Bengaluru: Demonstrators from the Bhim Army staged a protest outside the Halasur Gate Police Station near Town Hall on Thursday, expressing their dissatisfaction over the perceived delay in the arrest of popular Kannada film actor Upendra. The actor is accused of making derogatory statements against Dalit communities during an interaction with his fans on Facebook.

The protestors also issued a threat to besiege the residence of Karnataka's Home Minister, Dr. G Parameshwara, if action is not taken against Upendra.

Speaking to the gathering, Bhim Army leader Rajashekhar highlighted the concern that Upendra had not been taken into custody more than 48 hours following the registration of the case against him. Rajashekhar drew attention to the standard practice of arresting an individual within 24 hours after an FIR is filed. However, he criticized the police's purported hesitation to act, asserting that they had not received instructions from their superiors to apprehend Upendra.

Rajashekhar further expressed his condemnation of the perceived favoritism shown towards Upendra due to his popularity, describing this delay in arrest as a manifestation of injustice towards the general populace. In a stern warning, he announced that if immediate action was not taken to arrest Upendra, members representing various Dalit organizations would initiate a siege at the residence of Home Minister Dr. G Parameshwara.

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

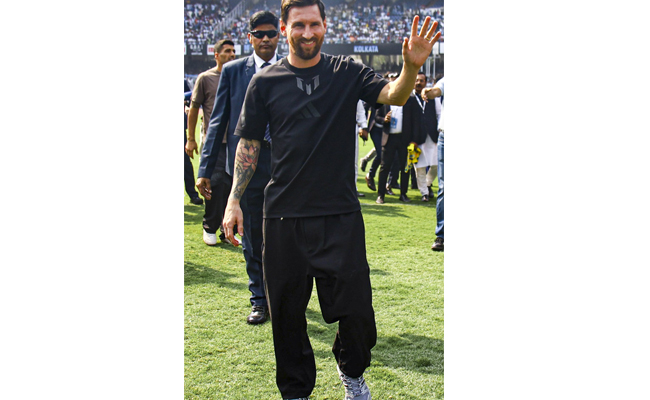

Mumbai (PTI): In view of Argentine superstar footballer Lionel Messi's visit to Mumbai on Sunday, the city police are implementing stringent security measures, like not allowing water bottles, metals, coins inside the stadiums and setting up watchtowers to keep an eye on the crowd, officials said.

The police also said taking extra care to avoid any stampede-like situation and to prevent recurrence of the chaotic situation that unfolded in Kolkata during Messi's visit on Saturday as thousands of fans protested inside the Salt Lake stadium here after failing to catch a clear glimpse of the football icon despite paying hefty sums for tickets.

Messi is expected to be present at the Cricket Club of India (Brabourne Stadium) in Mumbai on Sunday for a Padel GOAT Cup event followed by attending a celebrity football match. He is expected to proceed to the Wankhede Stadium for the GOAT India Tour main event around 5 pm.

"In view of Lionel Messi's visit to Mumbai, the police are geared up and have put in place a high level of security arrangements in and around the stadiums located in south Mumbai. Considering the chaos that prevailed in Kolkata and the security breach, we have deployed World Cup-level security arrangements at Brabourne and Wankhede stadiums," an official said.

Expecting heavy crowd near the stadiums during Messi's visit, the city police force has deployed more than 2,000 of its personnel near and around both the venues, he said.

As the Mumbai police have the experience of security 'bandobast' during the victory parade of ICC World Cup-winning Indian team and World Cup final match at the Wankhede Stadium, in which over one lakh cricket fans had gathered, we are prepared to handle a large crowd of fans, he said.

"We are trying to avoid the errors that occurred in the past," the official said.

There is no place to sneak inside the stadiums in Mumbai like the Kolkata stadium, according to him.

The police are also asking the organisers to provide all the required facilities to the fans inside the stadium, so that there will be no chaos, he said, adding the spectators have purchased tickets in the range of Rs 5,000 to 25,000. After paying so much of amount, any spectator expects proper services, while enjoying the event, he said.

The police are expecting 33,000 spectators at the Wankhede Stadium and over 4,000 at Brabourne Stadium. Besides this, more than 30,000 people are expected outside and around the stadiums just to have a glimpse of the football sensation, he said.

The organisers responsible for Messi's India visit recently came to Mumbai to discuss security arrangements. During the meeting, the Mumbai police asked them not to take the event lightly, according to the official.

After those requirements were fulfilled, the final security deployment was chalked out, he said.

Police has the standard procedure of the security arrangements inside the Wankhede Stadium, where people are barred from taking water bottles, metals objects, coins. Police are setting up watch towers near the stadiums and there will be traffic diversions, so that there is maximum space available to stand, according to the official.

Police are also appealing to the spectators to use public transport service for commuting and avoid personal vehicles to reach south Mumbai.

To avoid any stampede-like situation, police are also taking precautionary measures and will stop the fans some distance ahead of the stadium and public announcement systems will be used to guide the crowd. Barricades will be placed at various places to manage the crowd.

In case the crowd swells up beyond expectation, the police will divert people to other grounds and preparations in this regard underway, he said.

Additional police force has been deployed in south Mumbai to tackle any kind of situation, he said.