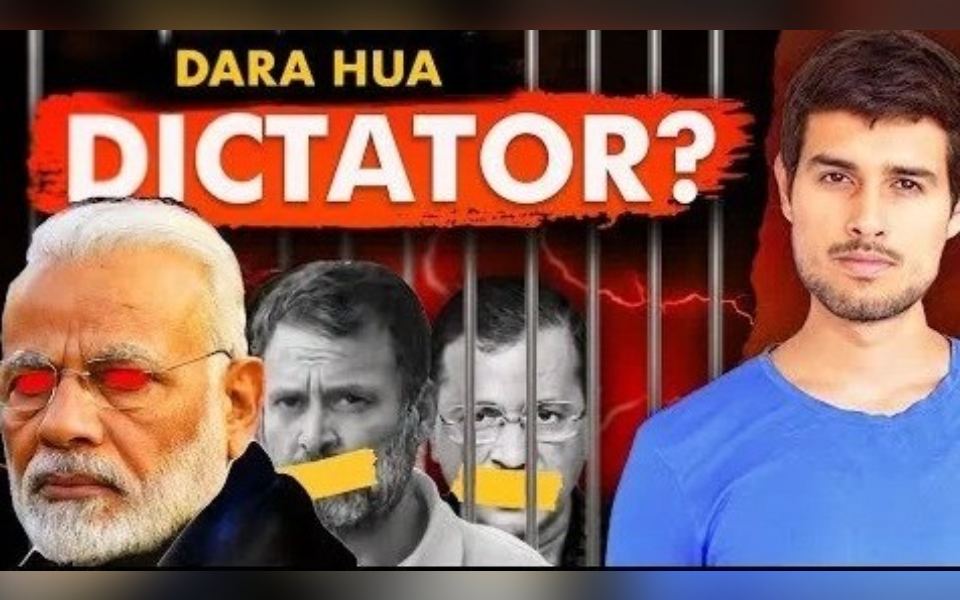

New Delhi: Renowned Indian YouTuber Dhruv Rathee has released a follow-up to his popular video titled 'Is India becoming a DICTATORSHIP?', following the recent arrest of Delhi Chief Minister Arvind Kejriwal. Similar to its predecessor, the second installment of the video series has rapidly gained traction, amassing over five million views since its release.

In his latest video, Rathee spoke about Kejriwal's arrest, alleging that it is part of a broader effort to stifle dissenting voices within the country's political opposition.

The video also touches upon the government's decision to freeze the bank account of the Indian National Congress and Kejriwal's arrest by the Enforcement Directorate, purportedly without sufficient evidence of financial wrongdoing or a prior conviction. Rathee's bold commentary has garnered praise from many netizens.

In his video, Rathee urges viewers to raise their voices against perceived injustices, emphasizing the importance of voting and encouraging others to do the same.

Rathee shared the video on his social media platforms, sparking a range of reactions from users. While some commended Rathee for providing fact-based analysis on significant issues, others criticized him for allegedly spreading false information, especially with the approaching 2024 Lok Sabha elections.

One user, Harsh Tiwari, expressed curiosity about Rathee's significance to the political Right Wing, acknowledging the factual nature of Rathee's content. Tiwari's sentiments were echoed by others who lauded Rathee's courage in addressing contentious topics.

Conversely, Mona Shandilya mocked Rathee's portrayal of Kejriwal as a threat, citing Kejriwal's limited electoral success in recent Lok Sabha elections.

Meanwhile, another user, Darshan Pathak, humorously remarked on Rathee's frequent declaration of the importance of his videos, suggesting a tendency toward sensationalism.

In response to Rathee's video, YouTuber Ankit Kumar Avasthi released a counter-video discussing the concept of dictatorship.

Dhruv Rathee, recognized for his incisive commentary on political and social issues, gained further prominence in 2023 when he was featured in TIME Magazine's list of Next Generation Leaders. As of March, Rathee boasts a substantial subscriber base of approximately 21.56 million across all his channels.

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

Belthangady: Labourers have begun digging operations near the Netravati bathing ghat in Dharmasthala at a riverside location identified by the key witness in the ongoing investigation.

Despite heavy rainfall hampering the operation, workers have commenced excavation at the first spot marked by the complainant. The SIT has prioritised this location as part of its search for possible buried remains.

The development has drawn large crowds, with hundreds of curious onlookers gathering near the Netravati ghat to witness the activity. Once excavation at the initial site is complete, the team is expected to move on to the next identified location.

Officials have indicated that the search team is likely to exit the forest area only during the midday meal break.