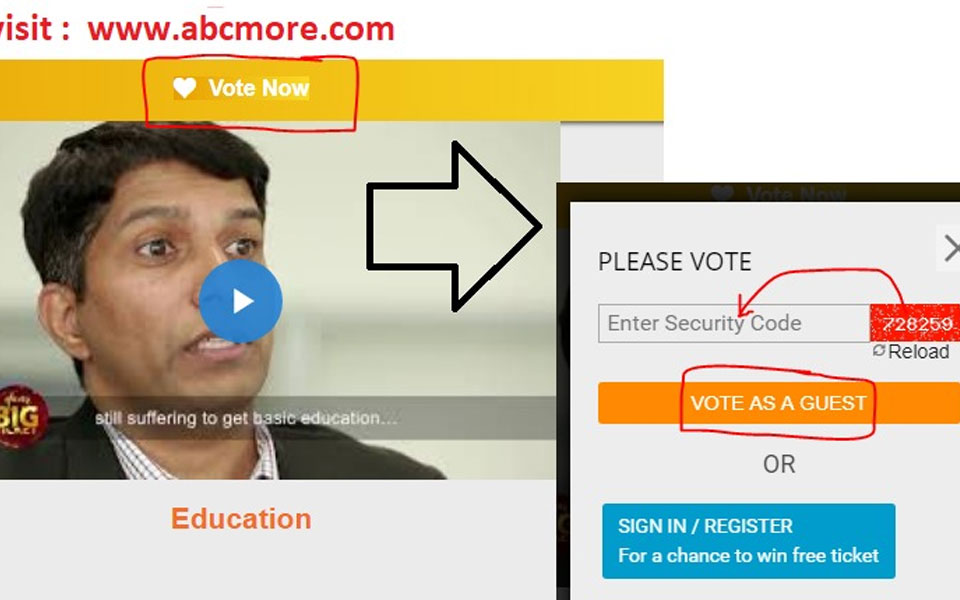

All we have to do is just five seconds work. Just take your mobile phones and open www.abcmore.com or www.dearbigticket.ae website.

Click the vote now button that has the name of Muhammed Hanif from Puttur. Type the six digit security code that appears before you. Click VOTE AS A GUEST option. And now we are done. But to do this we have only five-six days time. Hence, vote as soons as you get this message and help an Indian to realise his dream.

Do not forget that by just voting from your mobile phone and spending your five seconds will provide poor children with modern computer education.

What and Why?

Muhammed Hanif, son of Abbas Haji, a daily wage worker from Balleri in Aryapu village in Puttur taluk of Dakshina Kannada district is currently working as a software engineer at Muhammed Bin Rashid space centre lab of Dubai university.

Hanif is striving hard for the prosperity of the people of his village and is quietly serving the poor people. He is also the director of UAE zone of Mangaluru M Friends.

Hanif was born and brought up in a poor family. His father was daily wage worker. Due to his hard work Hanif managed to complete engineering in electronics and communication from Malnad engineering college.

What is Big Ticket?

‘Dear Big Ticket’ competition is being organised at Abu Dhabi international airport in association with duty free, Asia net. Earlier Big Ticker used to give away million dirham cash prize and international brand car as prize. But this time Big Ticket has invited the people with special offers.

The organisers have sought answer for one Big question: What a person will do if he wins 10 million dirham (Rs.20 crores)? More than 20,000 people have applied for the competition and Big ticket has already selected the top 20 contestants. Muhammed Hanif from Puttur is one of them.

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

Srinagar (PTI): Several parts of Kashmir witnessed protests against the killing of Iran's Supreme Leader Ayatollah Ali Khamenei for the second day on Monday, with security forces using mild force to disperse protesters in a few places.

According to the officials, the protests broke out in Bemina, Gund Hassibhat, and Jehangir Chowk areas of the city here, and in Pulwama town in south Kashmir.

Scores of protesters gathered in these areas, which have a large Shia population. They marched through the streets, raising anti-US and anti-Israel slogans.

In some areas, the security forces resorted to using mild force to disperse the protesters.

Khamenei was killed in joint air strikes by the US and Israel on Iran early Saturday. Iranian state media confirmed his death on Sunday.

Iran is firing missiles at Israel and the Arab countries in retaliation.

_vb_95.jpeg)

_vb_21.jpeg)