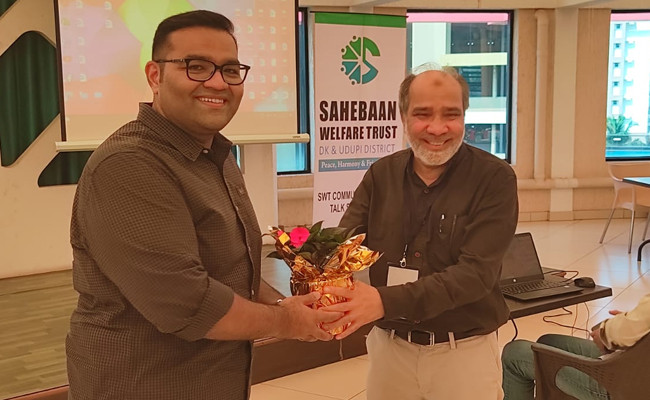

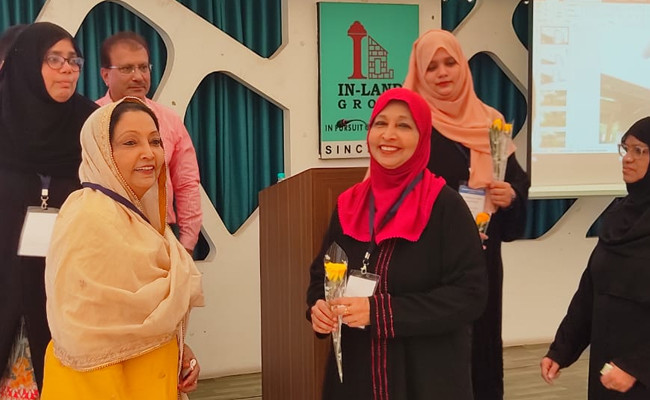

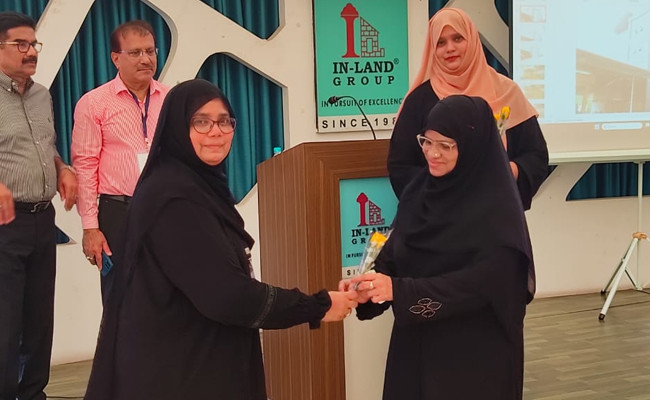

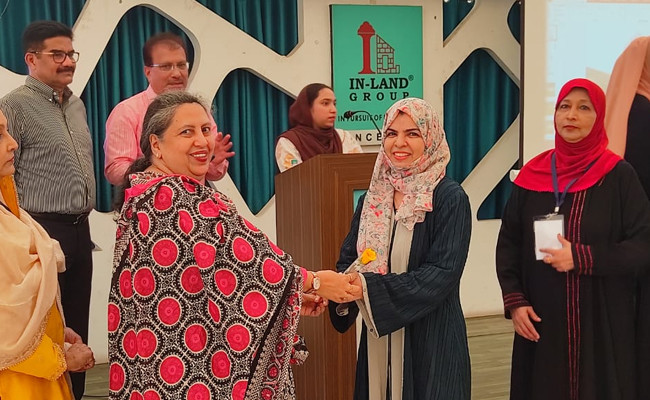

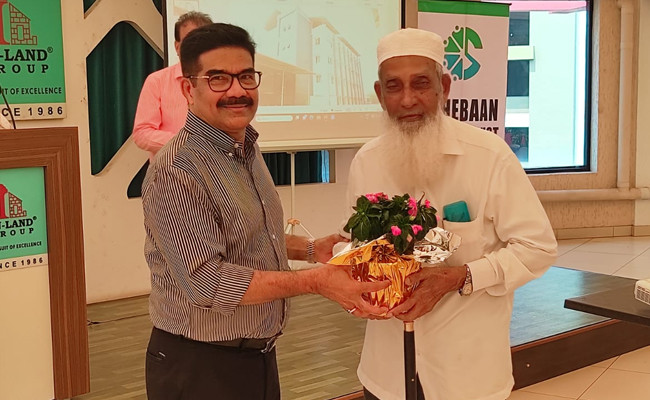

Mangaluru: The ladies' wing of Sahebaan Welfare Trust (SWT) hosted the inaugural session of the 'Community Welfare Talks Series 2024' at Senate Hall, Inland Ornate Complex, in the city on January 21, with Siraj Ahmed, Managing Director, Inland Infrastructure Pvt Ltd, inaugurating the event.

Ahmed, in his inaugural address, lauded the efforts of SWT at initiating the talk series for the benefit of the community members as well as the society at large.

Meraj Yousef, Executive Director, Inland Buiders, who spoke on the occasion, pledged his support towards community welfare activities of SWT.

Educationist and Motivational Speaker Obeida Shoukath, who was one of the speakers of the day, spoke on the challenges faced by students on campus and the remedial measures while the second speaker Dr. Mohammed Noorulla, Senior Unani Consultant at the District Wenlock Hospital, Mangaluru, explained on the occasion the history and benefits of AYUSH, the Indian Alternative Medicine system, and the services available at the Ayush Hospital in the city.

Syed Siraj Ahmed, Secretary of SWT, welcomed the gathering on behalf of the President, Afroze Assadi Saheb. The program was ably compered by Zaiba Khatib.

The Qirat was read by Fariha Fathima and Ayesha Shahnaz.

The event was conducted by the Ladies' Youth Wing of the SWT under the leadership of Amreen Khatib, who was ably assisted by Aliya Imtiaz and Rifaa Sheikh, with the support extended by Ayaan Sheikh and Luqman Tonse. Umme Kulsum proposed the Vote of Thanks.

Senior Sahebaan Community members and SWT trustees Althaf Khatib, Rafik Assadi and Imtiaz Khatib were present on the occasion.

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

Bengaluru: JD(S) supremo and former Prime Minister H.D. Deve Gowda has indicated that the party is open to an understanding with the NDA in the upcoming local body, taluk and zilla panchayat elections.

Speaking to reporters at J.P. Bhavan on Wednesday, he said the JD(S) is a regional party, while the BJP is a national party. “We have to wait and see what decision they take regarding a pre-poll alliance. As far as local body elections are concerned, we will discuss the matter together before taking a decision,” he said.

Responding to Chief Minister Siddaramaiah’s allegation that the JD(S) does not give positions to anyone outside the family, Deve Gowda said the charge has no substance. “My memory is still strong. I will respond to everything at the appropriate time,” he remarked.

He also said that a JD(S) convention will be held in Vijayapura on February 27 and that he has been invited to participate in the event.