New Delhi, May 24: Taking a cue from the fitness challenge gone viral on Twitter, Congress President Rahul Gandhi on Thursday dared Prime Minister Narendra Modi to bring down petrol and diesel prices or face country-wide agitation.

"Dear PM, Glad to see you accept the @imVkohli fitness challenge. Here's one from me: Reduce fuel prices or the Congress will do a nationwide agitation and force you to do so.

"I look forward to your response," Gandhi tweeted with the hashtag #FuelChallenge, a fitness campaign where people post their exercise regime on social media and challenge others to do the same.

Petrol prices in Mumbai breached the Rs 85 a litre mark on Thursday and was sold at Rs 85.29 per litre. The price of the fuel is already at an all-time high in Mumbai along with Delhi and Chennai and is now creating new benchmarks daily.

Diesel prices too have reached unprecedented levels and set new records across the country. In Delhi, Kolkata, Mumbai and Chennai, it was sold at Rs 68.53, Rs 71.08, Rs 72.96 and Rs 72.35 per litre respectively.

Dear PM,

— Rahul Gandhi (@RahulGandhi) May 24, 2018

Glad to see you accept the @imVkohli fitness challenge. Here’s one from me:

Reduce Fuel prices or the Congress will do a nationwide agitation and force you to do so.

I look forward to your response.#FuelChallenge

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

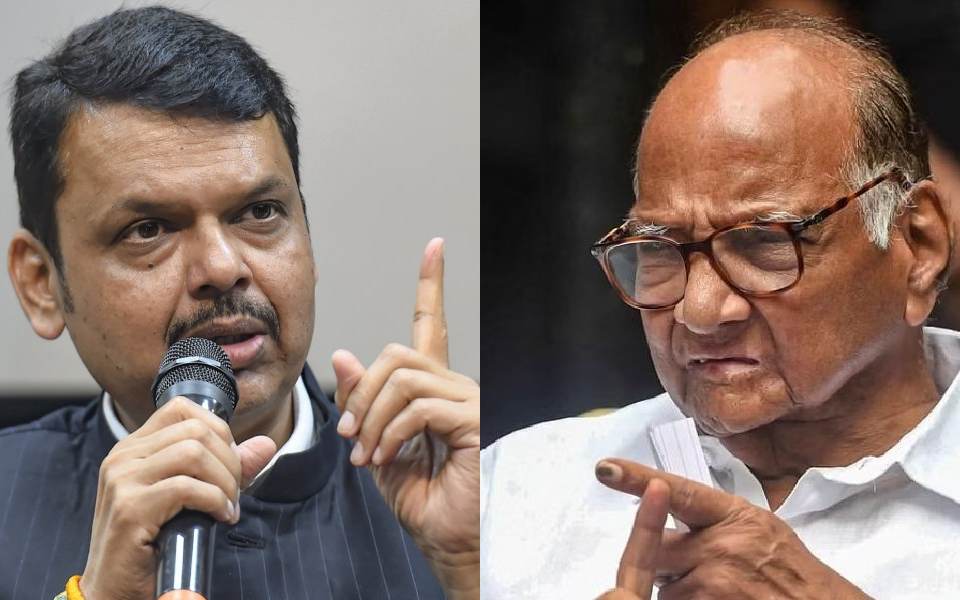

Nagpur, Jan 10: Maharashtra Chief Minister Devendra Fadnavis on Friday said NCP (SP) chief Sharad Pawar praised the RSS after realising how the outfit managed to overcome the fake narrative spread by the opposition in the 2024 Lok Sabha polls.

The opposition had claimed BJP wanted to win 400 seats to change the Constitution and end reservations, a narrative which BJP leaders later claimed hit the party hard.

On Pawar praising the RSS recently, the CM said the MVA was successful in creating a fake narrative during the 2024 Lok Sabha polls.

"When assembly polls were approaching, many people from diverse fields who are inspired by the RSS played their role and burst the balloon of this fake narrative. Sharad Pawar saheb is very intelligent. He would have certainly studied this aspect. He realised that this (RSS) is not a regular political power but a nationalist power. In any competition it is good to praise others," he added.

That is why Pawar may have praised the RSS, Fadnavis said.

Speaking at an interaction with senior editor Vivek Ghalsasi at Late Vilasji Fadnis Jivhala programme here, Fadnavis also said he had asked for organisational work when Eknath Shinde was made chief minister in June 2022, but senior leaders asked him to join the government.

He also said Prime Minister Narendra Modi asked him not to behave like an extra-constitutional authority in the government.

He said the decision to become deputy chief minister on the command of the party leadership earned him a lot of praise from the cadre.

After the massive mandate the ruling alliance received in the 2024 assembly polls, Fadnavis said people and party workers would not have been happy if the CM was not from the BJP.

Shinde himself agreed within minutes that the CM must be from the BJP, which itself got 132 seats and was close to a majority of its own in the 288-member assembly, he added.

On Shiv Sena (UBT) chief Uddhav Thackeray meeting him during the winter sessions of the legislature in Nagpur, Fadnavis said he had announced he would not indulge in politics of revenge after becoming CM and all leaders responded positively to it.

On chances of the NCP (SP) and NCP coming closer or reuniting, Fadnavis said, "If you see the developments that took place from 2019 to 2024, I realised never say never and anything can happen. Uddhav Thackeray goes to some other party and Ajit Pawar comes to us. In politics anything can happen though I am not saying this should happen."

He praised BJP leader Arun Gujarati from whom he learnt patience, which he claimed was an important quality in politics along with the ability to take criticism.

In a lighter vein, he said, "I only get angry when I am hungry. If you see me angry then give me something to eat and my anger will go away."