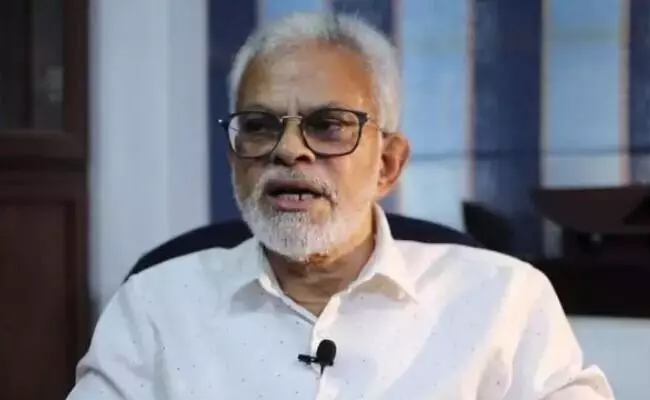

New Delhi, May 19 : Supreme Court judge Justice Jasti Chelameswar, who retired on Friday, has said that he stood up for certain "issues and values" wherever he perceived things were going wrong and had nothing personal against anyone in the system.

"I stood up for certain issues and values. Wherever I perceived that things were going wrong, I stood up, I raised questions... If something is good, it is to be preserved. If something is doubtful, it is to be checked and rectified, I had nothing personal against anyone in the system," Justice Chelameswar said in a farewell event on Friday.

He also said the younger generation of lawyers has supported him in "democratising the institution", but acknowledged constitutional lawyers and jurists attacked him from every side.

"What is the law or the scripture which says judges cannot hold press conferences? They shouldn't hold a press conference to defend their judgments, I knew that when I opened my mouth I would have to go through all this and I was willing to take it...," he added.

Justice Chelameswar had turned down the Supreme Court Bar Association (SCBA)'s request to participate in a farewell function it wanted to arrange for him, saying he wanted his retirement to be a "private affair". However, later in the evening on Friday, he attended a reception organised by Lawyers Collective.

On his last working day on Friday, he shared a bench with Chief Justice Dipak Misra, a custom and practice of the Supreme Court.

The 65-year-old judge has been at loggerheads with Justice Misra over the functioning of the apex court including the allocation of sensitive cases and on recommendation of judges for appointment to higher judiciary.

He was at the forefront of the unprecedented press conference on January 12 saying "all was not well" on the administrative side of the court.

At the gathering of Lawyer Collective, an advocacy NGO founded by activist senior lawyers Indira Jaising and Anand Grover, on Friday, Justice Chelameswar said in the last six months, wherever he went in the country, people have come up to him and said: "We are glad you did it".

He said he was willing to face the consequences of his actions, whether it be his abstention from collegium meetings after the NJAC judgment or the press conference he held.

He told the younger generation present at the gathering that they required to have courage and determination to fight the system if they want to bring a good change.

"But if you are convinced on principle that the fight is to be carried on for good change, please go ahead. If you have an opinion, speak up," he added.

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

Mangaluru: Air India Express will introduce a late-night daily flight service on the Bengaluru–Mangaluru–Bengaluru sector starting March 10, 2026.

According to the sources, flight IX 5971 will depart from Bengaluru at 9.25 pm and arrive in Mangaluru at 10.40 pm. The return flight, IX 5972, will depart from Mangaluru at 11.10 pm and reach Kempegowda International Airport, Bengaluru, at 12.20 am.

The additional service will operate daily and will remain in effect until March 28, 2026.

Meanwhile, Air India Express has cancelled all its scheduled international flights from Mangaluru International Airport (IXE) on March 7 due to the ongoing crisis in the Middle East.

The Bengaluru–Mangaluru sector already has multiple daily services. Apart from Air India Express, IndiGo also operates flights on this route.