Bengaluru: Karnataka Minister of Health Dinesh Gundu Rao has requested the chief ministers, finance ministers and health ministers of seven states ruled by governments of non-BJP parties to urge the GST Council, during its meeting in New Delhi on Monday, to reduce the tax burden in health insurance for the people.

The Health Minister added that he has written to the West Bengal, Andhra Pradesh, Telangana, Kerala, Punjab, Jharkhand, and Himachal Pradesh state governments, amid a widespread demand to reduce the GST being levied on the premiums of health and insurance from 18 per cent to 5 per cent.

Minister Dinesh Gundu Rao has said that an 18 pc GST creates an unnecessary burden on the lower and middle income families and also dissuades them from taking health insurance. He had brought this point to the notice of Prime Minister Narendra Modi, asking him to direct the GST Council to reduce the burden on at least the lower and middle income groups. He opined that a collective effort at communicating the matter would give the states a greater chance of gaining the required result.

Earlier too, many asked for a scrapping of GST on health insurance. The Opposition parties had raised the issue in Parliament, during the monsoon season last month, and also staged a protest outside the House demanding for a reduction.

Union Finance Minister Nirmala Sitharaman, who heads the GST Council, the apex body on taxation policies and rates, has said that 54th meeting of the Council is scheduled for Monday, when the matter will be discussed.

The finance ministers of states are members of the GST Council and, as state governments are wary of possible shortfalls in revenue if a reduction in tax is implemented, arriving at a consensus during the Council meetings remains a challenge. A group of ministers headed by Bihar Deputy Chief Minister Samrat Choudhary is looking rate rationalization, and the Council has asked for the appointment of a fitment committee, comprising the commercial tax officers of states, in order to analyse the implication of the proposed health insurance tax cut on the state revenue. The fitment committee report is expected on Monday.

C Shika, commercial tax commissioner and fitment committee member refused to divulge the details in the report as it was related to a government policy. The officer added that the document will be studied but the final decision on tax rate would be taken by the GST Council.

A majority of the Council members are reportedly in favour of a reduction in tax on health and life insurance policies with annual premiums up to Rs 50,000 and the Council may even consider capping the sum assured for a lower GST levy.

Trade representatives from the insurance sector have concurred on the need to lower the tax burden given the rising cost of healthcare. They said that the policy should aim at making healthcare affordable especially for the middle-class citizens.

Dr. KT Venkatesh, Deputy Vice-president of HDFC Ergo, has said that the GST should be exempted for health insurance policies up to Rs 5 lakh, as this what the bulk of the middle-class opts for. The measure would be in line with the Union government’s ‘health for all’ policy too, he opined.

The GST Council is also expected to discuss the rate rationalization of all other commodities and services, as several states, including Karnataka, have asked for compensation for a shortfall in revenue if rates are rationalized.

Basavaraj Rayareddi, economic advisor to Karnataka Chief Minister Siddaramaiah, said that the government has been firm in its demand that the Centre should adequately compensate states as a slash in rates would cause revenue implications.

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

New Delhi: Several press organisations have called for the withdrawal of the FIR filed by the Uttar Pradesh Police against Mohammed Zubair, co-founder of fact-checking platform Alt News. The FIR includes allegations of endangering India’s sovereignty, unity, and integrity under s. 152 of the Bharatiya Nyaya Sanhita (BNS).

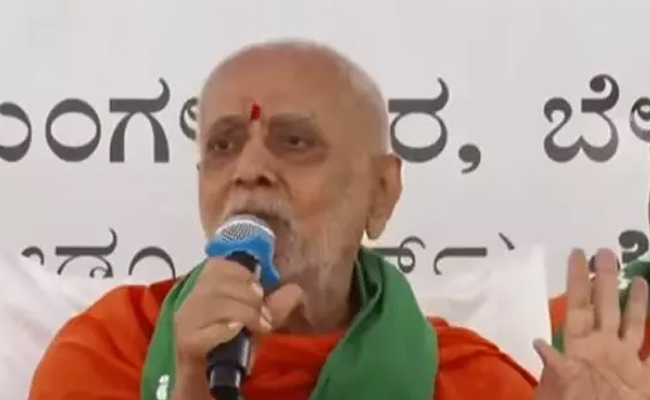

The case stems from Zubair’s social media post on October 3, where he shared a video of Hindutva leader Yati Narsinghanand’s speech that allegedly contained derogatory remarks about Prophet Muhammad. The video, shared on X (formerly Twitter), led to protests from Muslim groups across several cities. The complaint against Zubair was filed by Udita Tyagi, general secretary of the Yati Narsimhanand Saraswati Foundation, claiming the post was intended to incite violence.

On November 27, the Allahabad High Court was informed that s. 152 of the BNS and s. 66 of the Information Technology Act had been added to the FIR. While the court allowed these additions, press bodies expressed strong opposition to the charges, calling them a misuse of laws meant to stifle press freedom and dissent.

The Press Club of India described s. 152 as a "new avatar" of the sedition law, warning of its potential to silence media and free thinkers. Similarly, DIGIPUB, an association of digital news organisations, condemned the FIR as a "vindictive and unreasonable overreach" by the authorities.

DIGIPUB questioned whether the Uttar Pradesh government intends to target journalists who expose hate speech against minorities. It urged the police to shift focus to prosecuting individuals making hate speeches rather than harassing journalists like Zubair.

The Allahabad High Court has scheduled the next hearing on December 3, directing the investigating officer to provide detailed affidavits regarding the charges. Meanwhile, Zubair has sought legal protection against arrest.

_vb_67.jpeg)