Bengaluru (PTI): Bengaluru Police Commissioner B Dayananda on Tuesday said that efforts are on to file an appeal in the Supreme Court, against the bail granted to Kannada actor Darshan Thoogudeepa and other accused in the Renukaswamy murder case.

A proposal will be submitted to the state government in this regard, he said.

The Karnataka High Court on Friday granted conditional bail to Darshan, who is accused number 2 in the case.

The bench of Justice S Vishwajith Shetty had also granted bail to Darshan's friend Pavithra Gowda, who is accused number 1, and other accused - R Nagaraju, Anu Kumar alias Anu, Lakshman M, Jagadeesh alias Jagga and Pradoosh S Rao.

"In connection with the Renukaswamy murder case, with regards to bail that has been granted, efforts are on to file an appeal in the Supreme Court. We will submit a proposal to the government on this," Dayananda told reporters here.

Darshan was arrested on June 11. Pavithra Gowda and 15 other co-accused in the case were arrested during the same period.

The 47-year-old actor was already out on interim bail for medical reasons.

He had walked out of Ballari jail on October 30 after being imprisoned for more than four months, hours after the Karnataka High Court gave him relief for six weeks on medical grounds, to undergo spine surgery.

Pavithra Gowda, today walked out of the Parappana Agrahara central prison here on bail, after completing formalities.

According to police, 33-year-old Renukaswamy, a fan of the actor, had sent obscene messages to his friend Pavithra Gowda, which enraged Darshan, allegedly leading to his murder. His body was found near a stormwater drain next to an apartment in Sumanahalli here on June 9.

Raghavendra, one of the accused who is part of Darshan's fan club in Chitradurga, had brought Renukaswamy to a shed in R R Nagar here, on the pretext that the actor wanted to meet him. It was in this shed that he was allegedly tortured and murdered.

According to the post-mortem report, Renukaswamy, a native of Chitradurga, died due to shock and hemorrhage as a result of multiple blunt injuries.

Police have said Pavithra, who is accused number one, was the "major cause" for Renukaswamy's murder, claiming that it has been proved from the probe that she instigated other accused, conspired with them, and took part in the crime.

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

New Delhi (PTI): Congress leader Shashi Tharoor on Thursday praised the AI Impact Summit, saying the first couple of days had gone "extremely well" and "some glitches" can happen at any "large event".

He said what has been impressive is the attendance of presidents, prime ministers, and world leaders who have come with a strong message of wanting to see a newly integrated world in artificial intelligence development.

While noting that the first couple of days went “extremely well” at the summit, Tharoor said there have been “some glitches” but such issues can happen at big events.

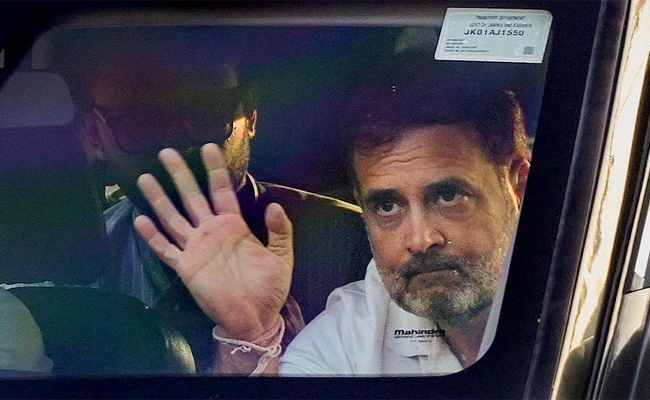

His remarks come a day after former Congress president Rahul Gandhi dubbed the ongoing AI Summit in Delhi a "disorganised PR spectacle" and alleged that Chinese products were being showcased there.

ALSO READ: Chhatrasal Stadium murder case: Delhi HC seeks police's stand on wrestler Sushil Kumar's bail plea

Congress president Mallikarjun Kharge and other senior party leaders have also criticised the event, saying alleged mismanagement has resulted in "embarrassment" for the country.

Responding to a reporter's question after the launch event of his new book on Narayana Guru, Tharoor said, "Though I have not had the chance to go to the summit, I am speaking there tomorrow. From what I understand, these first couple of days have gone extremely well. There have been some glitches, some organisational things, these things happen in a large event."

"But by and large what has been impressive is the attendance... a number of presidents, prime ministers, and world leaders are here, and they've come with a strong message of wanting to see a newly integrated world in AI development, where the impact upon society would be the principle," Tharoor said.

"Preoccupation in India has clearly led the drive in this area," he added.

Asked about French President Emanuel Macron's remarks about procurement of Rafale jets by India and the Make in India component of the deal, Tharoor said as far as the French Rafale is concerned, parts of it are being manufactured in India.

That is a very important aspect of the deal because it is part of strengthening defence, but also increasing our self-reliance in the defence sector, he said.

"Defence is important for India not because we want to go to war, but because we don't want others to think that we are so weak that they can be tempted to go to war. It is a defensive defence literally, and that is what we are working for and I support the government on that,” he said.

On the upcoming film Kerala Story 2, Tharoor said the first film, Kerala Story, was a “hate-mongering film”.

“They were saying that thousands of people were converted, which is not true. I think there were around 30 such cases over a number of years. Ours is a very big country. If a case occurs here and there, it doesn't mean you should turn it into a big story and use it as propaganda,” Tharoor said.

“In our childhood, films like Amar Akbar Antony used to get entertainment tax exemptions,” he added.