New Delhi, May 25: The tremor in his voice is evident as Godwin Jose begins to recount the horror of police firing in the protest rally against Sterlite on May 22. The 23-year-old from Sorispuram in Thoothukudi was among the tens of thousands of people who had gathered to take out the rally which ended with bloody violence leaving at 11 dead and several injured.

“The police opened fire when we tried to enter the Collectorate. So, we stepped away and sat somewhere outside. That was when there was a lathicharge too. Fearing lathicharge, we entered the Collectorate again, and there was shooting again,” Godwin says.

Godwin has no shred of doubt that the firing was pre-planned. “It looked as if the police were singling out those who were vocal, those who led the protests, and shot them above the abdomen,” he says.

“There was of course indiscriminate shooting, too, and many of us were hurt in the legs. But there were several rounds of fire, and we could see they were picking the targets at times. Thamizharasan, for example, was very active in the protest for quite some time. He has been shot dead. When you target the organisers and kill them, it is evident you want to kill the protest,” Godwin says.

Henry Tiphagne, executive director of People’s Watch, couldn’t agree more. “It was certainly planned and intended at quelling the protests,” he says.

On May 20, the district administration had called for a peace committee meeting in which over 20 organisations including traders’ associations and fishermen associations had participated. At this meeting, warnings were given against participating in the rally.

“We were advised against the protest rally in the meeting. The administration warned us against taking out a rally, since there were chances that it could turn violent. All of us agreed to hold a call-attention protest on a playground that was earmarked for us, and signed an agreement to that effect,” says S Raja of Tamil Nadu Vanigar Sangam (Traders Association). But the agreement did not go down well with many other protestors.

Henry says that people were also kept in the dark about the peace meeting and imposition of section 144. “Many villagers were in fact not informed of this agreement,” Henry says.

“Even when the collector issued Section 144 the previous day, it was not done the way it has to be. Normally when 144 is issued, there is a mike announcement made in the area. But in this case, there were no announcements. The people were still thinking the protest march was on,” Henry points out, “When the peace committee was a sham and there were no announcements, then how can the administration expect us to believe this was not planned?”

He adds that it is an abject failure on the part of central and state intelligence. “If the administration was really serious about finding a solution, they should have invited everyone who had a stake in the protest to the peace committee meeting. The Collector called only those he thought were protesters. The administration might have its own differences with an organisation like Makkal Adhikaram, but it is not fair that they were kept out of the peace committee meeting,” Henry explains.

Godwin says the administration’s advice to hold a call-attention protest was itself a strategy to dilute the protest. “We have been protesting for 100 days. We still couldn’t attract the attention of the administration or the government. How could the government have paid any attention on the 100th day alone?” he asks. Godwin also says the cops tracked down many protesters and had them arrested throughout the day.

This is not the first time that the TN police have attempted to put down a protest using force. In September 2012, a year after protests erupted against the Kudankulam nuclear power plant, the police opened fire against the protesters, killing one fisherman in the process. The week-long protests for jallikattu at Chennai’s Marina Beach in January 2017 culminated in violence, after a clash between the police and protesters.

“Every time the police decide to use force to put down a protest, they begin to say that protesters resorted to violence. From Kudankulam to Marina and Sterlite, the protests have always remained peaceful till the police reach the scene. So, who is to blame?” asks G Sundarrajan of Poovulagin Nanbargal.

Henry Tiphagne says the police had intended the protest to end the way the jallikattu protests did. “Their idea was to kill the protests. They have used brute force for that. The administration should realise a permanent solution will only be to shut Sterlite down,” he says.

