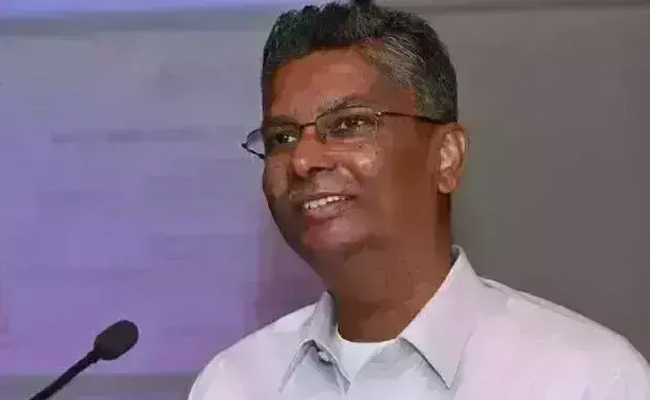

Mysuru, May 29: Chamundeshwari constituency MLA G T Deve Gowda said that the party leadership would decide whether the JDS would require alliance with the Congress or not for the forthcoming Lok Sabha election after completing one year of JDS-Congress coalition government in the state.

Speaking to reporters here on Tuesday, he said that it was a special election. The voters have given five seats to JDS in Mysuru city and district, he added thanking the voters.

In order to keep the communal forces away from the power and for the development of the state, the JDS has inevitably joined hands with the Congress. Both JDS and Congress are secular parties. After the coalition government completing one year, the party leaders would decided whether to go with the Congress or not for LS poll, he said.

He has the confidence that Kumaraswamy would complete five years as the Chief Minister. But some people have been saying that he is a short-term CM. UPA chairperson Sonia Gandhi, AICC president Rahul Gandhi, former prime minister HD Deve Gowda and Chief Minister HD Kumaraswamy have taken a decision. So, if some others spoke about the Chief Minister’s tenure, there is no need to read much about it, he said.

Only media has been showing that the Congress leaders have conditions on expanding the cabinet. But the Congress leaders have extended unconditional support to the JDS. But JDS leaders have decided to take Congress leaders into the cabinet. Cabinet expansion was delayed because it should not spoil the purpose of the coalition government. It was also delayed because of Rahul Gandhi’s foreign tour, he said.

CM Kumaraswamy has already met Congress senior leader Ghulam Nabi Azad and discussed on whom to be taken for the cabinet. It would be finalized in a couple of days. It is said that JDS is being given 12 portfolios. But the party has 37 MLAs and all of them are aspirants of the minister posts. But they would abide by the party decision, he said.

Farmers loan waiver

It is sure that CM Kumaraswamy would waive off the farmers loan. Before election, Kumaraswamy has announced that he would write off the farmers loan if JDS came to power. But the JDS did not get the majority due to which it is delayed. Because it is a coalition government, Kumaraswamy could not take unilateral decision on this issue. The CM has already discussed the issue with the officials concerned and got information and even made strategies. Though Kumaraswamy has promised of taking a decision within a week, the BJP leaders have called for Karnataka bandh and failed, he said.

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

Ghaziabad(UP) (PTI): A 48-year-old woman was killed allegedly by her tenants when she went to their flat to collect rent, police said on Thursday.

The deceased, identified as Deepshikha Sharma, was killed around 11 pm at Aura Chimera Society, Assistant Commissioner of Police (ACP) Nandgram Upasna Pandey said.

Preliminary investigation revealed that Deepshikha and her husband, Umesh Sharma, owned two flats in the society, one of which had been rented out to a couple.

She went to the rented flat to collect rent but did not return till late night, raising suspicion.

Her maid, along with neighbours, went to the flat to look for her, following which Deepshikha's body was recovered stuffed inside a red bag from the flat, the ACP said.

Police were informed at around 11.15 pm through the PRV, after which a team reached the spot and arrested the couple, identified as Ajay Gupta (35) and Akriti Gupta (33), she said.

A case was registered and the body was sent for post-mortem examination. Further investigation is underway, the ACP added.

#WATCH | Amethi, UP: On Landlady murdered over rent dispute, UP Women Commission Member Priyanka Maurya says, "... This incident has disgraced humanity. It is saddening and painful to hear about incidents like this. The couple have been arrested, and I believe strict action will… pic.twitter.com/Nj88sbYmHg

— ANI (@ANI) December 18, 2025