Reliance Industries has agreed to buy German firm Metro AG's wholesale operations in India for Rs 2,850 crore as the conglomerate run by billionaire Mukesh Ambani seeks to strengthen its dominant position in India's mammoth retail sector.

Reliance Retail Ventures Ltd (RRVL), a subsidiary of the oil-to-telecom conglomerate, signed definitive agreements to acquire a 100 per cent equity stake in Metro Cash & Carry India Pvt Ltd for a total cash consideration of Rs 2,850 crore, subject to closing adjustments, the two firms said in a joint statement.

Reliance is India's biggest brick-and-mortar retailer with over 16,600 stores, and a strong wholesale unit would further deepen its operations in India.

Metro started operations in India in 2003 as the first company to introduce a cash-and-carry business format in the country and currently operates 31 large format stores across 21 cities with about 3,500 employees.

These stores sell products such as fruits and vegetables, general grocery, electronics, household goods and apparel to business customers like hotels, and restaurants as well as offices and companies, small retailers and kirana stores.

Half of the stores are in southern India.

''The multi-channel B2B cash and carry wholesaler has reach to over 3 million B2B customers in India, of which 1 million are frequently buying customers, through its store network and eB2B app,'' the statement said.

Metro India generated sales of Rs 7,700 crore - its best since its entry into India - in the financial year ended September 2022.

''With a presence in 8 of the 10 large cities, the acquisition should be a bolt-on to RIL's ambition to grow its last-mile reach by leveraging the relationship with Kirana stores,'' Morgan Stanley said in its comments on the deal.

Its past acquisition of Just Dial, Dunzo and the recent launch of FMCG consumer goods brand, 'Independence', have been steps to get more integrated in its retail offering, build on its around 3 million kirana merchant partners and expand its presence especially in Metros/Tier 1 cities.

The acquisition would give Reliance access to a large base of registered kiranas and other institutional customers, and strong supplier network, among others.

Its retail business effectively operates 3 large different business models - B2C via its physical stores; digital businesses (Jio Mart, Ajio among others); and a B2B business. It is the largest organized retailer in the key segments of grocery, fashion and lifestyle and consumer electronics.

''Over the years, Reliance has focused on the large kirana store ecosystem in India and the acquisition of Metro's wholesale business is a positive,'' said J P Morgan.

Upon closing of the transaction by March 2023, Metro will see a transaction gain of about 150 million euro at closing, and higher earnings per share are anticipated, the company said in a statement late Wednesday.

Metro India's equity value of approx 0.3 billion euros implies an EV/sales multiple of 0.6x based on sales of the financial year 2021-22 and considering lease rental and other related liabilities of 150 million euros.

Speaking about this investment, Isha Ambani, Director, RRVL, said, ''The acquisition of Metro India aligns with our new commerce strategy of building a unique model of shared prosperity through active collaboration with small merchants and enterprises.'' Metro India is a pioneer and key player in the Indian B2B market and has built a solid multi-channel platform delivering strong customer experience.

''We believe that Metro India's healthy assets combined with our deep understanding of Indian merchant / kirana ecosystem will help offer a 0differentiated value proposition to small businesses in India,'' she said.

Isha is the daughter of Mukesh Ambani, chairman and managing director of Reliance Industries Ltd.

Steffen Greubel, CEO of METRO AG, said, ''With Metro India, we are selling a growing and profitable wholesale business in a very dynamic market at the right time. We are convinced that in Reliance we have found a suitable partner who is willing and able to successfully lead Metro India into the future in this market environment.

''This in one hand will benefit both our customers and our employees, for whose loyalty and performance we are very grateful, and on the other hand, will enable METRO to focus on accelerating growth in the remaining country portfolio.'' With the acquisition of Metro India, Reliance Retail will continue to build reach across the country to serve the entire spectrum of Indian society i.e. households, kiranas and merchants, HoReCa (hotels, restaurants, and catering) and small and medium enterprises and institutions, and be the partner of choice, the statement said.

This will also enable win-win opportunities for producers, brand companies and global suppliers, it added.

Reliance Retail is ranked 56th amongst the top global retailers with USD 18 billion in revenues. It is the world's second-fastest-growing retail company behind only South Korea's Coupang.

