New Delhi: While digital devices have helped couples to communicate and stay connected to each other, these have also led to arguments between nearly 60 per cent of romantic partners on overuse and cybersecurity issues, revealed a survey.

The survey led by Kaspersky Lab showed that over 50 per cent have argued about a device being used during a meal or face-to-face conversation.

Nearly 60 per cent of couples that live together, have argued with their partner due to too much time being spent on a device compared to 49 per cent of those who are dating but live separately.

This suggests that people don't like feeling neglected and want their partner's attention to be on them when they are together, the survey showed.

"These digital devices which help couples to secure their love when they are apart, can also cause arguments when they are used irresponsibly," Dmitry Aleshin, VP for Product Marketing, Kaspersky Lab, said in a statement on Thursday.

Nearly a quarter of couples have argued after one person infected the device with malware and 19 per cent have rowed after one partner lost money online by mistake or because of malware.

On the other hand, 8-in-10 people revealed that they always stay in touch with their partner online when they are apart from each other.

This digital devotion also extends to shared devices, as 53 per cent of people say their relationship has improved since sharing their online activities, such as accounts and devices.

"By making a conscious effort to take care of their digital lives -- including devices, accounts and online activities -- and to not neglect their partners in the physical world, people can enjoy the many benefits that the digital world offers without upsetting their other half," Aleshin suggested.

The survey was conducted on 18,000 people from 18 countries around the globe who have been in relationships for more than six months.

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

Ottawa (PTI): Three Indian nationals have been arrested by Canadian police on an anti-extortion patrol and charged after bullets were fired at a home.

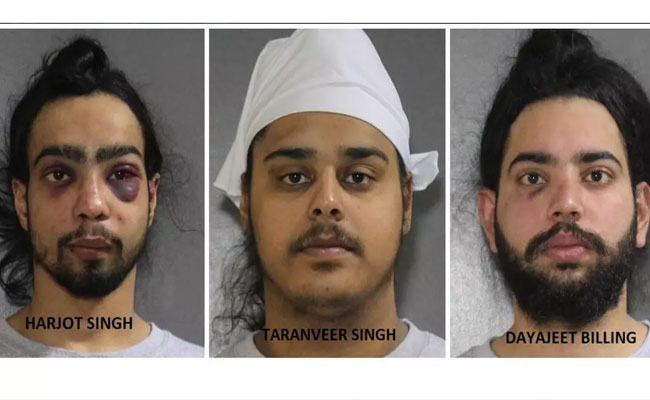

Harjot Singh (21), Taranveer Singh (19) and Dayajeet Singh Billing (21) face one count each of discharging a firearm, and all have been remanded in custody until Thursday, the Surrey Police Service (SPS) said in a statement on Monday.

The suspects were arrested by patrol officers after an early morning report of shots fired and a small fire outside a home in Surrey's Crescent Beach neighbourhood, the LakelandToday reported.

On February 1, 2026, the SPS members were patrolling in Surrey’s Crescent Beach neighbourhood when reports came in of shots being fired and a small fire outside a residence near Crescent Road and 132 Street.

The three accused were arrested by SPS officers a short time later, the statement said.

SPS’s Major Crime Section took over the investigation, and the three men have now been charged with Criminal Code offences, it said.

All three have been charged with one count each of discharging a firearm into a place contrary to section 244.2(1)(a) of the Criminal Code.

The investigation is ongoing, and additional charges may be forthcoming. All three have been remanded in custody until February 5, 2026.

The SPS has confirmed they are all foreign nationals and has engaged the Canada Border Services Agency, it said.

One of the suspects suffered injuries, including two black eyes, the media report said.

Surrey police Staff Sgt. Lindsey Houghton said on Monday that the suspect had refused to comply with instructions to get out of the ride-share vehicle and started to "actively resist."

"As we were trained, he was taken to the ground and safely handcuffed," said Houghton.

A second suspect with a black eye was also injured in the arrest after refusing to comply, Houghton said.

The arresting officers were part of Project Assurance, an initiative that patrols neighbourhoods that have been targeted by extortion violence.

Houghton said the Canada Border Services Agency (CBSA) is also involved because the men are foreign nationals, and the trio may face additional charges.

It's not clear if the men are in the country on tourist visas, a study permit, or a work permit, but Houghton said CBSA has started its own investigation into the men's status.

Surrey has seen a number of shootings at homes and businesses over the last several months, but there's been an escalation since the new year.