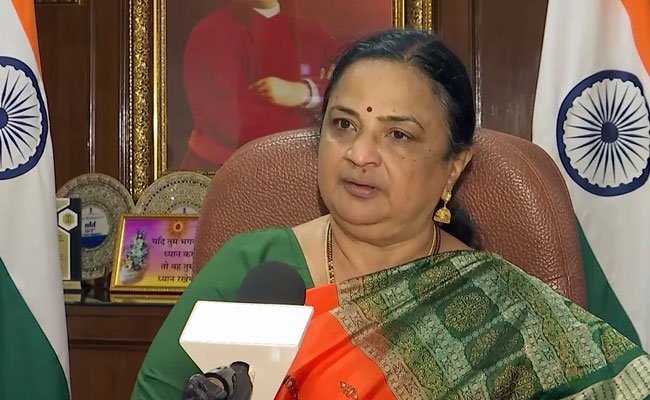

Mumbai (PTI): Jawaharlal Nehru University (JNU) Vice-Chancellor Santishree Dhulipudi Pandit on Sunday wondered whether the Supreme Court would treat "us" equally the way it did to grant relief to activist Teesta Setalvad on a Saturday night.

The JNU VC was referring to the SC granting interim protection on July 1 to Setalvad from arrest in connection with a case of alleged fabrication of evidence to frame innocent people in 2002 post-Godhra riot cases.

"The Leftist ecosystem still exists. You know, the Chief Justice of the Supreme Court opened the court on a Saturday night to give Teesta Setalvad bail. Will it happen for us," she asked while speaking at the launch of Marathi book Jagala Pokharnari Davi Walvi' (World-weakening Leftist Termites) in Pune.

Pandit had served as a professor in the Political Science department at the Savitribai Phule Pune University in Maharashtra.

"To retain political power, you need (to have) narrative power. We need to have it. Unless we attain it, we will be like a directionless ship," she said.

She recalled her childhood association with RSS-affiliated organisations. She said, "I was a Bal Sevika' in my childhood. I got my sanskars (values) from the RSS only. I am proud to say that I belong to the Sangh (RSS) and I am proud to say that I am a Hindu. I do not hesitate at all."

"Garv se kehti hu main Hindu hoon," she repeated, with the audience shouting Jai Shri Ram'.

"Left and RSS are individual ideologies. There has been a major paradigm shift post-2014 in the conflict between these two ideologies," she said.

Pandit, who was appointed as the JNU VC in February last year, said some people opposed her decision to put the national flag and Prime Minister Narendra Modi's photo on the varsity premises.

Pandit said she told them that they were enjoying free meals on the campus with taxpayers' money and they should bow before the national flag and PM Modi's photo.

"Until I went to JNU, there was no photo of PM Modi, the President of India or the national flag. Many people told me not to bring (them) on the campus. I told them you enjoy free meals here with taxpayers' money, bow before them."

She said, "He is the prime minister of the country. He does not belong to any party. More than a year has passed and nobody has protested against it," she said.

Referring to the upcoming Nalanda University in Bihar, she said, "I recently visited the Nalanda University at Bakhtiyarpur. We should change that Bakhtiyarpur name. What kind of name is that."

On the country's ancient civilisation, she said, "Our Bharatiya civilisation is superior, feminist and greatest in the world. Draupadi is the first feminist and not one Simone De Beauvoir (French philosopher). Our civilisation is nature-centric."

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

Belagavi: Speaker U.T. Khader on Friday warned that members who disrupt Assembly proceedings by talking in their seats during debates will be made to sit in the House for an entire day as a disciplinary measure.

The warning came after the Question Hour, when Deputy Leader of the Opposition Arvind Bellad was permitted to initiate a discussion on the development of North Karnataka.

At this point, expelled BJP MLA Basanagouda Patil Yatnal objected, stating that he had been seeking a debate for the past three days but had not been given an opportunity.

ALSO READ: IndiGo board ropes in external aviation expert for flight disruption probe

Responding to the objection, Speaker Khader said Bellad had already been granted permission and assured Yatnal that he would be allowed to speak at the next opportunity. He noted that even as a serious discussion was underway, several MLAs were speaking among themselves with their microphones on, disrupting the proceedings.

Expressing displeasure over the conduct of members, Khader likened the situation to football, where players receive red, yellow, or white cards for violations. Similarly, he said, the Assembly issues warning cards to members who disturb the House. If they fail to correct themselves despite repeated warnings, they would be required to remain seated in the Assembly hall for a full day as punishment, he stated.