Raigad: Aanvi Kamdar, a 26-year-old Instagram influencer from Mumbai known for her love of monsoon tourism, tragically lost her life after falling into a gorge at Kumbhe waterfall in Raigad, Maharashtra.

Aanvi was on a trip with seven friends when the incident occurred around 10:30 AM on July 16. While shooting a video near the waterfall, she slipped and fell approximately 300 feet into a deep crevice.

Local authorities responded immediately to the emergency, mobilizing a rescue team that included assistance from the Coast Guard, Kolad rescue team, and Maharashtra State Electricity Board staff.

"After reaching the spot, we found the girl had fallen nearly 300-350 feet. Due to heavy rain and her injuries, it was challenging to extricate her directly. Therefore, we used a vertical pulley system for the rescue," recounted one of the rescuers to NDTV.

Following a six-hour operation, Aanvi was successfully retrieved from the gorge but succumbed to her injuries shortly after being admitted to Managaon sub-district hospital.

In the aftermath, local authorities, including the Tehsildar and Managaon police inspector, issued an appeal to tourists and citizens alike. They urged everyone to enjoy tourism responsibly and prioritise safety while exploring the scenic beauty of the Sahyadri ranges.

Aanvi, an avid traveller and social media influencer known for her passion for monsoon tourism died in an attempt to capture the beauty of Kumbhe waterfall.

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

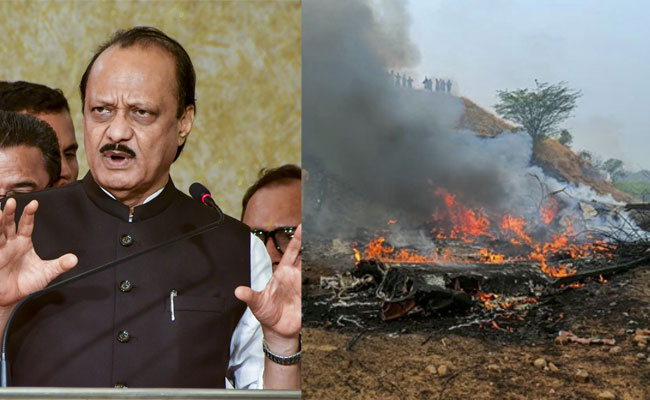

New Delhi (PTI): Prime Minister Narendra Modi on Wednesday said the death of Maharasthra deputy chief minister Ajit Pawar in a plane crash was untimely and very shocking.

In a post on X, Modi said Ajit Pawar was a leader of the people with a strong grassroots level connect.

Pawar, 66, and four other persons were killed after an aircraft carrying them crashed near his hometown Baramati in Pune district on Wednesday morning, officials said.

"Shri Ajit Pawar Ji was a leader of the people, having a strong grassroots level connect. He was widely respected as a hardworking personality at the forefront of serving the people of Maharashtra.

"His understanding of administrative matters and passion for empowering the poor and downtrodden were also noteworthy. His untimely demise is very shocking and saddening. Condolences to his family and countless admirers. Om Shanti," Modi said.