New Delhi: The account of the independent research initiative “Hindutva Watch in India '' has been withheld by social media platform X “in response to a legal demand” from the Union government. The action was taken on the evening of Tuesday, January 16. The organisation’s founder Raqib Hameed Naik said that they received a notification of the same from X three hours after the account was withheld.

The email from X read, “In the interest of transparency, we are writing to inform you that X has received a legal removal demand from the Government of India regarding your X account, @HindutvaWatchIn, that claims the following content violates India's Information Technology Act, 2000.”

🚨 Update from Hindutva Watch

— Raqib Hameed Naik (@raqib_naik) January 16, 2024

Today, our @X account was withheld in India following a legal demand from the Government of India.

Three hours after the withholding of our account, we received an email from X notifying us of this action. pic.twitter.com/YPAwBl1QdP

Reacting to the action, Raqib Hameed said, “While shocking, it's not surprising, considering Prime Minister Modi regime's history of suppressing free press & critical voices. This won't deter us! We remain committed! The suppression of our account in India only fuels our determination to continue our work undeterred. (sic)”

Hindutva Watch monitors “reports of attacks on members of minority and marginalised communities for their faith by the radicalised Hindus and the Hindutva militia groups in India” with the aim of exposing “ideology, institutions and people responsible for acts of violence and injustice”.

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

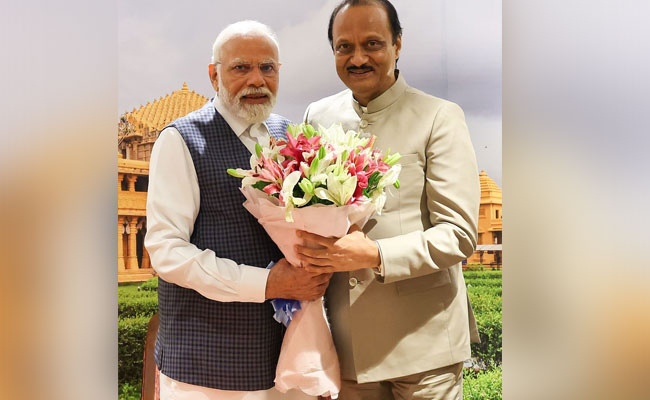

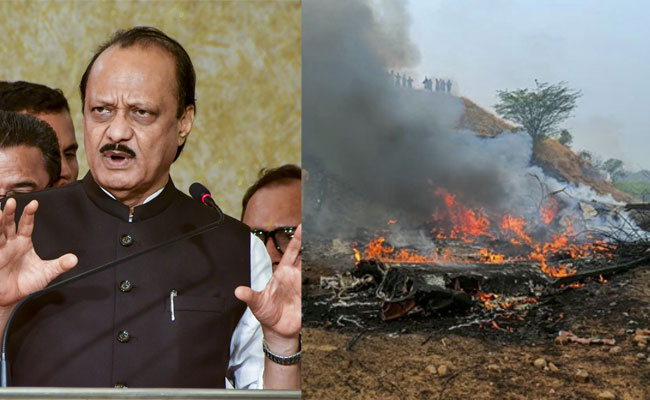

New Delhi (PTI): Prime Minister Narendra Modi on Wednesday said the death of Maharasthra deputy chief minister Ajit Pawar in a plane crash was untimely and very shocking.

In a post on X, Modi said Ajit Pawar was a leader of the people with a strong grassroots level connect.

Pawar, 66, and four other persons were killed after an aircraft carrying them crashed near his hometown Baramati in Pune district on Wednesday morning, officials said.

"Shri Ajit Pawar Ji was a leader of the people, having a strong grassroots level connect. He was widely respected as a hardworking personality at the forefront of serving the people of Maharashtra.

"His understanding of administrative matters and passion for empowering the poor and downtrodden were also noteworthy. His untimely demise is very shocking and saddening. Condolences to his family and countless admirers. Om Shanti," Modi said.