Bengaluru (PTI): The Aditya Solar wind Particle Experiment payload onboard India's Aditya-L1 satellite has commenced its operations and is performing normally, ISRO said on Saturday.

ISRO's Polar Satellite Launch Vehicle (PSLV-C57) on September 2 had successfully launched the Aditya-L1 spacecraft, from the second launch pad of Satish Dhawan Space Centre, Sriharikota.

Aditya-L1 is the first Indian space-based observatory to study the Sun from a halo orbit around first Sun-earth Lagrangian point (L1), which is located

roughly 1.5 million km from Earth.

In a statement, ISRO said Aditya Solar wind Particle Experiment (ASPEX) comprises two cutting-edge instruments 'the Solar Wind Ion Spectrometer (SWIS) and SupraThermal and Energetic Particle Spectrometer (STEPS). The STEPS instrument was operational on September 10, 2023. The SWIS instrument was activated on November 2, 2023, and has exhibited optimal performance.

"SWIS, utilising two sensor units with a remarkable 360 field of view each, operates in planes perpendicular to one another," the statement read.

According to ISRO, the instrument has successfully measured solar wind ions, primarily protons and alpha particles.

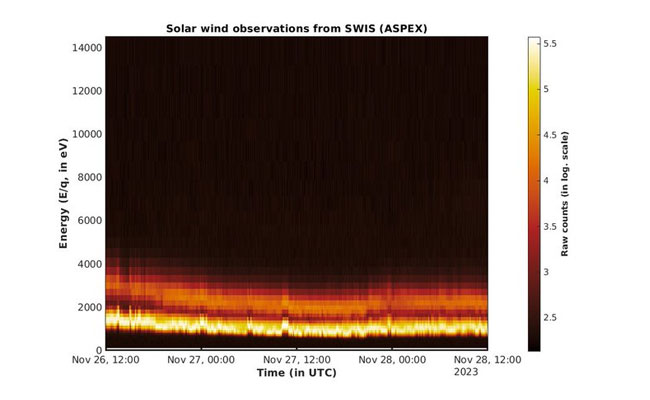

A sample energy histogram acquired from one of the sensors over two days in November 2023 illustrates variations in proton and alpha particle (doubly ionized helium, He2+) counts, the agency said.

"These variations were recorded with nominal integration time, providing a comprehensive snapshot of solar wind behaviour," ISRO said.

The directional capabilities of SWIS enable precise measurements of solar wind protons and alphas, contributing significantly to addressing longstanding questions about solar wind properties, underlying processes, and their impact on Earth, the space agency explained.

"The change in the proton and alpha particle number ratio, as observed by SWIS, holds the potential to provide indirect information about the arrival of Coronal Mass Ejections (CMEs) at the Sun-Earth Lagrange Point L1," ISRO said.

Enhanced alpha-to-proton ratio is often regarded as one of the sensitive markers of the passage of interplanetary coronal mass ejections (ICMEs) at the L1 and hence considered crucial for space weather studies.

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

Kalaburagi: Four men have been arrested in Kalaburagi on charge of hacking a man with lethal weapons and pelting stones at him under the limits of Station Bazaar Police Station recently.

According to police sources, Anand Jalak Shinde (34), Ashitosh Jalak Shinde (30), Imran Mehboob Sheikh (28) and Sohaib Anwar Qureshi have been arrested. The men are accused of the brutal murder of Syed Mehboob, a resident of Station Bazaar Upper Line Hamalawadi in the city.

An FIR was filed by the Station Bazaar Police Station based on a complaint given by Syed Ismail, father of the deceased Syed Mehboob.

Following quick probe, the police team successfully arrested the suspects within 24 hours. The arrested men were produced in court and have been sent to judicial custody.

The City Police Commissionerate has appreciated in an official release the police team’s quick solving of the murder case and arrest of the four men accused of murdering Syed Mehboob.