Kundapur: Former Prime Minister and JD(S) supremo HD Devegowda and his wife Channamma who are in Udupi District for Naturopathy treatment, on Friday afternoon visited Amrateshwari Temple in Kota and took part in special puja on the occasion.

The special invitation card of grand son’s wedding was also presented during the puja.

Devegowda and his wife will stay in Kaup for treatment till May 16 and during the course are expected to visit several temples and offer puja.

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

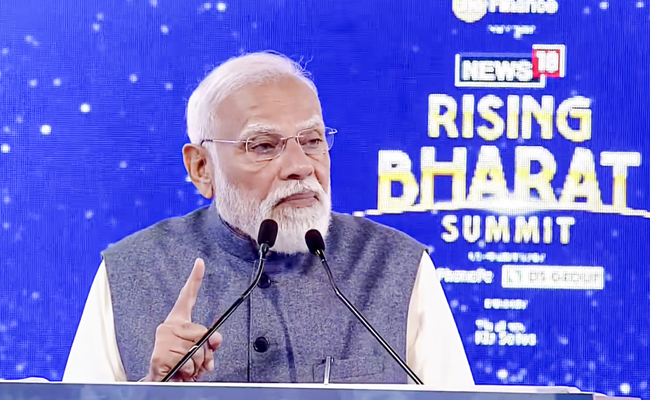

New Delhi (PTI): Prime Minister Narendra Modi on Friday came down heavily on the Congress for the shirtless protest by its youth wing members at the AI Impact Summit recently, saying the opposition party can tear as many clothes as it wants, but his government will continue to work for the country's progress.

Addressing the News18 Rising Bharat Summit, Modi also said that the Congress did not just remove its clothes in front of foreign guests but also exposed its intellectual bankruptcy, asserting that the millennials have already taught the country's oldest party a lesson, and now Gen-Z is ready to do the same.

In an apparent jibe at Congress leader Rahul Gandhi, Modi said the opposition was unhappy seeing the statue of "Babbar Shers" (lions) installed atop the new Parliament building, but their own “Babbar Shers" were running away after facing the "shoes" of the general public.

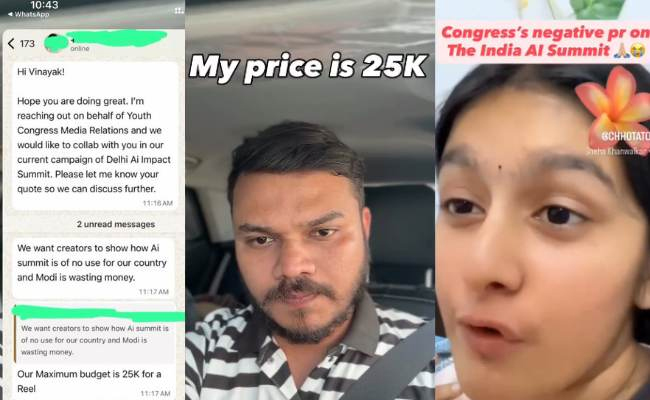

Gandhi, the Leader of Opposition in the Lok Sabha, had said on February 24 that he was proud of the "Babbar Shers" of the Indian Youth Congress, who "fearlessly" raised their voice at the AI Summit.

"Congress ke Babbar Sher logon ki jute kha ke bhaag gaye (The 'lions' of Congress ran away after being hit by shoes by the public)," Modi said.

The prime minister was apparently referring to the protesting Youth Congress workers being heckled by some people at the AI Summit.

On February 20, a group of Indian Youth Congress (IYC) workers staged a dramatic protest inside Hall No. 5 of the summit venue in Delhi by removing their shirts to reveal T-shirts printed with anti-government slogans, triggering a political slugfest between the BJP and the Congress.

“Congress can tear as many clothes as it wants, but we will continue to work for India's development. Congress not just shed clothes at the AI Summit, it also exposed its incapabilities in front of foreign guests,” Modi said in his nearly 45-minute speech.

He said the AI Summit was a moment of pride for the entire nation, but unfortunately, Congress attempted to tarnish this national celebration.

"When the frustration and despair of failure weigh on the mind, and arrogance makes one's head spin, such a mindset emerges to defame the country," he said.

The prime minister also alleged that the Congress always takes refuge in Mahatma Gandhi to hide its failures, but tries to give credit to one family for anything good.

"People of our country welcomed every good step taken by our government, but the Congress only knows how to oppose everything. The votes of Congress are not stolen; rather, people do not consider Congress worthy of their votes. Millennials first taught a lesson to Congress, now Gen-Z is ready to do the same," he said.

Modi also said that in a democracy, the role of the opposition is not just about blindly opposing every move of the government, but presenting an alternative vision, and that is why the "enlightened public" of the country is "teaching a lesson" to Congress now.

In 1984, the Congress got 39 per cent of the votes and more than 400 seats. But its votes declined consistently in the subsequent elections, Modi said.

"Today, the condition of the Congress is such that it has more than 50 MLAs in just four states. Over the past 40 years, the number of young voters in the country has increased, but the Congress has clearly diminished," Modi said.

On the recent trade deals that India signed with foreign countries, Modi said the country has discovered its inherent strength and strengthened its institutions, which prompted developed nations to come forward and sign deals with India.

He also said that even after Independence, some people ensured that the colonial mindset remained for their own benefits.

"No country would have done trade deals with us had we not discovered our inherent strength and strengthened our institutions. Because of this, developed nations have come forward to sign trade deals (with India)," he said.

Modi also said that even after Independence, India was unable to break free from the mentality of slavery, for which the country is still paying the price.

"The latest example of this can be seen in the ongoing discussions on trade deals. Some people are shocked – ‘what has happened, how did this happen? Why are developed countries so eager to do trade deals with India?’ The answer is – a confident India is emerging from despair and frustration," he said.

Over the long span of history, centuries of slavery had instilled a feeling of inferiority, while the ideology imported from other countries deeply ingrained in society the notion that Indians were uneducated and subservient, the prime minister said.

"If the country was still mired in the despair of the pre-2014 era, counted among the 'Fragile Five', and gripped by policy paralysis, who would strike a trade deal with us?

"Over the past 11 years, a new surge of energy has flowed into the nation's consciousness. India is now striving to reclaim its lost potential," Modi said.

The prime minister also said that due to the recent series of reforms initiated by his government, the world's most powerful nations are now coming forward to sign trade deals with India.

"There was a time when India was only a consumer of new technology. But now we are not just developing them, but also setting standards," he said.

The prime minister also said that India's digital public infrastructure has become a subject of global discussion today, and every move India makes is closely watched and analysed across the world.

"The AI Summit was a clear example of this," he said.

The government's 'Viksit Bharat by 2047' is not a political slogan but an effort to correct the mistakes of the previous Congress governments by making India self-reliant, he said.

“So far, in every industrial revolution, India and the Global South largely remained followers, but in this age of artificial intelligence (AI), India is not only participating but is also shaping it. India now has its own AI startup ecosystem,” Modi said.

He also said the world is astonished that India, where around 30 million families lived in darkness until 2014, has now risen to become one of the top countries in solar power capacity.

India, where many cities had no hope of improving their public transport system, has now become the country with the world's third-largest Metro network, Modi said.

“The Indian Railways was known only for chronic delays and sluggish speeds, yet semi-high-speed connectivity like Vande Bharat and Namo Bharat has now become possible,” he said.

Nation-building never happens through short-term thinking; it is shaped by a long-term vision, patience and timely decisions, the prime minister added.