which involve various fixed and variable costs. Over the past decade, disputes and litigation related to pricing methodologies have been common in Indian courts. It's worth noting that these costs, ultimately borne by the public, are indirectly affected, considering India's complex network of public and private companies responsible for power generation, transmission, and distribution. Some parts of this network are financially fragile, as highlighted by rating agency Standard & Poor’s, estimating substantial losses of about $70 billion within state-owned distribution companies.

In 2016, the Directorate of Revenue Intelligence (DRI) suspected that illicit over-invoicing of coal led to an estimated value of Rs300 billion, approximately $5 billion at the time. Recently, in August of this year, opposition politicians in Gujarat accused the state government of making nearly $500 million in excess payments to Adani Power over five years, related to a power purchase agreement linked to coal prices. They claimed a letter from the state utility GUVNL indicated these excess payments for coal procured at premium prices, with Adani allegedly not providing necessary documentation. The government responded by stating the payments were interim and subject to adjustment, while Adani dismissed the allegations as "baseless," emphasizing their adherence to an open, transparent global bidding process for coal procurement on a long-term supply basis in India, eliminating the possibility of price manipulation.

Tariffs in India are set by the central regulator through evaluation of all variables, consultations with power generators, distributors, and retail consumers. This approach involves multiple stakeholders and opportunities to assess all aspects, including the import value of coal, making claims of over-invoicing or price manipulation baseless, according to official statements. While the DRI's investigation into coal over-invoicing appears stalled, the finance ministry's Enforcement Directorate and the Central Bureau of Investigation have pursued related cases since 2016. Recently, a man named by the DRI was denied bail in a case involving alleged swindling from public utilities and money laundering through shell companies. Opposition politicians have aimed to make coal and crony capitalism significant issues in the upcoming elections, echoing the anti-corruption sentiment that propelled Modi's Bharatiya Janata party to power in 2014. At that time, the government auditor estimated a significant loss of tax revenue due to low royalty rates in questionable coal mining concessions, which became a focal point of political discourse.

The orignal report was published by Financial Times on October 12, 2023. The story was originally authored by Dan McCrum of Financial Times. This report is only analysis of the findings of the investigation carried by Financial Times.

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

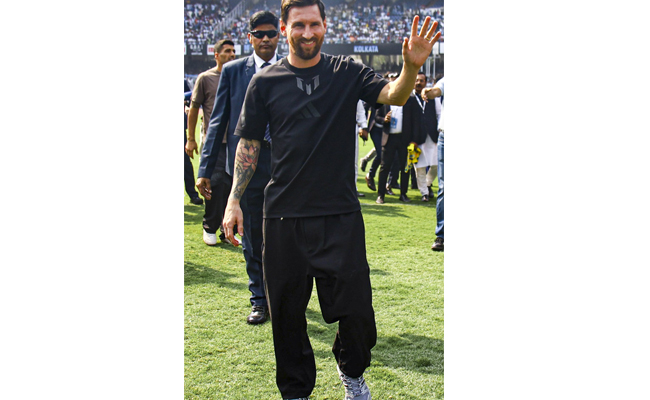

Mumbai (PTI): In view of Argentine superstar footballer Lionel Messi's visit to Mumbai on Sunday, the city police are implementing stringent security measures, like not allowing water bottles, metals, coins inside the stadiums and setting up watchtowers to keep an eye on the crowd, officials said.

The police also said taking extra care to avoid any stampede-like situation and to prevent recurrence of the chaotic situation that unfolded in Kolkata during Messi's visit on Saturday as thousands of fans protested inside the Salt Lake stadium here after failing to catch a clear glimpse of the football icon despite paying hefty sums for tickets.

Messi is expected to be present at the Cricket Club of India (Brabourne Stadium) in Mumbai on Sunday for a Padel GOAT Cup event followed by attending a celebrity football match. He is expected to proceed to the Wankhede Stadium for the GOAT India Tour main event around 5 pm.

"In view of Lionel Messi's visit to Mumbai, the police are geared up and have put in place a high level of security arrangements in and around the stadiums located in south Mumbai. Considering the chaos that prevailed in Kolkata and the security breach, we have deployed World Cup-level security arrangements at Brabourne and Wankhede stadiums," an official said.

Expecting heavy crowd near the stadiums during Messi's visit, the city police force has deployed more than 2,000 of its personnel near and around both the venues, he said.

As the Mumbai police have the experience of security 'bandobast' during the victory parade of ICC World Cup-winning Indian team and World Cup final match at the Wankhede Stadium, in which over one lakh cricket fans had gathered, we are prepared to handle a large crowd of fans, he said.

"We are trying to avoid the errors that occurred in the past," the official said.

There is no place to sneak inside the stadiums in Mumbai like the Kolkata stadium, according to him.

The police are also asking the organisers to provide all the required facilities to the fans inside the stadium, so that there will be no chaos, he said, adding the spectators have purchased tickets in the range of Rs 5,000 to 25,000. After paying so much of amount, any spectator expects proper services, while enjoying the event, he said.

The police are expecting 33,000 spectators at the Wankhede Stadium and over 4,000 at Brabourne Stadium. Besides this, more than 30,000 people are expected outside and around the stadiums just to have a glimpse of the football sensation, he said.

The organisers responsible for Messi's India visit recently came to Mumbai to discuss security arrangements. During the meeting, the Mumbai police asked them not to take the event lightly, according to the official.

After those requirements were fulfilled, the final security deployment was chalked out, he said.

Police has the standard procedure of the security arrangements inside the Wankhede Stadium, where people are barred from taking water bottles, metals objects, coins. Police are setting up watch towers near the stadiums and there will be traffic diversions, so that there is maximum space available to stand, according to the official.

Police are also appealing to the spectators to use public transport service for commuting and avoid personal vehicles to reach south Mumbai.

To avoid any stampede-like situation, police are also taking precautionary measures and will stop the fans some distance ahead of the stadium and public announcement systems will be used to guide the crowd. Barricades will be placed at various places to manage the crowd.

In case the crowd swells up beyond expectation, the police will divert people to other grounds and preparations in this regard underway, he said.

Additional police force has been deployed in south Mumbai to tackle any kind of situation, he said.