courtesy : thenewsminute.com

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

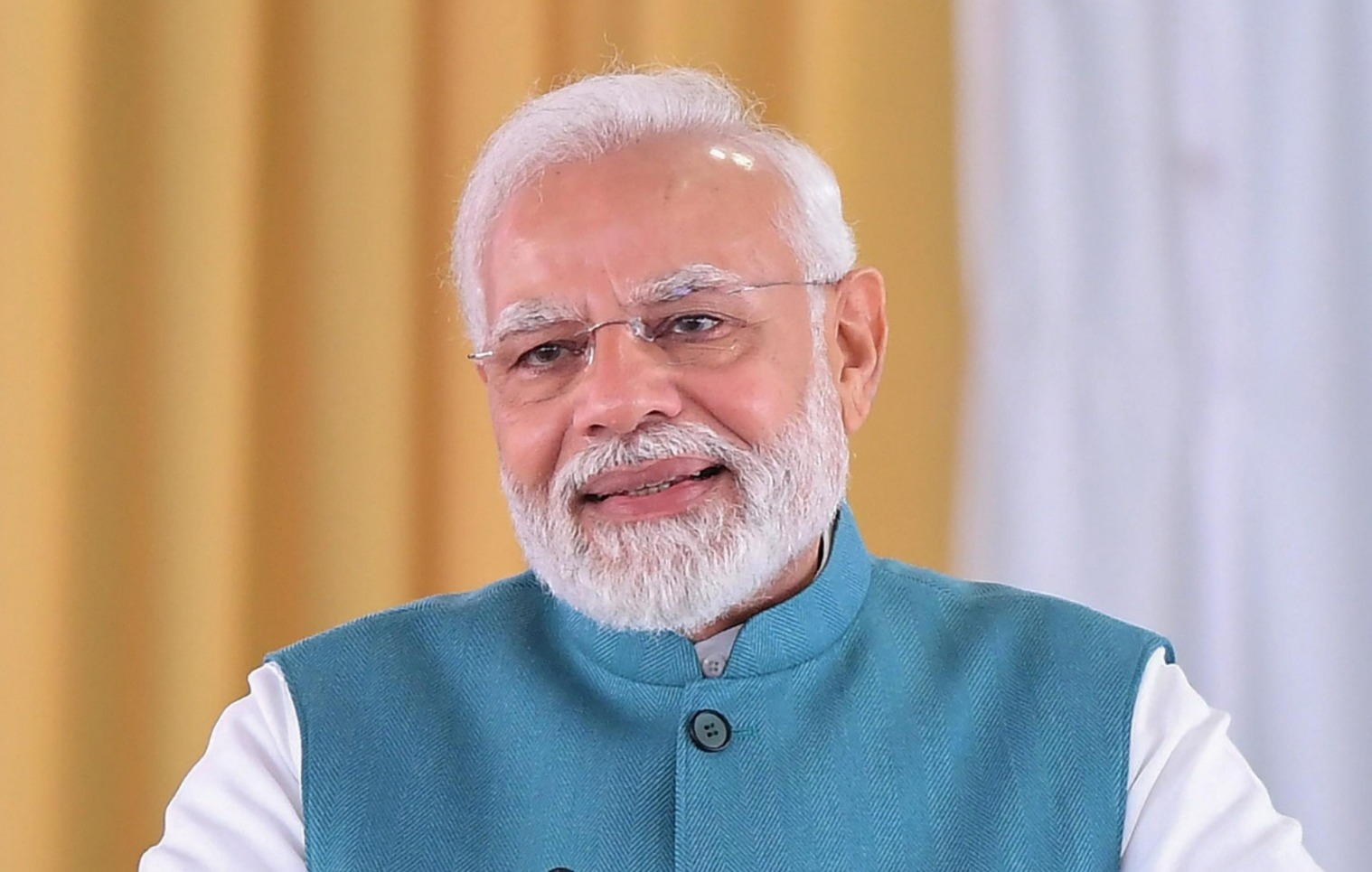

New Delhi (PTI): Prime Minister Narendra Modi will address the nation at around 8 PM tonight, his first since the start of Operation Sindoor, officials said.

The address comes two days after India and Pakistan reached an understanding to stop all firings and military actions on land, air and sea with immediate effect.

The understanding was reached after four days of cross-border strikes that triggered fears of a wider conflict.

Operation Sindoor was launched by India on the intervening night of May 6 and 7 to avenge the killings of 26 people in the Pahalgam terror attack. Indian armed forces targeted nine terror sites in Pakistan and Pakistan-occupied Kashmir, killing over 100 terrorists.

Pakistan then attempted to attack several Indian military bases on May 8, 9 and 10.

The Indian armed forces launched a fierce counter-attack on several Pakistani military installations, including Rafiqui, Murid, Chaklala, Rahim Yar Khan, Sukkur and Chunian.

Radar sites at Pasrur and Sialkot aviation base were also targeted using precision munitions, causing massive damage

Director General of Military Operations (DGMO) Lt Gen Rajiv Ghai has said 35-40 Pakistani military personnel have been killed in the combat and New Delhi achieved its desired objectives.

Ghai is scheduled to speak with his Pakistani counterpart this evening, the second time since Saturday.