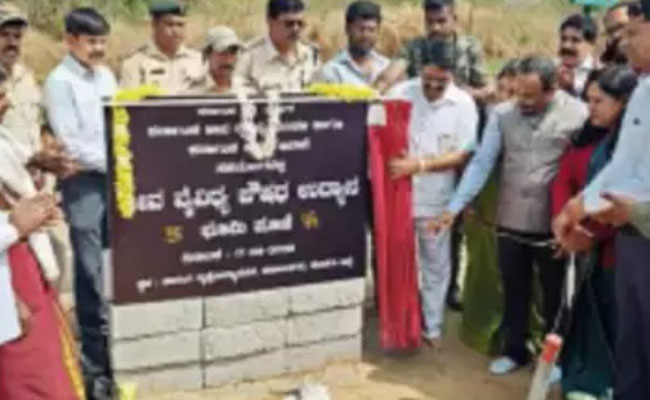

Madikeri: The work to develop the first biodiversity park of the state was launched in Harangi, by laying the foundation stone on Friday.

Legislator Appachu Ranjan, who conducted the ‘bhoomipooja’ for the biodiversity park work, said, “India is the biggest exporter of medicinal herbs. The new park will help us.”

He said that a medicinal herbal park will also be opened in Bhagamandala soon.

“Medicinal plants are needed to cure diseases. Also, the environment will be healthy if there is enough greenery,” he pointed out.

Karnataka Biodiversity Board chairperson Napanda Ravi Kalappa, who presided over the ceremony in Harangi, said that a master plan of building a model medicinal garden in the district was readied by the Board. The park is also being launch to conserve the richness of the flora of Kodagu, he added.

“The Karnataka Biodiversity Board intends to establish similar parks in every panchayat of Kodagu. The Coorg Mandarin used to be an exclusive plant to Kodagu, but is virtually not to be found anywhere now. Research is now being conducted to promote this species,” Kalappa said.

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

Lucknow (PTI): The Uttar Pradesh Congress on Wednesday staged a statewide protest demanding a fair and transparent inquiry into the FIR lodged against Swami Avimukteshwaranand Saraswati and those who filed the complaint against him.

In a statement issued here, the party said memorandums addressed to Prime Minister Narendra Modi were submitted through district magistrates in all districts of the state.

Uttar Pradesh Congress spokesperson Manish Hindvi told PTI that the memorandums were handed over through the district administration in all 75 districts.

In the memorandum, the party alleged that Saraswati and his disciples were "unnecessarily harassed and humiliated" by police on the occasion of Amavasya and were prevented from taking a ritual bath (at the Magh Mela). It further alleged that some disciples were manhandled and taken to a police station.

The memorandum also claimed that an FIR was later registered against Saraswati, his disciple Swami Mukundanand Brahmachari and several unidentified persons in a sexual harassment case. It termed the case a "conspiracy" aimed at tarnishing the seer's reputation.

Citing Articles 25 and 26 of the Constitution, the memorandum stated that these provisions guarantee religious freedom and the right of religious denominations to manage their own affairs.

It described the position of shankaracharya held by Saraswati as "one of the highest spiritual posts in Sanatan tradition" and alleged that the entire episode appeared to have been "orchestrated in a planned manner".

"We request that the background of the persons who got the FIR registered be investigated in a transparent manner by a retired high court judge and strict action be taken against them," the memorandum said.

It also sought a "fair and transparent probe" into the allegations levelled against Saraswati so that the truth could be established.

Earlier, Uttar Pradesh Congress president Ajay Rai had told reporters in Varanasi after meeting Saraswati that the party stood firmly with him.

The Congress said it would continue to press for an impartial inquiry into the entire episode.

On February 21, an FIR was lodged in Prayagraj against Saraswati and his disciple Mukundanand Brahmachari on charges of sexually abusing two persons, including a minor, over the past year at a gurukul and religious congregations, including the recently concluded Magh Mela.

Days after he was booked, Saraswati had said on Monday that he would not oppose his arrest and asserted that the "fabricated story" would be exposed sooner or later.

At a press conference on Wednesday, Saraswati alleged that criminals rule in Uttar Pradesh, level allegations and influence investigations, as he denied having any contact with the two persons for whose alleged sexual abuse he has been booked.

_vb_77.jpeg)

_vb_00.jpeg)