New Delhi, Jul 10: Zepto faced social media ire after a user called out the quick commerce platform for listing coriander at an exorbitant price of Rs 131 for 100 grams.

Zepto said the system glitch had "caused significant pricing disparities" across the platform and assured that the issue has been resolved. The company said its platform is now reflecting accurate prices.

Zepto drew flak when a user from Gurugram found that 100 grams of coriander leaves were listed at Rs 131 on Zepto, and called out the brand for overpricing Dhaniya, in a post, along with a screenshot, on X.

Several netizens expressed outrage and shock, while some highlighted how the exorbitant prices on the platform sharply contrasted with roadside vegetable vendors bundling free coriander alongside veggies to woo buyers.

"Maybe it is grown on moon soil?" wondered a netizen on X.

In its response, Zepto said that the system glitch had led to the pricing disparities and that the company is committed to addressing customer concerns promptly and transparently.

"Yesterday, a system glitch caused significant pricing disparities across our platform, leading to some unusual price tags for various products, including coriander. While some items were priced three times lower, others saw a substantial hike," Zepto said, adding that the issue has been fixed.

"We are pleased to inform our customers that the issue has been resolved, and accurate prices are now back on track," Zepto said.

It, however, said that Zepto prices might not always match those of peers and that the company prioritises quality above all else.

"At Zepto, we are dedicated to delivering the finest quality while striving to offer the best prices. Quality is never compromised, and we are committed to ensuring our customers receive only the best produce," the company asserted.

Dhaniya 100 gm costs you Rs 131 on Zepto 🙏🥲 pic.twitter.com/u1La4duidU

— Harsh Upadhyay (@upadhyay_harsh1) July 8, 2024

‘Grown in moon soil’: #Gurugram man’s post on #Zepto listing 100 gram dhaniya for Rs 131 sparks chatter#viral https://t.co/4u8jQTGR7O

— Express Trending 😷 (@ietrending) July 10, 2024

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

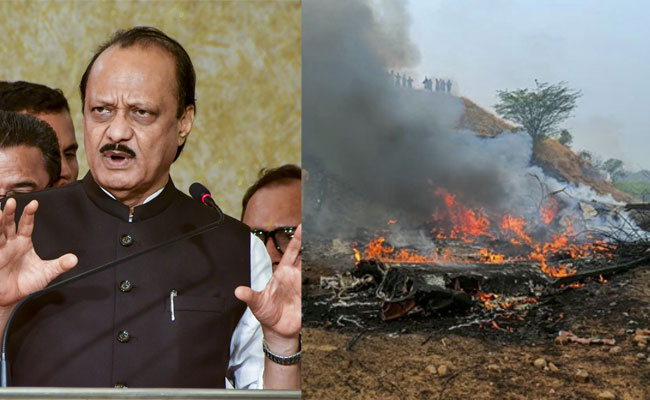

New Delhi (PTI): Prime Minister Narendra Modi on Wednesday said the death of Maharasthra deputy chief minister Ajit Pawar in a plane crash was untimely and very shocking.

In a post on X, Modi said Ajit Pawar was a leader of the people with a strong grassroots level connect.

Pawar, 66, and four other persons were killed after an aircraft carrying them crashed near his hometown Baramati in Pune district on Wednesday morning, officials said.

"Shri Ajit Pawar Ji was a leader of the people, having a strong grassroots level connect. He was widely respected as a hardworking personality at the forefront of serving the people of Maharashtra.

"His understanding of administrative matters and passion for empowering the poor and downtrodden were also noteworthy. His untimely demise is very shocking and saddening. Condolences to his family and countless admirers. Om Shanti," Modi said.