The Indian retail is a Rs 60 lakh crore market with food and grocery constituting 60 per cent of it. Organised retail is expected to be 12 per cent of the entire retail segment.

Reliance already has a 20 per cent market share in the organised food and grocery business, with a store count that is nearly triple of its nearest competitor 'More' in the segment.

This month, it made a foray into FMCG space with the launch of brand 'Independence' for staples, processed foods, beverages and other daily essentials, rivalling likes of ITC, Tata Consumer Products Ltd, Patanjali and Adani Wilmar.

The B2B segment is considered to be a low-margin business and multinationals such as Carrefour have exited from the country.

E-commerce major Flipkart Group has acquired a 100 per cent stake in Walmart India Pvt Ltd, which operates the Best Price cash-and-carry business.

Retailers including Siam Makro which operates Lots Wholesale cash and carry trading business, under brand name LOTS Wholesale Solutions was also in the race to acquire Metro Cash & Carry business.

In August 2020, Reliance announced a Rs 24,713-crore deal to acquire the retail business of the Kishore Biyani-led Future group. As per the deal, it was to acquire 19 Future group companies operating in the retail, wholesale, logistics and warehousing segments.

The deal was called off by Reliance Industries in April this year after it failed to get lenders' support.

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

Ottawa (PTI): Three Indian nationals have been arrested by Canadian police on an anti-extortion patrol and charged after bullets were fired at a home.

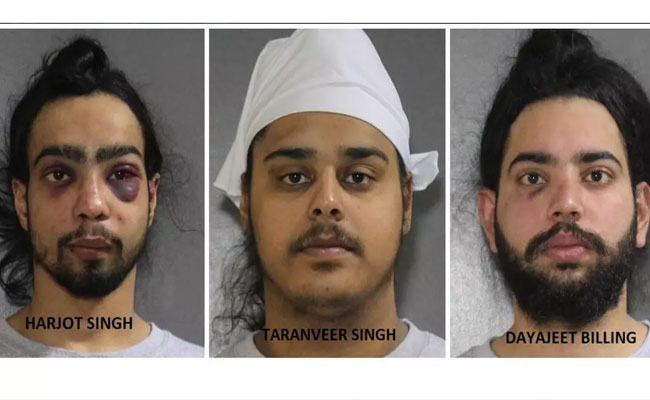

Harjot Singh (21), Taranveer Singh (19) and Dayajeet Singh Billing (21) face one count each of discharging a firearm, and all have been remanded in custody until Thursday, the Surrey Police Service (SPS) said in a statement on Monday.

The suspects were arrested by patrol officers after an early morning report of shots fired and a small fire outside a home in Surrey's Crescent Beach neighbourhood, the LakelandToday reported.

On February 1, 2026, the SPS members were patrolling in Surrey’s Crescent Beach neighbourhood when reports came in of shots being fired and a small fire outside a residence near Crescent Road and 132 Street.

The three accused were arrested by SPS officers a short time later, the statement said.

SPS’s Major Crime Section took over the investigation, and the three men have now been charged with Criminal Code offences, it said.

All three have been charged with one count each of discharging a firearm into a place contrary to section 244.2(1)(a) of the Criminal Code.

The investigation is ongoing, and additional charges may be forthcoming. All three have been remanded in custody until February 5, 2026.

The SPS has confirmed they are all foreign nationals and has engaged the Canada Border Services Agency, it said.

One of the suspects suffered injuries, including two black eyes, the media report said.

Surrey police Staff Sgt. Lindsey Houghton said on Monday that the suspect had refused to comply with instructions to get out of the ride-share vehicle and started to "actively resist."

"As we were trained, he was taken to the ground and safely handcuffed," said Houghton.

A second suspect with a black eye was also injured in the arrest after refusing to comply, Houghton said.

The arresting officers were part of Project Assurance, an initiative that patrols neighbourhoods that have been targeted by extortion violence.

Houghton said the Canada Border Services Agency (CBSA) is also involved because the men are foreign nationals, and the trio may face additional charges.

It's not clear if the men are in the country on tourist visas, a study permit, or a work permit, but Houghton said CBSA has started its own investigation into the men's status.

Surrey has seen a number of shootings at homes and businesses over the last several months, but there's been an escalation since the new year.