Mangalore: The District Consumer Disputes Redressal Commission has ordered Bajaj Finance Limited to provide all necessary loan-related documents and issue a No Objection Certificate (NOC) to a complainant who alleged deficiency in service. The Commission has also directed the finance company to pay a compensation of ₹25,000 and litigation costs of ₹10,000 for failing to address the grievances of the complainant in a timely manner.

The case was filed by Mohammed Nawaz, a 30-year-old resident of Demmale Gudde House in Mallur Village, Mangalore Taluk, against Bajaj Finance Limited, represented by its Managing Director. The complainant was represented by Advocate Shwetha, while Advocate Rupesh Kumar N appeared on behalf of the finance company. Nawaz had taken a loan of ₹1,90,000 from the Moodabidre Branch of Bajaj Finance Limited on September 30, 2018, for the purchase of an auto-rickshaw under Loan Agreement No. L3WMLR06324087. As per the agreement, he was required to repay the amount in 60 monthly installments of ₹5,526 each.

Nawaz claimed that he had diligently paid his Equated Monthly Installments (EMIs), even during the COVID-19 pandemic when many borrowers struggled to meet their financial commitments. By the time he sought a loan closure certificate to remove the hypothecation of his vehicle (KA19AC6385) from the Regional Transport Office (RTO), he had already paid a total amount of ₹3,28,500.16 towards the loan and interest. However, to his shock, Bajaj Finance refused to issue the NOC, citing an outstanding balance of ₹1,22,356.76. Nawaz disputed this claim, alleging that the company was engaging in unfair trade practices by demanding an additional sum that was neither justified nor documented properly.

After repeated requests failed to yield any response from Bajaj Finance, Nawaz served a legal notice to the company on January 26, 2024, followed by a corrected notice on January 29, 2024. In his notice, he demanded a copy of the loan application and sanction letter, the hypothecation agreement along with other loan-related documents, and the NOC for the removal of hypothecation from the vehicle. Despite these notices, the company allegedly failed to respond, leading Nawaz to file a complaint under Section 35 of the Consumer Protection Act, 2019.

In response, Bajaj Finance admitted that the loan was sanctioned but argued that the complainant had defaulted on his payments. The company claimed that Nawaz had availed of a moratorium from March 2020 to August 2020 due to financial constraints during the COVID-19 pandemic. It stated that, as a result, the loan tenure was extended from the initially agreed 60 months to 77 months, with additional interest applied for the deferred payments. Bajaj Finance further alleged that the complainant had not cleared the EMIs for the moratorium period and failed to provide proof of payments made. The finance company also contended that the dispute involved complex legal interpretations and should have been addressed in a civil court rather than a consumer forum.

The Consumer Commission, after carefully analyzing the documents and hearing the arguments, found that Nawaz had provided substantial proof that he had made regular payments amounting to ₹3,28,500.16. On the other hand, Bajaj Finance failed to submit any valid evidence to justify its claim of an additional outstanding amount. The Commission ruled that the finance company was guilty of deficiency in service for refusing to issue the NOC and the requested loan-related documents despite the complainant having fulfilled his repayment obligations.

Following the proceedings, the Commission partly allowed the complaint and passed an order directing Bajaj Finance to provide all loan-related documents to the complainant and issue the NOC for the removal of hypothecation of vehicle KA19AC6385 before the RTO. Additionally, the company was instructed to pay ₹25,000 as compensation for the inconvenience caused due to its failure to provide proper service and ₹10,000 towards the legal expenses incurred by the complainant.

The Commission specified that the directives must be implemented within 30 days from the date of receipt of the order. Failure to comply with the ruling would attract further legal action under the Consumer Protection Act, 2019.

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

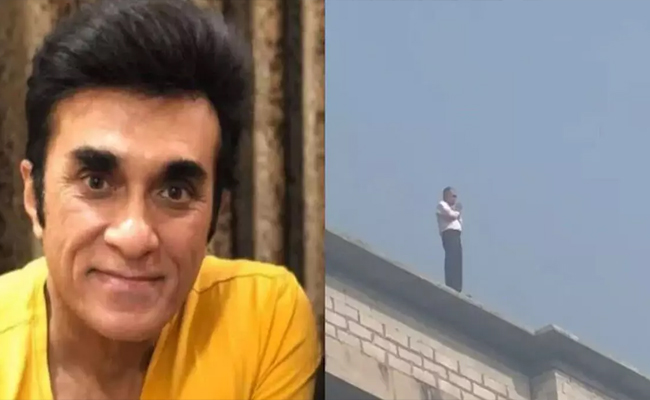

Ranchi (PTI): A Ranchi-based businessman died allegedly by suicide by jumping from the sixth floor of his apartment here, police said on Friday.

The incident took place around 10:30 pm on Thursday in Hindpiri police station area, they said.

“The deceased, Anurag Sarawgi, was heard speaking to someone over the phone in a loud tone. The door of his room was bolted from inside. He then suddenly jumped from the sixth floor of the apartment,” SP (City) Paras Rana told PTI.

No suicide note was recovered from his room, Rana said.

A thorough investigation is underway, the SP added.

(Assistance for overcoming suicidal thoughts is available on the state’s health helpline 104, Tele-MANAS 14416.)